Nvidia hits $2 trillion valuation, riding high on AI boom

The US chipmaker Nvidia, riding high on the AI boom, has just hit a market valuation of $2 trillion.

The shares rose 4.3%, valuing the company at $2.05trn.

Yesterday, the shares jumped 16.4% in New York, adding $277bn to the Californian firm’s market value. It reported bumper results after the closing bell on Wednesday, sparking a rally on the Nasdaq in New York, and other stock markets around the world. Japan’s Nikkei achieved an all-time closing high yesterday.

Nvidia’s chief executive Jensen Huang said on Wednesday he believed the world was at an AI “tipping point” and said demand for the group’s microchips was “surging worldwide across companies, industries and nations”.

The tech-heavy Nasdaq rose 54 points, or 0.3%, when Wall Street opened, while the S&P 500 went through 5,100 for the first time, rising 15 points, or 0.3%, to 5,102.

Key events

Closing summary

The US chipmaker Nvidia, riding high on the AI boom, has hit a market valuation of $2 trillion.

The shares rose more than 4% shortly after the opening bell, valuing the company as much as $2.05trn, and are now up 3.8%. The company has gone from a market cap of $1trn to $2trn in a record eight months – less than half the time it took tech giants Apple and Microsoft.

Nvidia posted record revenues on Wednesday after the closing bell, driving its shares 16.4% higher yesterday, which added $277bn to its market value – Wall Street’s largest one-day gain on record. It is benefiting from strong demand for its chips that made the Californian firm a pioneer of the artificial intelligence boom.

US stock markets made moderate gains in early trading today after soaring yesterday, when the S&P 500 enjoyed its best day in more than a year in New York, rising 2.1% amid a global equities rally. The technology-heavy Nasdaq gained 3%.

The energy price cap in Great Britain will fall by £238 to £1,690 this spring thanks to a mild winter and lower gas prices, easing pressure on household finances.

Set by energy regulator Ofgem, the cap reflects the average annual bill for 29 million households in England, and takes effect from April. It is a 12.3% reduction from £1,928 in the current quarter.

In a boost to the poorest households, Ofgem also confirmed it would equalise standing charges – the set fee paid before any gas or electricity is used – meaning customers with prepayment meters will no longer be charged more for their connection than those on credit or direct debit.

Wholesale gas prices have fallen as a mild winter in Europe reduced demand, helped by plentiful supplies of liquified natural gas in Europe and Asia, leading to a fall in household bills.

The outsourcing company Serco has been ordered to stop using facial recognition technology (FRT) and fingerprint scanning to monitor staff’s attendance in its leisure business.

Britain’s data protection watchdog, the Information Commissioner’s Office, carried out an investigation that found Serco Leisure, Serco Jersey and seven associated community leisure trusts have been unlawfully processing the biometric data of more than 2,000 employees at 38 leisure facilities, for attendance checks and subsequent payment for their time.

Our other main stories today:

Thank you for reading. Have a fab weekend. We’ll be back next week. Take care! – JK

Paula Vennells, the former chief executive of the Post Office, has been formally stripped of her CBE by the King for “bringing the honours system into disrepute”.

She had previously said would hand back her CBE, an ignominious end to a career that will be remembered for her organisation’s relentless run of wrongful prosecutions against more than 900 post office operators.

Last year, Alan Bates, the operator who led the campaign to expose the Horizon IT scandal and whose story has now been told in an ITV drama, turned down an OBE, making the point that it would be “inappropriate” while victims still suffered and Vennells retained her accolade.

She was awarded her CBE for services to the Post Office and charity at the start of 2019, shortly before she stepped down – ending a seven-year period as chief executive during which she collected more than £4.5m in pay.

Nvidia hits $2 trillion valuation, riding high on AI boom

The US chipmaker Nvidia, riding high on the AI boom, has just hit a market valuation of $2 trillion.

The shares rose 4.3%, valuing the company at $2.05trn.

