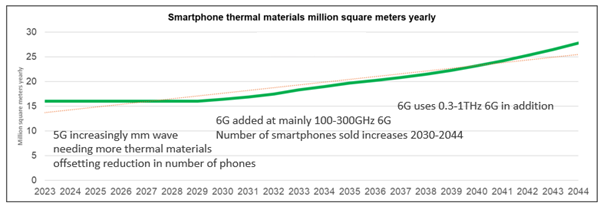

If 6G is successful, thermal materials in smartphones will grow by 1 million square meters per year worldwide from 2023 to 2044.

DUBLIN, Jan. 15, 2024 (Globe Newswire) — The “6G Communications: Materials and Hardware Market, Technology 2024-2044” report has been added. ResearchAndMarkets.com Recruitment.

This comprehensive study delves into the heart of the 6G revolution and provides deep insight into the evolving landscape of materials, devices, and communications technologies.

Main highlights:

-

Unprecedented market dynamics: This report examines the transformative landscape of 6G communications, highlighting evolving market dynamics, breakthroughs, and setbacks. It serves as an important resource for up-to-date assessment of the latest needs and market size.

-

Thorough analysis: The report meticulously covers the goals, challenges, and key players in the 6G space, with 13 key conclusions, a 6G SWOT assessment, and easy-to-understand infographics.

-

Chapters with emphasis: Each chapter delves into key aspects of 6G, including thermal management, reconfigurable intelligent surfaces, 6G devices, and the vast opportunities presented by graphene and other 2D materials.

-

Global insights: This report contains a comprehensive overview of 6G communications projects around the world, revealing the nature of materials and component developments and the key players driving innovation.

In short, this report reveals how a multi-billion dollar business manufacturing value-added materials and components for 6G could emerge. This means everything from fine metal patterning and flexible thin-film electronics to energy harvesting for facilities, thermal management for giant base stations, and critical parts of his RIS facades for skyscrapers.

Questions answered included:

-

Probably the winners and losers

-

Progress and intentions by region

-

Fairly evaluate the advantages and disadvantages

-

Gap in the market that can be addressed

-

Analysis of research pipeline and trends

-

Potential partners, acquisitions and competitors

-

What 6G frequencies are possible and in what order they may be used?

-

What kind of materials and hardware are needed, when and why?

-

There are 15 material prediction lines.device, host equipment

-

Technology, launch and standards roadmap from 2024 to 2044

-

Unresolved issues become opportunities for materials and devices

-

Favorable compounds, devices, frequencies, and active regions emerge

-

A 20-year roadmap for decision-making, technical capabilities, and implementation.

Main topics covered:

1 executive summary and 15 forecasts from 2023 to 2043

1.1 Purpose of this report

1.2 Methodology of this analysis

1.3 6G Needs, Frequencies, Other Options and 13 Key Conclusions

1.4 6G Detailed Benefits, Standard Status, and Deployment 1980-2044

1.5 Some 6G global architecture proposals including complementary systems

1.6 Probably 6G hardware and related manufacturers

1.7 SWOT assessment of 6G communications as currently understood

1.8 Dissemination of 6G Materials and Device Opportunities

1.9 Recent hardware advances that can support 6G 2024-2044

1.10 Key needs for advanced materials in envisioned 6G systems

1.11 System Aspects of Emerging Hardware Needs 2024-2044

1.12 6G thermal materials will become a big market

1.13 Market and Technology Roadmap and 16 Forecasts 2024-2044

1.14 Locations of major 6G materials and component activities around the world

2. Introduction

2.1 Methodology, presentation and context

2.2 Situation in 2024

2.3 6G is more than just communication

2.4 Progress from 1G to 6G Deployment from 1980 to 2044

2.5 6G Addition: Opportunity or Threat to Viability?

