[ad_1]

Artificial intelligence (AI) promises to significantly shape our world in the coming decades. One of the main expected benefits of this is significant cost and time savings for businesses and consumers. goldman sachs Research predicts that language processing tools such as generative AI alone will add 7%, or nearly $7 trillion, to the global economy.

While ‘Magnificent Seven’ stocks offer a better (and potentially safer) way to invest in AI, some investors may find them growing much faster and offering even greater returns from AI adoption. We are trying to seize opportunities in small and medium-sized businesses that have potential.If this describes what you’re looking for, here’s why C3.ai (NYSE:AI) and Soundhound AI (NASDAQ: SOUN) are two promising stocks worth considering now to buy and hold for the next 10 years.

1.C3.ai

C3.ai is an emerging leader in helping businesses and governments build AI applications. The company has grown significantly in recent years, and this momentum caused the stock to soar in the first half of 2023 before falling back.

Wall Street is concerned about increased competition and the potential impact on C3.ai’s profitability. C3.ai is growing revenue at a double-digit pace, but is not yet profitable. One risk is that tech companies could lower C3.ai’s price by bundling his AI development tools with existing cloud services.

But it may not be so easy for deep-pocketed tech giants to compete with C3.ai. The company has a patented AI platform that allows software developers to add new AI models to their applications instead of writing code from scratch. And aside from a temporary slowdown in growth early last year, C3.ai has had no trouble finding customers for its services. He reported third-quarter sales of $73 million, nearly double his quarterly sales for the same quarter four years ago.

Sales rose 17% year-on-year in the quarter that ended in October, but investors should expect this growth rate to accelerate in the coming years. C3.ai has moved to a consumption-based revenue model, charging customers based on platform usage. This could significantly boost growth as the transition progresses.

The company’s stock trades at a price-to-sales ratio of 9.7 times, which is typical for fast-growing cloud and software companies. Analysts expect annual revenue to reach $443 million over two years, 55% higher than C3.ai’s trailing 12-month total. Investors should expect the stock price to rise in line with that growth.

2. Soundhound AI

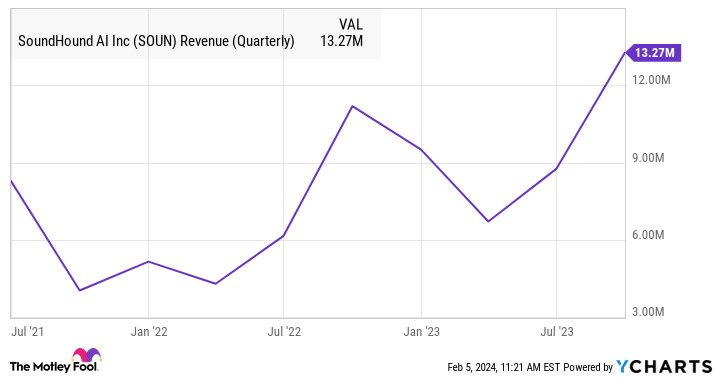

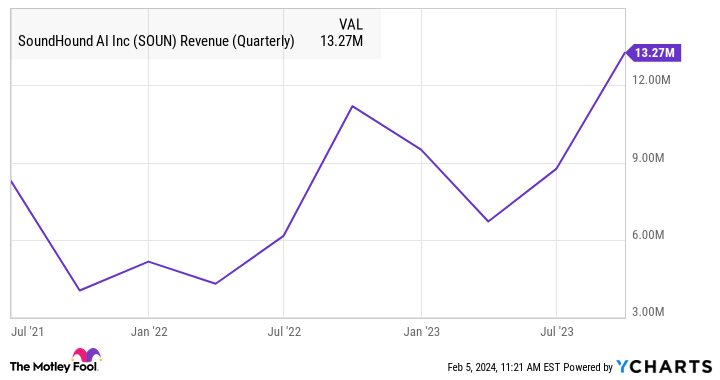

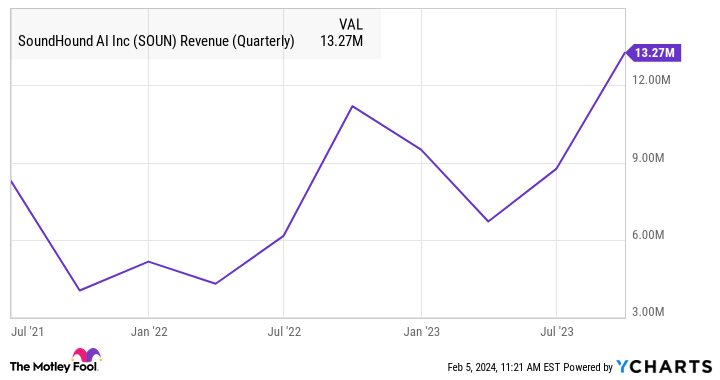

Another big opportunity in the world of AI is voice assistants. You don’t need industry estimates to see how big this opportunity is. One need only keep an eye on Soundhound AI’s accelerating revenue growth.

Revenue for the quarter was $13.3 million, up 19% year over year, but even more impressively, up 52% sequentially. Soundhound AI offers a promising technology that is increasingly being adopted in the automotive and restaurant industries.

One of the many highlights of last quarter was the announcement of a new collaboration with. samsung Developing new display technology for White Castle’s voice AI drive-thru. This could be a promising start for the company as it hopes to acquire more customers across the quick-service industry.

The risk for Soundhound is that it won’t profit from its technology. The company reported a loss of $20 million last quarter, a significant improvement from the $30 million loss in the same period last year.

Soundhound has a potentially lucrative business model, earning royalties, subscriptions, and advertising revenue from speech recognition services using its technology. We have over 120 patents and over 140 patents pending. Investors should expect the company to continue toward breakeven as it wins new customer deals for its technology and grows revenue.

Expectations for growth are high, and the P/S ratio of the stock is 9.4 times. As long as the company continues to move toward profitability, it has the potential for significant gains over the next decade.

Should you invest $1,000 in C3.ai now?

Before buying C3.ai stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors can buy right now…and C3.ai wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of February 5, 2024

John Ballard has a position at C3.ai. The Motley Fool has a position in and recommends Goldman Sachs Group. The Motley Fool recommends his C3.ai. The Motley Fool has a disclosure policy.

2 Explosive AI Stocks to Buy and Hold for 10 Years was originally published by The Motley Fool.

[ad_2]

Source link