[ad_1]

Nokia Corporation NOK recently signed a multi-year patent cross-licensing agreement with smartphone maker Vivo. The agreement requires Vivo to pay royalties to Nokia based on mutually agreed terms. The agreement will likely end all pending patent litigation between the companies in all jurisdictions.

A 5G patent cross-license agreement is a legal arrangement in which the parties mutually agree to license each other’s 5G-related patents and focus on developing new products and services without infringing each other’s intellectual property rights. .

The licensing deal with China-based Vivo is the company’s sixth major deal in the past 13 months, with other partnerships with Apple, Samsung, OPPO, Honor and Huawei.

This development could sustain Nokia’s licensing business in the long term and strengthen its portfolio in the 5G ecosystem.

Nokia is well-positioned in the ongoing technology cycle given the strength of its end-to-end portfolio. The company’s win rate is encouraging, with significant success in key 5G markets in the US and China. The company invests in research and development to drive innovation, develop new technologies and maintain a competitive edge in the rapidly evolving communications industry around the world.

The company currently has 319 commercial 5G contracts with communication service providers around the world. There are 110 live 5G networks, both public and private. 5G portfolios are gaining increasing attention among enterprise customers.

Additionally, Nokia could see healthy momentum in the automotive, consumer electronics, IoT, and multimedia sectors as it moves towards the end of its smartphone license renewal cycle. The company is expected to have an annual net sales run rate of €1.4 billion to €1.5 billion ($1.51 billion to $1.62 billion) over the medium term.

Since 2000, Nokia has invested approximately 150 billion euros in research and development, which consists of approximately 20,000 patent families, including more than 6,000 patents declared essential for 5G. Contains patent families. This makes the company a leader in the patent portfolio industry. Nokia contributes to open standards in exchange for the right to license its inventions under fair, reasonable and non-discriminatory terms.

Businesses can easily license Nokia technology and software and save significant investment by not having to build their own. This collaboration is expected to foster innovation and accelerate the development of new products and services in the market.

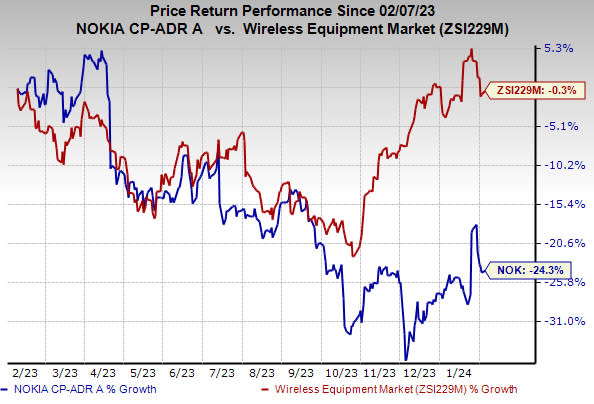

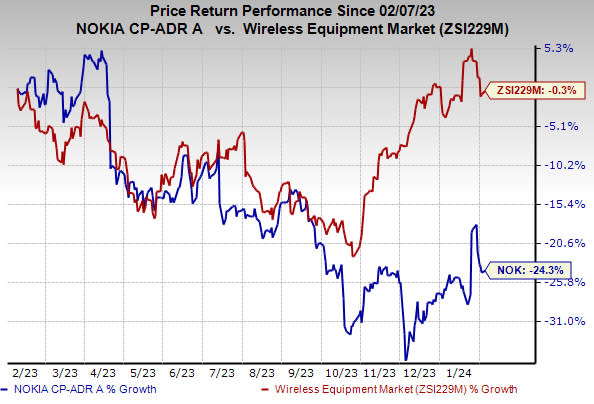

The company’s stock price has declined 24.3% over the past year, compared to the industry’s decline of 0.3%.

Image source: Zacks Investment Research

Nokia currently carries a Zacks Rank #3 (Hold).You can view See the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to consider

Arista Networks Co., Ltd. Currently carrying a Zacks Rank #1, ANET could benefit from strong momentum and diversification across its top industries and product lines. The company takes a software-driven, data-centric approach to help customers build cloud architectures and improve cloud experiences. Arista averaged an impressive 12% return in his subsequent four quarters.

The company holds a leadership position in the 100 Gigabit Ethernet switching share of ports in the high-speed data center segment. 200 Gig and 400 Gig high-performance switching products are gaining increasing attention in the market. The company remains well-positioned for healthy growth in its data-driven cloud networking business with its proactive platform and predictive operations.

NVIDIA Corporation NVDA currently has a Zacks Rank #2 (Buy), but its average return for the fourth quarter was a surprise of 18.99%. In the last reported quarter, the stock delivered an impressive return of 19.64%.

NVIDIA is the world leader in visual computing technology and the inventor of the graphics processing unit. Over the years, the company’s focus has evolved from his PC graphics to AI-based solutions that support high-performance computing, gaming, and virtual reality platforms.

Interdigital Co., Ltd. IDCC is a pioneer in advanced mobile technologies that enable wireless communications and functionality. The company designs and develops a wide range of advanced technology solutions for use in digital mobile phones, wireless 3G, 4G, and IEEE 802 products and networks.

This Zacks Rank #2 stock has expectations for long-term earnings growth of 17.4% and has surged 75.3% over the past year. An established global footprint, a diverse product portfolio and the ability to reach different markets are InterDigital’s key growth drivers. Adding sensor, user interface, and video-related technologies to its already strong portfolio of wireless technology solutions has the potential to create significant value given the huge size of the markets in which the company serves licensed technology. there is.

Want the latest recommendations from Zacks Investment Research? Today you can download 7 Best Stocks for the Next 30 Days.Click to get this free report

Nokia Corporation (NOK): Free stock analysis report

NVIDIA Corporation (NVDA): Free stock analysis report

InterDigital, Inc. (IDCC): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research

[ad_2]

Source link