Yesterday, the shares jumped 16.4% in New York, adding $277bn to the Californian firm’s market value. It reported bumper results after the closing bell on Wednesday, sparking a rally on the Nasdaq in New York, and other stock markets around the world. Japan’s Nikkei achieved an all-time closing high yesterday.

Nvidia’s chief executive Jensen Huang said on Wednesday he believed the world was at an AI “tipping point” and said demand for the group’s microchips was “surging worldwide across companies, industries and nations”.

The tech-heavy Nasdaq rose 54 points, or 0.3%, when Wall Street opened, while the S&P 500 went through 5,100 for the first time, rising 15 points, or 0.3%, to 5,102.

UK voters oppose tax cuts if this means spending cuts – poll

Phillip Inman

UK voters oppose tax cuts that would force the government to cut public services, according to a poll that unites Tory and Labour supporters.

In a poll ahead of the budget next month, 64% of voters said they oppose tax cuts if they result in cuts to spending on public services.

The poll by Opinium for the Fairness Foundation shows that 33% of UK voters support keeping taxes as they are, while 31% said they wanted the government to raise taxes. Only 16% wanted tax cuts if it meant cutting public services.

Only 16% of the British public supported cutting taxes and spending less on public services. Even among Conservatives, the 17% of voters who back tax cuts were outnumbered by those who want to see public spending maintained (50%) or increased (23%).

Jeremy Hunt is expected to offer tax cuts in his budget on 6 March. The chancellor has hinted that his room for manoeuvre will be limited, forcing him to search for efficiency savings and spending reductions across Whitehall to make further funds available.

Respondents said they were also concerned about wealthy people avoiding higher rates of tax. A majority (53%) backed a minimum 35% tax rate for those earning more than £100,000.

The foundation said it asked this question after it was revealed that Rishi Sunak paid the same tax rate as a teacher on his total income last year due to lower rates of tax on income earned from wealth.

ECB must resist early rate cut temptation – Nagel

In Frankfurt, a European Central Bank policymaker has urged caution about cutting interest rates, and said the bank can only consider a potential reduction once it has inflation data for the second quarter.

Bundesbank president Joachim Nagel said eurozone inflation remains stubbornly high so the ECB should not rush into reducing borrowing costs. Inflation edged down to 2.8% in January from 2.9% in December, above the central bank’s 2% target.

The ECB has kept interest rates at a record high since September and pushed back on rate cut talk despite market hopes for an early reduction. Financial markets are now pricing in the first move in June.

Nagel said in a speech:

Even though it may be very tempting, it is too early to cut interest rates.

We will only receive a more detailed picture of how domestic price pressures are unfolding during the second quarter. Then we can contemplate a cut in interest rates.

The US chipmaker Nvidia, riding high on the AI boom, could hit a market valuation of $2 trillion when Wall Street opens in about 20 minutes.

The shares are up more than 2% in pre-market trading, valuing the company at $1.96trn.

Yesterday, the shares jumped 16.4% in New York, adding $277bn to the Californian firm’s market value, as investors were cheered by stellar revenue growth reported after the closing bell on Wednesday. This triggered a rally on the Nasdaq in New York, and other stock markets around the world. Japan’s Nikkei achieved an all-time closing high yesterday.

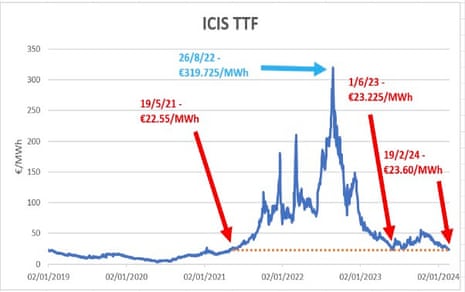

European gas prices at pre-energy crisis low

European gas prices have fallen to their lowest levels since spring 2021, sparking hopes that the energy crisis of the last three years may be coming to an end.

Warmer-than-usual winter weather, strong imports of liquefied natural gas and lower demand caused by high prices in recent years mean that gas stored in European underground storage is at high levels – and driving prices lower.

