(Bloomberg) — Taiwan Semiconductor Manufacturing Co. has gained a market capitalization of about $42 billion after investors bet the chipmaker against Nvidia and Apple to be the biggest winner of the AI development frenzy.

Most Read Articles on Bloomberg

Taiwan’s largest company soared 7.9% in its first trading after the week-long Lunar New Year holiday, taking its capital to a record $575 billion. This was enough to overtake Visa and become the 12th most valuable company in the world. Morgan Stanley raised its price target for TSMC by about 9%, marking the stock’s biggest rise in more than a year.

The surge pushed Taiwan’s benchmark index to an all-time high. TSMC last week reported a 7.9% sales increase in January, the latest sign of a long-awaited recovery in global consumer electronics demand.

At the same time, investors continue to flock to companies expected to ride the wave of AI development activity that has accelerated since OpenAI rolled out ChatGPT. The Philadelphia Stock Exchange’s semiconductor index recently hit a new all-time high, and Nvidia’s market capitalization has soared to about $1.82 trillion, surpassing Amazon.com and Alphabet.

“Taiwan has been driven by technology, especially AI themes,” said Xin Yao Ng, Asia equity investment director at abrdn. “After Jensen Huang’s visit to Taiwan, NVIDIA became a catalyst to further boost sentiment, increasing investor appetite for AI his value chain business and his NVIDIA suppliers.”

Read more: TSMC monthly sales increase in latest sign of sector recovery

Morgan Stanley analysts including Charlie Chan said this week that the move to larger language models like ChatGPT should increase demand for high-end chips, which will benefit TSMC’s cutting-edge foundry business. writes.

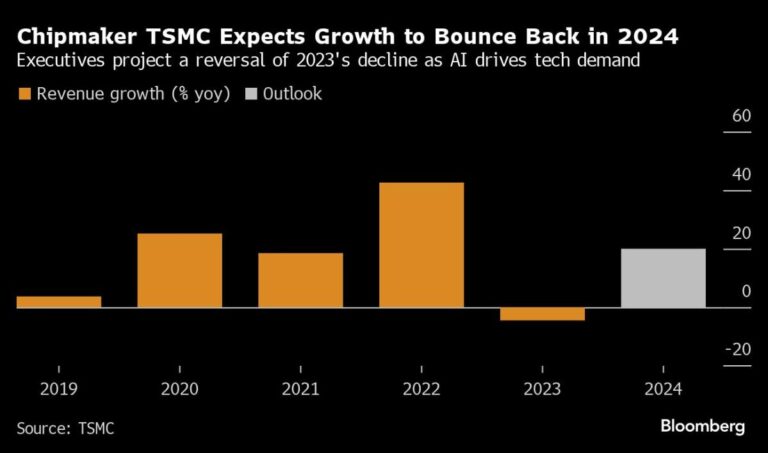

TSMC executives said in January that they expected a return to solid growth this quarter, giving them room to ramp up capital spending in 2024, as the world’s most valuable chipmaker looked to a recovery in demand for smartphones and computing. He hinted that he was expecting it.

The outlook for Taiwanese companies comes after years of weak technology demand. Executives also spent a lot of time discussing potential catalysts from AI training and development, which requires powerful chips that TSMC is good at manufacturing.

Last month, company executives met with NVIDIA CEO Huang to discuss AI chip supply constraints, a major challenge for the industry.

Read more: Taiwan stock index rises to record high on optimism about AI

–With assistance from Charlotte Yang.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP