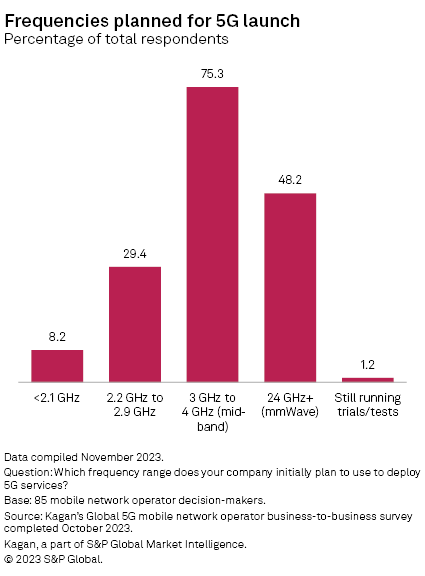

According to Kagan’s 2023 Global 5G Survey of decision makers at 85 mobile network operators (MNOs), for the third consecutive year, the majority of mobile operators have selected mid-band, specifically the 3 GHz to 4 GHz band, as the most suitable frequency spectrum range for the rollout of 5G networks.

The 2023 5G study also provided additional, expected examination of fixed wireless access (FWA) technology, a 5G service that primarily utilizes millimeter wave (mmW) spectrum and is being marketed by carriers such as T-Mobile US Inc. and Verizon Communications Inc. as an alternative to wired broadband services.

For the third consecutive year, the majority of Kagan’s Global 5G Survey respondents selected mid-band, specifically the 3GHz to 4GHz band, as the most suitable frequency spectrum range for 5G network deployment. In 2023, 75% of respondents will already be utilizing the mid-band frequency range or plan to provide 5G services. This is a significant year-over-year increase from 67% of operators who cited mid-band as their first choice for 5G in the 2022 survey.

The 2023 5G survey also provided additional expected validation for FWA technology, a 5G service that primarily leverages mmW spectrum (above 24 GHz) that carriers such as T-Mobile USA and Verizon Communications are selling as an alternative to wired broadband services. In fact, FWA/mmW saw the largest year-over-year increase in response to our question, “What frequency range do you plan to use initially for your 5G deployment?”, from 37% in 2022 to 48% in 2023.

There has been a clear shift in MNOs’ 5G deployment plans over the past three-year survey period, from 2021 to 2023. While mid-band has remained their first choice of frequency spectrum for deploying 5G, the second choice indicated by MNOs has shifted from being equal in 2021 (31% for both 2.0GHz-2.9GHz and mmW spectrum options) to mmW in 2022, with 27% of operators citing the 2.0GHz-2.9GHz range and 37% of respondents selecting mmW. This gap has widened even further this year, from 10 percentage points in 2022 to 19 percentage points in 2023.

Low bands (sub-2.1 GHz) further receded year-over-year as the least popular frequency option for MNOs to deploy 5G services, with 8% of respondents naming this option in 2023 compared to 13% in 2022. However, it should be noted that even T-Mobile USA, a strong proponent of mmW technology, is utilizing low band RAN technology (600 MHz in T-Mobile’s case) to provide 5G services.

5G Migration Options

When it comes to time-to-market planning for mobile operators’ 5G network/architecture technology evolution roadmaps, leveraging existing 4G LTE spectrum (and accompanying infrastructure) remains the most preferred option. In fact, this path to 5G is growing in popularity every year, increasing by five percentage points from 50% in 2022 to 55% in 2023. This solution, known as non-standalone 5G, allows MNOs to roll out 5G services more quickly and cost-effectively than other 5G network options.

The second most popular choice for 5G service deployment (27% of respondents, 23% in 2022) was leveraging 4G LTE networks in combination with Licensed Assisted Access (LAA) technology. LAA accelerates time to market and reduces the cost of implementing 5G services, but like non-standalone 5G, it also has the limitation of lowering overall performance due to its reliance on 4G network elements (and lack of a 5G core). LAA is primarily preferred by European operators (46%) and North American operators (36%).

The third most popular option for MNOs is to build a standalone 5G network running in parallel with existing 4G networks and services, which around 24% of respondents have implemented or are planning, up from 18% in 2022. This is costlier as it requires investment and deployment in 5G core. As highlighted in our latest 5G Tracker report, 5G standalone architectures were robustly pursued by operators in most parts of the world in 2023.

Standalone 5G networks are sometimes referred to as “true 5G” because they can provide both higher throughput speeds and lower latency services without using any 4G network elements. Standalone 5G networks also have lower operational costs, although the initial capital investment to launch a standalone network is higher.

The least popular option for network migration from 4G to 5G was the exclusive use of open RAN technology, chosen by just 14% of respondents in 2023. However, this is a notable increase from the previous year: in 2022, just 8.5% of mobile operators said they plan to leverage open RAN architectures to power their 5G services.

Open RAN leverages cloud and software-based solutions to enable 5G services, as opposed to traditional hardware-centric approaches, but is expected to become more widely adopted in the future as 5G networks are more widely deployed and mobile operators become more comfortable with open and/or “virtualized” RAN technologies.

The data presented in this article comes from Kagan’s Fall 2023 B2B Global 5G Survey. 85 operator decision makers familiar with their companies’ 5G rollout plans were questioned online or over the phone. Of the respondents, 11 were from North American operators, 28 from Europe, 13 from the Middle East/Africa, 14 from Latin America, and 19 from Asia Pacific.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, a division of S&P Global.