The European gas March benchmark fell to as low as €22.34 per megawatt hour this morning, the lowest since May 2021, and is on track for a third weekly decline.

British Gas prices fell more than 2% earlier, and are now down 1.4% at 56.49p per therm. In August, they jumped to 640p per therm.

The energy crisis started in 2021 when a long cold winter left Europe with low natural gas storage levels. Prices shot up after Russia’s invasion of Ukraine in late February 2022 when it squeezed gas supplies, but even before, Russia was sending less gas to Europe, perhaps to pressure Germany and other governments to approve the Nord Stream 2 gas pipeline (which was shelved just after Russia invaded Ukraine).

Prices soared over €300 per megawatt hour in August 2022, and then fell back as Europe switched towards liquefied natural gas.

‘We won’t be remote-controlled’: how German football fans took on investors and won

Toy cars mounted with flares and other stunts have disrupted Bundesliga matches. Now fans’ dogged defiance appears to have paid off, our Berlin correspondent Kate Connolly reports.

They have hurled tennis balls and chocolate coins on to the pitch; they have disrupted play with remote-control cars and planes mounted with smoke bombs. In recent months German football fans have thrown almost everything they have into protests aimed at preventing foreign investors from increasing control of their much-loved clubs.

This week it appeared their dogged defiance, driven by deep-seated grassroots sentiment, had paid off, after the German football league (DFL), which runs the Bundesliga, dropped its plans to sell an estimated €1bn (£850m) stake in its media rights income to a private equity firm.

The league’s board said it would no longer go ahead with the deal, in the hope, it said, of ending the unprecedented wave of protests, which have disrupted almost every game in the top two male divisions of German football since the start of 2024.

The stunts have led to lengthy delays, even match cancellations, which bosses said were a threat to the integrity of German football.

For fans, though, they were a winning gameplan that pulled off an unlikely victory. Comparing the struggle to that of David and Goliath, the fan group Unsere Kurve (Our Stands) celebrated the decision, and noted: “Ultimately the key to this success were these comprehensive, and very peaceful and creative protests.”

UK watchdog orders Serco to stop using facial recognition, fingerprint scanning to monitor staff

The outsourcing company Serco has been ordered to stop using facial recognition technology (FRT) and fingerprint scanning to monitor staff’s attendance in its leisure business.

Britain’s data protection watchdog, the Information Commissioner’s Office, carried out an investigation that found Serco Leisure, Serco Jersey and seven associated community leisure trusts have been unlawfully processing the biometric data of more than 2,000 employees at 38 leisure facilities, for attendance checks and subsequent payment for their time.

Serco provides defence, security, immigration, health and transport services for the UK and other governments. Shares in the London-listed company fell 1.4% today.

The ICO said:

They failed to show why it is necessary or proportionate to use FRT and fingerprint scanning for this purpose, when there are less intrusive means available such as ID cards or fobs.

Employees have not been proactively offered an alternative to having their faces and fingers scanned to clock in and out of their place of work, and it has been presented as a requirement in order to get paid. Due to the imbalance of power between Serco Leisure and its employees, it is unlikely that they would feel able to say no to the collection and use of their biometric data for attendance checks.

Serco has also been ordered to destroy all biometric data that it is not legally obliged to retain. This must be done within three months.

John Edwards, UK Information Commissioner, said:

Biometric data is wholly unique to a person so the risks of harm in the event of inaccuracies or a security breach are much greater – you can’t reset someone’s face or fingerprint like you can reset a password.

Serco Leisure did not fully consider the risks before introducing biometric technology to monitor staff attendance, prioritising business interests over its employees’ privacy. There is no clear way for staff to opt out of the system, increasing the power imbalance in the workplace and putting people in a position where they feel like they have to hand over their biometric data to work there.

This is neither fair nor proportionate under data protection law, and, as the UK regulator, we will closely scrutinise organisations and act decisively if we believe biometric data is being used unlawfully.

He said this action “serves to put industry on notice that biometric technologies cannot be deployed lightly”.

