-

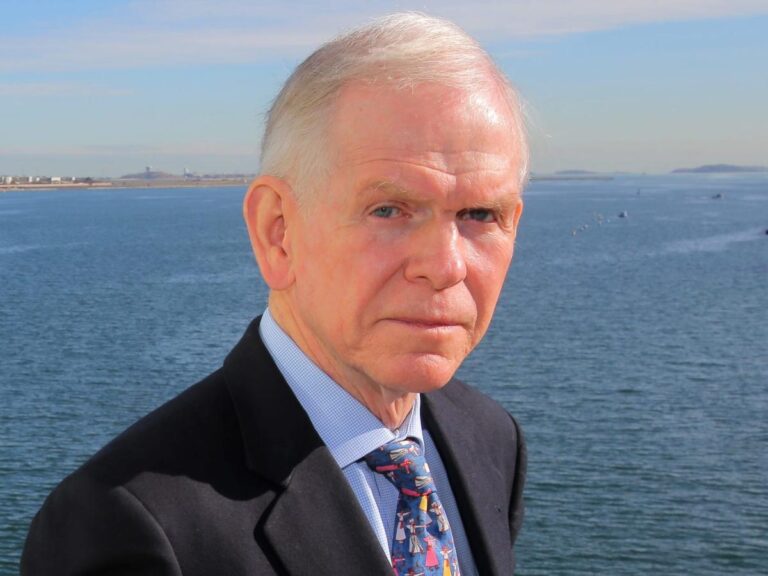

Jeremy Grantham said US stocks are vastly overvalued, a recession is looming and AI is overhyped.

-

The investor said the stock would have fallen another 20% or 30% in 2023 without the AI boom.

-

Mr Grantham said he was concerned about wars abroad, especially at a time when asset prices were at record highs.

Jeremy Grantham has warned that stocks will likely be prohibitively expensive and will struggle, that artificial intelligence is a bubble destined to burst, and that the economy will suffer a mild recession or worse.

The co-founder and long-term strategist at fund manager GMO recommended avoiding U.S. stocks in a recent interview with ThinkAdvisor. “They are almost ridiculously higher than other parts of the world,” he said.

“It’s going to be a tough year for the stock market,” he continued. He said U.S. corporate profit margins are at historically high levels compared to foreign competitors, creating a “double jeopardy” situation for stock prices that could reduce both earnings and multiples. he added.

Grantham, a market historian, warned of a multi-asset “super bubble” in early 2022, and the bubble burst in the same year when the S&P 500 fell 19% and the tech-heavy Nasdaq Composite fell 33%. said.

He said stocks would have fallen another 20% or 30%, but that decline was “unceremoniously interrupted” by the AI frenzy that “changed the flight path of the entire stock market” in early 2023. Stated.

The veteran investor said that “AI is not a hoax, just like Bitcoin is fundamentally,” but predicted that the “incredible euphoria” surrounding it would be short-lived. . Still, he suggested it could become as revolutionary as the Internet in the coming decades.

Grantham also said that gross domestic product (GDP) growth in the fourth quarter was strong at 3.3%, that unemployment and annualized inflation were below 4% in December, and that multiple interest rate cuts have been made this year. The outlook for the U.S. economy was grim, despite the outlook for On the other hand, an inverted yield curve and a prolonged decline in leading economic indicators suggest trouble ahead.

“The economy will weaken further,” he said. “At least it will be a mild recession.”

Mr Grantham also pointed to the threat posed by conflicts in Ukraine and the Middle East, warning that war could foster a geopolitical context in which “hell-hell-horrible, bad things can happen.” He added that the backdrop is particularly worrying when assets are at record highs.

“My specialty outside of bubbles is long-term, undervalued negative situations,” Grantham said. “And lo and behold, I now have a large collection of negatives.”

The bubble guru urged investors to be cautious and look for undervalued assets in emerging markets like Japan, depressed sectors like natural resources, and growth areas like climate protection.

It is worth emphasizing that Mr Grantham’s dire predictions have not come true in recent years. For example, in April, he suggested that the S&P 500 index could be cut in half to around 2,000 points in a worst-case scenario, but the benchmark stock index has since risen to an all-time high of more than 4,900 points.

Read the original article on Business Insider