[ad_1]

European 6G market

DUBLIN, Feb. 6, 2024 (Globe Newswire) — The “European 6G Market – Analysis and Forecast, 2029-2035” report has been added. ResearchAndMarkets.com Recruitment.

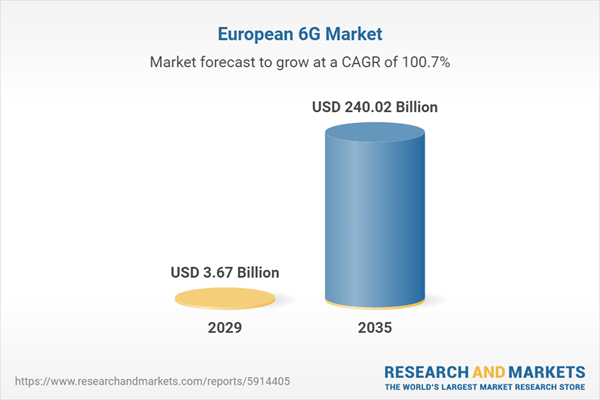

The European 6G market is projected to be $320 million in 2028 and is expected to grow at a CAGR of 100.72% to reach $240.02 billion by 2035. The European 6G market is expected to expand, especially due to the growing demand for low-latency networks. Applications as well as the use of edge computing devices and internet services are expanding.

Many countries and companies are investing in this technology, and Europe is establishing itself as a pioneer in 6G research and development. The 6G Action Plan was introduced by the European Union to organize and finance regional research projects. We aim to ensure that Europe can compete with other leading players around the world and maintain our leadership position in 6G innovation.

Many European countries, including Finland, Sweden, and Germany, have set up specialized research facilities and testbeds to study and advance 6G technology. Several European-based companies are actively working on his 6G research and development, including Ericsson and Nokia.

A number of use cases and applications are expected to drive Europe’s 6G industry, including improved mobile broadband, ultra-reliable and low-latency communications, giant machine-type communications, and holographic communications. To enable high-speed, low-latency, and efficient wireless communications, these applications require advanced technologies such as artificial intelligence, terahertz frequencies, and millimeter wave communications.

Leading companies such as Nokia, Telefonaktiebolaget LM Ericsson, Vodafone Group, Deutsche Telekom AG and Tele2 AB are responding to the demand for 5G solutions and 6G development in the European region. Germany, Finland, Sweden and Switzerland are certainly noted as leading countries in the development of his 6G market in Europe due to their larger consumer base, presence of major manufacturers and suppliers, and technological advancements in the telecommunications industry.

Overall, the European 6G market is expected to present noteworthy prospects for technology suppliers, network operators, and other relevant industry participants. This is essential to the advancement of next-generation wireless technology and the digital revolution in many sectors such as manufacturing, entertainment, transportation, and healthcare.

What value does this report bring to your organization?

The growing need for low-latency, high-data transfer networks to improve consumer experience and industrial operations is driving the 6G market. Therefore, 6G business is expected to be a model that generates large investments and high returns.

The European 6G market is in the development or conceptualization stage and is expected to grow rapidly. This market offers significant opportunities for established and emerging market players. Strategies covered in this segment include mergers and acquisitions, partnerships and collaborations, product launches, business expansion, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships and collaborations followed by product development.

Key players in the European 6G market analyzed and profiled in this study include 6G manufacturers that develop, maintain, and sell 6G technology services, devices, equipment, and materials. Additionally, a detailed competitive benchmarking of players operating in the 6G market is carried out to help readers understand how the players compete with each other and provide a clear market picture.

Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations are expected to help readers understand the untapped revenue sources of the market.

Analyst perspective on 6G market

The 6G market is likely to grow several times over in the coming years due to the continued development and introduction of M2M communication and computing devices, as well as the increasing demand for industry automation and adoption of smart technologies in various industries. there is.

Additionally, significant investments are required to develop new technologies and conduct extensive research and development to meet the performance requirements of next-generation networks. Expanding initiatives and support from governments around the world are expected to further accelerate the growth of the 6G market.

However, certain technological challenges, such as lack of global security guidelines and standards for 5G and 6G, increasing risk of data security and privacy threats, may restrain the growth of the 6G market. 6G technology is expected to be deployed in some regions of the developed world by 2028, and the technology is estimated to experience significant growth in all regions from 2030 onwards.

Key questions answered in the report

-

What are the key drivers, constraints, and opportunities for the European 6G market?

-

How is the market expected to grow during the forecast period 2029-2035?

-

What are the key development strategies implemented by leading companies to sustain in this competitive market?

-

Which is the fastest growing segment of the European 6G market?

