of S&P500 It recently hit an all-time high, closing at 4,840 on January 19th, officially entering bull market territory. Much of last year’s growth was due to the artificial intelligence (AI) boom, with many tech stocks soaring. This sector shows no signs of slowing down.

The AI market is expected to grow at a compound annual growth rate of 37% through at least 2030, and the industry will be valued at more than $1 trillion by the end of 2030, according to data from Grand View Research. . It’s not too late to invest in this emerging sector and benefit from its long-term development.

Therefore, I would like to introduce two AI stocks that I will “go all in” on in 2024.

1. Alphabet

alphabet (NASDAQ:GOOG) (NASDAQ:Google) Last year, he was looked down upon as a rival. Amazon and microsoft I feel like AI is progressing quickly. However, the company only took its time to hone its technology in preparation for his 2024 big splash in the industry.

Last December, Alphabet announced its long-awaited AI model Gemini. The new model excels at building generative AI programs with the ability to process data in various formats such as audio, video, and text. The tech giant has announced that he will be releasing three versions of Gemini. The most powerful of them are designed to operate data centers, and the smallest can power smartphones.

Gemini is creating a Google search experience similar to OpenAI’s ChatGPT, adding new AI tools to Google Cloud and Android, and technology to deliver more efficient advertising and better track viewing trends on YouTube. It could open the door to many growth opportunities in AI for Alphabet. .

Alongside Gemini, Alphabet announced a new generation of custom-built AI chips. Cloud TPU v5p is a tensor processing unit (TPU) designed for training large-scale AI models. It’s almost 3x faster than the previous version.

Over the past five years, Alphabet’s annual sales and operating profit have increased by 75% and 106%. Meanwhile, free cash flow increased 151% to $77 billion. The company is one of the most trusted technology companies and is still in its infancy in the AI space, with the potential for even higher revenues in the coming years.

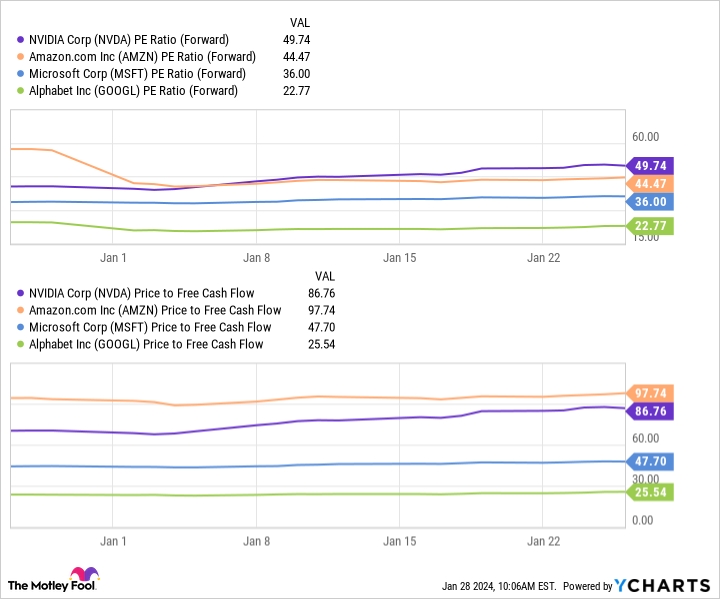

Additionally, this chart shows that Alphabet is one of the cheapest AI stocks. The company has the lowest forward price-to-earnings ratio and price-to-free cash flow of the most prominent companies in the AI space, suggesting its stock is the most valuable.

Alphabet has the funds and brand power to go far in the AI field, so it will be a strong buy for me in 2024.

2. Advanced microdevices

Chip stocks captivated Wall Street last year, and for good reason. These companies develop the hardware needed to train and run AI models, and are well-positioned to reap significant profits as demand for chips continues to soar.

meanwhile Nvidia Although it got a lot of attention last year, it’s worth considering investing in chipmakers in the early stages of AI expansion, as there may be more room to operate. Advanced Micro Devices (NASDAQ: AMD) This is an exciting choice as it prepares to challenge Nvidia in the AI space in 2024.

AMD announced its MI300X AI graphics processing unit (GPU) last December, announcing that the chip is on par with Nvidia’s H100 GPU when it comes to training and outperforms the H100 by 10-20% when it comes to inference. It has already attracted some of the biggest names in the tech industry.

In November, Microsoft announced that Azure would be the first cloud platform to use MI300X to optimize AI capabilities. Microsoft has partnered with OpenAI, making it a strong partner for AMD. At the same time as the agreement with meta platform — New chips will also be used — AMD’s future in AI is bright.

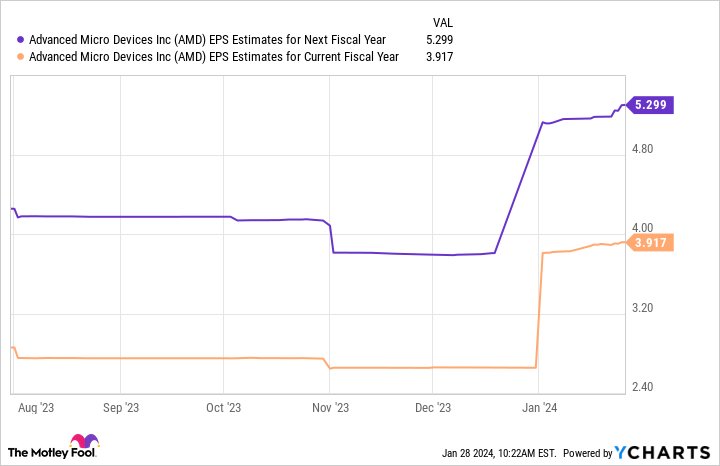

This table shows that AMD’s earnings could reach just over $5 per share by next year. Multiplying this number by the chipmaker’s expected P/E ratio of 45 yields a stock price of $239.

If predictions are correct, AMD stock will rise 35% by the end of 2024, outpacing the S&P 500’s 20% rise over the past 12 months. Along with the huge potential in AI, AMD is one of this year’s most exciting investment opportunities.

Should you invest $1,000 in Alphabet right now?

Before buying Alphabet stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Alphabet wasn’t one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor The service has more than tripled S&P 500 returns since 2002*.

See 10 stocks

*Stock Advisor will return as of January 22, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Dani Cook has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

2 AI Stocks I’ll Go ‘All In’ With in 2024 was originally published by The Motley Fool.