A spokesperson for the company told Reuters that the technology was introduced nearly five years following external legal advice and that it was “well-received” by staff, but added:

We take this matter seriously and confirm we will fully comply with the enforcement notice.

US man accused of making $1.8m from listening in on wife’s remote work calls

US regulators have accused a man of making $1.8m (£1.4m) by trading on confidential information he overheard while his wife was on a remote call, in a case that could fuel arguments against working from home.

The Securities and Exchange Commission (SEC) said it charged Tyler Loudon with insider trading after he “took advantage of his remote working conditions” and profited from private information related to the oil firm BP’s plans to buy an Ohio-based travel centre and truck-stop business last year.

The SEC claims that Loudon, who is based in Houston, Texas, listened in on several remote calls held by his wife, a BP merger and acquisitions manager who had been working on the planned deal in a home office 20ft (6 metres) away.

The regulator said Loudon went on a buying spree, purchasing more than 46,000 shares in the takeover target, TravelCentres, without his wife’s knowledge, weeks before the deal was announced on 16 February 2023. TravelCentres of America’s stock soared by nearly 71% after the deal was announced. Loudon then sold off all of his shares, making a $1.8m profit.

Loudon eventually confessed to his wife, and claimed that he had bought the shares because he wanted to make enough money so that she did not have to work long hours anymore.

She reported his dealings to her bosses at BP, which later fired her despite having no evidence that she knowingly leaked information to her husband. She eventually moved out of the couple’s home and filed for divorce.

Returning to the new energy price cap in Great Britain, Martin Lewis, founder of MoneySavingExpert.com, explains what the changes mean.

The cap dictates the price the huge majority of homes in England, Scotland and Wales pay for energy (so that’s you unless you’re on a fixed or special tariff) as most firms just charge the max. It moves every three months, mostly based on average wholesale rates, yet there’s a time lag – for example, this April to June Cap is based on November to February rates.

The new rates for 1 April have just been announced. In a nutshell, for every £100 a Direct Debit user spends on energy today, they’ll pay £87.70 for it from 1 April.

So it’s an improvement, and predictions are it’ll drop again in July, though overall prices are still too expensive, nearly double the price of the cheapest pre-crisis fixes.

His main takeaways are:

1. Prepay will become the cheapest way to pay.

Prepay standing charges have been lowered to equalise them with direct debit, yet as prepay unit rates are cheaper, that means overall for a typical user from April, prepay will be about 3% cheaper. The most vulnerable households often use prepayment meters and it has always been a rip off, so this is a staggering turnaround.

Those on the price cap will see a saving by moving to a prepayment meter – yet that doesn’t necessarily mean everyone should switch to one. If and when proper competition returns (see point 3) there are rarely any prepay deals – firms mostly focus on winning new Direct Debit customers, so it is likely Direct Debit deals will be cheapest for those who switch and prepayment will be cheapest for those that don’t.

2. The energy bill poll tax will get worse. Standing charges for Direct Debit will rise to £334/year (from £303 now).

Even though overall bills will fall, standing charges won’t. Full details on unit rates and standing charges can be found here.

Standing charges are a form of poll tax as you pay it regardless of usage and a moral hazard as those on lower usage get less benefit and are disincentivised from cutting bills. Ofgem is currently reviewing standing charges and we will be pushing it to make changes for the July price cap.

3. Switching deals may be kicked into action for 1 April as Ofgem’s changing one of the two background rules that stop it (it should have changed both).

From 1 April, Ofgem is ending the ‘Market Stabilisation Charge’ (MSC) regime it set up during the energy crisis, which means if you switch firm to cut the cost, the new company must compensate your old company if it’s offering a cheap deal because wholesale rates are cheaper. This has effectively blocked most firms from offering cheap switchers’ deals, and why paltry saving ‘existing customer only’ deals have been dominating. So I am delighted to hear it is going, and hope it will at last spur real competition to drive down prices.