-

What will happen to the adoption of 6G technology? Also, what will be his 6G market demand in different countries during the forecast period?

Key attributes:

|

report attributes |

detail |

|

number of pages |

132 |

|

Forecast period |

2029-2035 |

|

Estimated market value in 2029 (USD) |

$3.67 billion |

|

Projected market value to 2035 (USD) |

$240.02 billion |

|

compound annual growth rate |

100.7% |

|

Target area |

Europe |

Main topics covered:

1 market

1.1 Industry Outlook

1.1.1 Trends: present and future

1.1.1.1 Growing adoption of home automation solutions

1.1.1.2 Collaboration and partnership for 6G technology development

1.1.1.3 Growing efforts and government support around the world

1.1.2 Supply chain analysis

1.1.3 Ecosystem/Ongoing Programs

1.1.3.1 Consortiums and associations

1.1.4 Stakeholder analysis

1.1.4.1 Telecommunications carriers and network equipment

1.1.4.1.1 Changing carrier value propositions and adopting new strategies

1.1.4.2 Application-oriented companies

1.1.4.2.1 Increasing demand for Internet applications impacts Internet and mobile subscription growth

1.1.4.2.2 Smart city and smart mobility applications drive demand for high-speed connectivity

1.1.4.2.3 Others

1.1.5 Technologies that support 6G.

1.1.5.1 Artificial Intelligence (AI)

1.1.5.2 Terahertz communication

1.1.5.3 Optical wireless communication

1.1.5.4 Free-space optical backhaul

1.1.5.5 Blockchain

1.1.5.6 Aircraft

1.1.5.7 Self-free communication

1.1.5.8 Big data analysis

1.1.6 5G to 6G Migration

1.2 Business dynamics

1.2.1 Business drivers

1.2.1.1 Emphasis on low-latency networks for specific applications

1.2.1.2 Growing adoption of Internet services and edge computing devices

1.2.1.3 Growth of smart technology

1.2.1.4 Greater emphasis on satellite communications

1.2.1.5 Development of new low-loss materials for advanced networks

1.2.2 Business challenges

1.2.2.1 Slow migration from older communication generations

1.2.2.2 Very large investment requirements

1.2.2.3 Data security and privacy threats

1.2.3 Business opportunities

1.2.3.1 Use of holography in communications

1.2.3.2 6G in the growth of IoT, blockchain and artificial intelligence

1.2.3.3 UN SDGs and mobile communications

1.2.4 Business strategy

1.2.4.1 Product development

1.2.4.2 Market trends

1.2.5 Corporate Strategy

1.3 Startup situation

1.3.1 Major startups in the ecosystem

1.4 Patent analysis

1.5 Case study

2 regions

2.1 Europe

2.1.1 Market

2.1.1.1 Buyer Attributes

2.1.1.2 Major European Manufacturers/Suppliers

2.1.1.3 Business challenges

2.1.1.4 Business Drivers

2.1.2 Application

2.1.2.1 Europe 6G Market (by End-Use Application), Value Data

2.1.2.1.1 Europe 6G Market (by Consumer Application), Value Data

2.1.2.1.2 Europe 6G Market (by Industrial and Enterprise Applications), Value Data

2.1.3 Products

2.1.3.1 European 6G Market (by Product Type), Value Data

2.1.3.1.1 Europe 6G Market (by Device), Value Data

2.1.3.1.2 European 6G Market (by Telecommunications Infrastructure), Value Data

2.1.3.1.2.1 Europe 6G Market (by Wireless Infrastructure), Value Data

2.1.3.2 European 6G Market (by Materials), Value Data

2.1.4 European 6G Market (by country), value data

2.1.5 Europe (by country)

2.1.5.1 Germany

2.1.5.2 Finland

2.1.5.3 Sweden

2.1.5.4 Switzerland

2.1.5.5 Rest of Europe

Three Markets – Competitive Benchmarks and Company Profile

3.1 Competitive Benchmarking

3.1.1 Competitiveness Matrix

3.2 Product matrix of major companies

3.3 Market share analysis of major companies

3.4 Company profile

3.4.1 Telefonaktiebolaget LM Ericsson

3.4.1.1 Company Overview

3.4.1.1.1 Telefonaktiebolaget LM Ericsson’s role in the 6G market

3.4.1.1.2 Product Portfolio

3.4.1.2 Business strategy

3.4.1.2.1 Market development

3.4.1.2.2 Product development

3.4.1.3 Corporate Strategy

3.4.1.3.1 Partnerships, acquisitions, collaborations and joint ventures

3.4.1.4 Research and development analysis

3.4.1.5 Analyst perspective

4 Research methods

For more information on this report, please visit https://www.researchandmarkets.com/r/gbq5by.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[ad_2]

Source link