Stephanie Song, who previously worked on Coinbase’s Corporate Development and Ventures team, was often frustrated by the amount of due diligence tasks she and her team had to complete on a daily basis.

“Analysts spend hundreds of hours burning the midnight oil doing work that no one else wants to do,” Song told TechCrunch in an email interview. “At the same time, funds are looking for ways to invest less capital and increase team efficiency while reducing operating costs.”

Inspired to find a better way, Song teamed up with two former Coinbase colleagues, Brian Fernandez and Anand Chaturvedi, to create a platform that attempts to automate critical investment due diligence and critical investing. One Dili (not to be confused with the capital of East Timor) was launched. Portfolio management procedures for private equity and his VC firm using AI.

Mr. Dili, a Y Combinator alumnus, has received venture funding from backers including Allianz Strategic Investments, Rebel Fund, Singularity Capital, Corenest, Decacorn, Pioneer Fund, NVO Capital, Amino Capital, Rocketship VC, Hi2 Ventures, and Gaingels. has raised $3.6 million. Hyper Ventures.

“[AI] It impacts every part of the investment fund, from analysts to partners to back-office functions,” Song said. “Fund investment professionals are looking for a differentiated advantage in their decision-making and are leveraging rich data to help them combine understanding of a deal with how it fits into the fund. … Dili needs to raise funds in a difficult macro environment.”

Song is right that funds are looking for an edge, and more importantly, new and promising ways to reduce investment risk. VCs reportedly have $311 billion in unspent cash and raised $67 billion last year, the lowest in seven years, as they become more wary of early-stage ventures.

Dili is not the first company to apply AI to its due diligence process. Gartner predicts that by 2025, more than 75% of VC and early investor executives’ reviews will be informed using AI and data analytics.

Several startups and established companies are already using AI to feed financial documents and large amounts of data to create market comparisons and reports. They include Wokelo (whose clients include private equity and VC funds like Dili), Ansarada, AlphaSense, and Thomson Reuters (through the company). clear the reverse media unit).

But Song insists that Dili uses technology that is “first of its kind.”

“[We can] It provides very high accuracy for certain tasks, such as retrieving financial metrics from large unstructured documents,” she added. “We built a custom indexing and retrieval pipeline tailored to specific documents. [our AI] Models with high-quality context. ”

Dili leverages large language models aligned with GenAI, specifically OpenAI’s ChatGPT, to streamline investor workflows.