Yet Ofgem has extended its other market restricting rule which bans ‘acquisition only’ tariffs for another year (though it may review that sooner). In other words, firms must offer existing customers the same deal as new customers (existing customers can still get different deals).

In normal times I could support this. Yet at the moment when most firms are simply sitting on their existing customers, letting them languish on the price cap I think we should be stimulating competition as much as possible.

4. The British Gas Price Promise deal doesn’t look as good as it did.

It’s currently 12% cheaper than the market but promises to be £1 less than the April price cap, and now that won’t be as big a change (Cornwall Insight had been predicting a 15% cut). In which case, if you want to fix to get price certainty, then there are cheaper deals.

To see a full list and analysis of what’s available, see Lewis’s Should you fix my energy or stay on the Price Cap? guide.

5. You can undercut the price cap by 3%.

The Eon Next Pledge tariff, which you can switch to, charges roughly 3% less than the Price Cap for the first year. To get it, you need to be on direct debit and have or get a smart meter. So if that works for you, and you’re planning to stick on the price cap, it’s a no brainer.

Huge cybersecurity leak lifts lid on world of China’s hackers for hire

A big leak of data from a Chinese cybersecurity firm has revealed state security agents paying tens of thousands of pounds to harvest data on targets, including foreign governments, while hackers hoover up huge amounts of information on any person or institution who might be of interest to their prospective clients.

The cache of more than 500 leaked files from the Chinese firm I-Soon was posted on the developer website Github and is thought by cybersecurity experts to be genuine. Some of the targets discussed include Nato and the UK Foreign Office.

The leak provides an unprecedented insight into the world of China’s hackers for hire, which the head of the UK’s security services has called a “massive” challenge for the country.

The files, which are a mixture of chat logs, company prospectuses and data samples, reveal the extent of China’s intelligence gathering operations, while also highlighting the market pressures felt by the country’s commercial hackers as they vie for business in a struggling economy.

I-Soon appears to have worked with – and later been embroiled in a commercial dispute with – another Chinese hacking outfit, Chengdu 404, whose hackers have been indicted by the US Department of Justice for cyber-attacks on companies in the US as well as pro-democracy activists in Hong Kong, among other targets.

Other targets discussed in the I-Soon leaks include the British thinktank Chatham House and the public health bureaux and foreign affairs ministries of Asean countries. Some of this data seems to have been gathered on spec, while in other cases there are specific contracts with a Chinese public security bureau to gather a certain type of data.

Apple has condemned Spotify over the long-running competition complaint filed with the EU that could see the tech company face a huge fine if found guilty.

After reports the bloc has concluded its investigation into the music streaming service’s claims of anti-competitive behaviour by Apple over its App Store rules, with the prospect of a €500m (£425m) fine, the iPhone manufacturer has accused Spotify of trying to get “limitless” access to its tools without paying.

Stockholm-based Spotify filed a complaint with the EU in 2019, claiming that App Store rules limit choice and competition because Apple charges a 30% fee on purchases made through the store including music streaming subscriptions.

Reddit plans stock market debut

In other news:

Reddit set the stage for its highly anticipated stock market debut, preparing investors for the largest initial public offering by a major social network in four years.

A filing with the Securities and Exchange Commission on Thursday disclosed the financial performance of the social media group, and revealed that Sam Altman, the OpenAI founder and CEO, is its third-largest shareholder, with an 8.7% stake.

The company plans to trade on the New York Stock Exchange under the ticker symbol “RDDT.” Its much-awaited listing – expected in March – would be the biggest social media IPO since Pinterest went public in 2019.

The number of shares to be offered and the price range for the proposed offering have not yet been determined, Reddit said in a statement.

Business sentiment improves in Germany – Ifo

While the German economy remained stuck in the doldrums in the final months of last year, the outlook has brightened somewhat.

The Munich-based Ifo institute’s closely-followed business climate index rose to 85.5 points in February, from 85.2 points in January as sentiment among services firms improved. Clemens Fuest, the institute’s president, said:

This is due to slightly less pessimistic expectations. Assessments of the current situation remained unchanged – positive and negative responses here were nearly in balance. The German economy is stabilising at a low level.