2.6 Arguments against 6G and the possibility of slippage

2.7 Transmission distance dilemma

2.8 Greening Dilemma

2.9 SWOT Assessment of 6G Communications Materials and Components Opportunities

2.10 Manufacturing technology for major 6G high value-added materials

3. Thermal management: 6G materials, devices, and equipment

3.1 Overview

3.2 New and diverse challenges arise for new suppliers

3.3 SWOT Assessment of 6G Telecommunications Thermal Materials Opportunity

3.4 Thermal Materials and Construction of 6G Smartphones and Other Client Devices

3.5 Energy harvesting and on-site zero-emissions power will be important in 6G

3.6 6G Thermoelectric Elements for Temperature Control and Power

4. Reconfigurable intelligent surfaces

4.1 Overview

4.2 How 6G RIS and other metamaterials work

4.3 Possible areas, quantity costs and formulations of RIS materials

4.4 6G RIS Materials and Components Opportunities

4.5 Eight Tuning Device Families for 6G RIS from Recent Research Pipeline: Our Evaluation, References

5. Devices – 6G optical, electronic and electrical devices: development status and potential

5.1 Overview

5.2 Terahertz gap

5.3 Diode – Schottky is good but still has problems

5.4 How do CMOS and HEMT compete?

5.5 Optical fiber materials, design, deployment and 6G SWOT assessment issues

5.6THz waveguide materials, design, deployment, and SWOT evaluation issues for 6G

6. Graphene and other 2D materials for 6G communications

6.1 THz 2D Material Overview

6.2 Graphene landscape

6.3 Supercapacitors, LiC and pseudocapacitors for 6G

6.4 Graphene transistor surrogates and metasurfaces

6.5 Structure of graphene THz device

7. Other materials: 6G optical, electronic, electrical, micromechanical

7.1 Overview

7.2 Comparison of 14 applications of 46 elements and compounds in potential 6G communications

7.3 Selection of some physically tuned materials compared for metasurfaces

7.4 Selection of semiconductor materials

7.5 Silicon carbide electro-optic modulator

7.6 Overview of phase change materials for 6G electronics

7.7 Vanadium dioxide in many 6G applications

7.8 Chalcogenide phase change materials

7.9 Liquid Crystal Polymer LCP Nematic Liquid Crystal NLC

7.10 Materials for Solar Power in 6G Infrastructure and Client Devices

7.11 ENZ and low loss materials for THz and optical applications

7.12 Micromechanics, MEMS, and Microfluidics for 6G

8. 6G communication projects around the world with materials and component research

Companies mentioned

-

akela laser

-

AGC

-

Anritsu

-

Aoway

-

apple

-

AT&C

-

AT&T

-

azo material

-

Beacom

-

Bladon Jets

-

BT

-

CEA

-

Centro Richercia FIAT

-

china mobile technology

-

china communications

-

commscope

-

core lab

-

corning

-

CNRS

-

DCMS

-

Dow

-

dupont

-

Eaton

-

Ecdyne

-

Elbana Photonics

-

eurocom

-

evolve technology

-

Ericsson

-

Fractal antenna system

-

Fraunhofer HHI

-

GL poly

-

Google

-

greener wave

-

heidelberg

-

Henkel

-

home sun

-

Honda

-

huawei

-

ICS

-

IMEC

-

Ino

-

inmarsat

-

iQLP

-

intel

-

interdigital

-

ionic material

-

keysight technology

-

Kymeta

-

Laird

-

lattice

-

LG

-

lumen

-

media tech

-

meta

-

motorola mobility

-

Neograph

-

next navigation

-

nylium

-

nokia

-

bad debt

-

NTT

-

NTT Docomo

-

Nubia

-

noor energy

-

Nvidia

-

Oppo

-

orange

-

Oxford PV

-

parker road

-

proteomics

-

Qualcomm

-

Rohde Schwarz

-

samsung

-

Sekisui

-

Seminex

-

scene

-

Shinetsu

-

skoltec

-

SK Telecom

-

SNCF

-

sol aero

-

Sony

-

space tee

-

spectro lab

-

star link

-

Sanovate

-

Telecom Italia

-

telefonica

-

terrace

-

tencent

-

tesla

-

TII

-

ThinP

-

Toyota

-

Tubitac uekae

-

Inipi

-

western digital

-

WB solar power

-

WL Gore

-

verizon

-

Vivotech

-

ZTE

-

ZTE Winston

For more information on this report, please visit https://www.researchandmarkets.com/r/c6gom8.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900