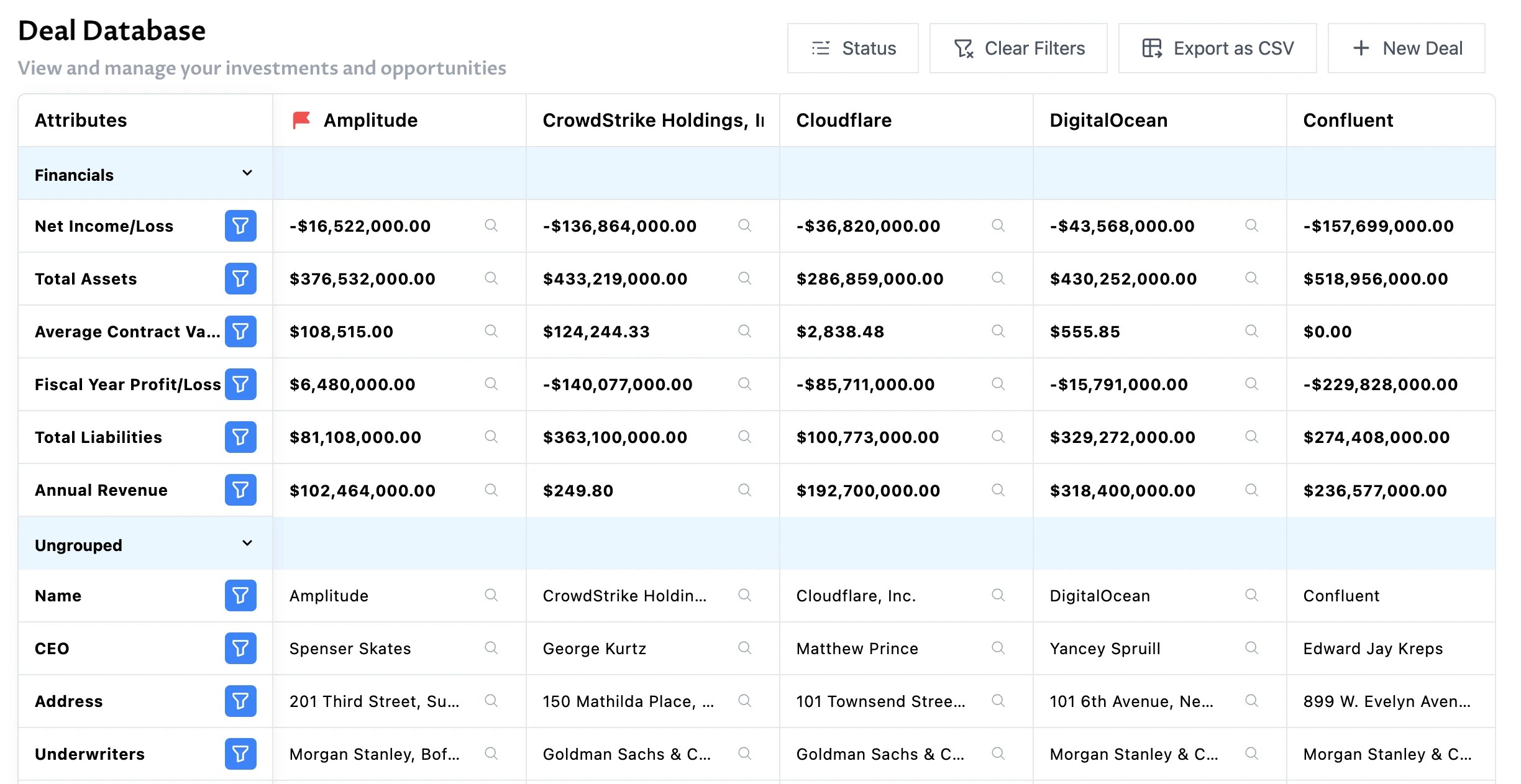

The platform first catalogs a fund’s historical financial data and investment decisions in a knowledge base, then applies the aforementioned model to parse databases of private company data, process due diligence request lists, and Automate tasks like unearthing lesser-known numbers. .

Dili recently added support for automatic comparative analysis and industry benchmarking on a company’s outstanding transactions. When a fund uploads trade data, he can compare past and current investment opportunities in one place.

“Receive emails alerting you to new investment opportunities and portfolio company updates, and instantly access preliminary summaries and notes powered by AI-generated trading red flags, competitive analysis, industry benchmarks, and the fund’s historical investment patterns. “Imagine what you can generate.”

The question is: Can Dili’s AI, or any other AI, be trusted when it comes to managing portfolios?

Image credits: Dili

After all, AI isn’t necessarily known for sticking to the facts. Fast Company tested his ability to summarize articles on ChatGPT and found that this model has a tendency to get things wrong, omit parts, or completely fabricate details not mentioned in the summarized articles. It turns out that there is. It is not difficult to imagine how this becomes a practical problem in due diligence work where accuracy is paramount.

AI can also introduce bias into the decision-making process. In an experiment conducted a few years ago by Harvard Business Review, an algorithm trained to recommend investments in startups chose white entrepreneurs over entrepreneurs of color and companies with male founders. It turns out he likes investing in startups. That’s because the public data on which the algorithm was trained shows that underrepresented women and founders from underrepresented groups tend to be disadvantaged in the funding process and end up raising less venture capital. Because it reflects reality.

Additionally, there is the fact that some companies may not feel comfortable operating their private, sensitive data through a third-party model.

To allay all these concerns, Diri continues to fine-tune its models, many of which are open source, to reduce the occurrence of hallucinations and improve overall accuracy, Song said. said. He also noted that no customer personal data is used to train Dili’s models, and that Dili plans to provide a way for funds to create their own models trained with their own offline fund data. emphasized.

“Hedge funds and public markets have invested heavily in the tech space, but there is a lot of untapped potential in private market data that Dili could unlock for companies,” Song said.

Dili ran an initial pilot last year with 400 analysts and users from a variety of funds and banks. But as the startup expands its team and adds new features, it is working on expanding into new applications, eventually becoming an “end-to-end” solution for investor due diligence and portfolio management. According to Mr. Song, the aim is to

“Ultimately, we believe this core technology we are building can be applied to any part of the asset allocation process,” she added.