In manufacturing, the business climate index fell, and perception of the current situation is at its lowest since September 2020. The decline in the order backlog continued, and companies announced further cuts to production.

However, in the service sector, the business climate improved. Service providers were more satisfied with their current business situation. Expectations were still pessimistic, but less so than they were in January. Orders remain weak, though.

In trade, the index dropped again. Companies were noticeably less satisfied with their current business situation, although their expectations improved slightly. They are still deeply skeptical of how business will develop in the months ahead.

In construction, the business climate indicator rose slightly, but remains at a low level. While the current situation has improved, expectations for the coming months fell to their lowest level since 1991.

How Ukraine’s largest private equity firm raised $350m during a war

Juliette Garside

How Ukraine’s largest private equity firm raised $350m during a war – by the Guardian’s deputy business editor Juliette Garside.

For Lenna Koszarny, the Canadian-born head of Ukraine’s largest private equity group, Horizon Capital, there was never any question of stopping work or leaving the country when Russia launched its February 2022 assault. But continuing to do business took resolve. “You’re in the centre of a hurricane,” she said.

There have been 7,400 missile and 3,900 drone attacks on Ukraine since the war began, and working through them is part of daily life. “The air raid sirens go off, you go into the bomb shelter, you take your computer … and you keep working until the all-clear comes.”

There have been no casualties on her team. It’s a different story for the 18 companies Horizon invests in – a third of employees have been killed. And yet Horizon, which manages $1.6bn (£1.26bn) in assets, has remained open throughout. “We haven’t shut the offices one day since the invasion.”

The company’s 35 staff relocated to Lviv, near the border with Poland, for a few weeks at the start of the invasion, but Koszarny and her team soon returned to Kyiv and have remained in the capital throughout.

Horizon has managed to not only keep its doors open and its employees safe, but to raise $350m in a funding round that originally began in October 2021. After a delay caused by Russia’s full-scale invasion, fundraising resumed, and the cap was raised from $200m to $300m, and then raised again, in a process that closed this month. It will be the first and largest private equity fund raised during the conflict.

Backers include the European Bank for Reconstruction and Development and the Rockefeller Foundation.

Amid the bombardment, talk of capital raising can feel out of place. But Ukraine’s ability to keep its economy afloat and continue exporting is crucial to the war effort.

Standard Chartered CEO’s pay jumps to £7.8m after profit bump

Rounding off the UK bank earnings season, Standard Chartered has handed its chief executive his largest pay package in nearly a decade as the lender reported a jump in profits, despite bracing for up to £1bn in potential losses due to China’s property downturn.

The profit bump helped push the longstanding chief executive Bill Winters’ pay up 22% to £7.8m – from £6.4m in 2022. It is the most he has been paid since 2015.

The London-headquartered bank, which makes most of its profits in Asia, Africa and the Middle East, said annual pre-tax profits rose by 19% in 2023, rising to $5.1bn (£4bn).

Standard Chartered shares are top of the FTSE 100 index, up 8.2%.

The growth was due in part to high interest rates, which allowed it to charge more for loans and mortgages. It said revenue from those interest charges, compared to what it paid out to savers, was expected to grow in 2024 “and beyond”.

The stronger performance helped offset the money that the bank put aside for potential losses. The lender is ultimately expecting a loss of up to $1.2bn linked to its Chinese commercial real estate portfolio, though the actual charges taken for the year were offset by improvements in other parts of the business, and totalled $528m.

Standard Chartered also took a $153m hit in the value of its stake in China Bohai Bank, as Chinese lenders have become increasingly exposed to bad debts linked to its property crisis.

Winters’ pay award outstrips every other year since he has led the bank apart from his first year, in 2015, when the 62-year-old’s pay package was flattered by a buyout award and totalled £8.4m.

This week, rival HSBC nearly doubled the payout for its own chief executive, Noel Quinn, to £10.6m.