- In some markets, operators are waiting for evidence of successful use cases before switching to 5G SA..

- In the first half of 2023, Asia Pacific continued to lead in 5G SA core deployment.

- Ericsson led the overall market, followed by Nokia, Huawei, ZTE, Samsung and Mavenir.

Counterpoint Research recently published July update of 5G SA Core Tracker is the culmination of extensive research on the 5G SA market. It provides details of all carriers with 5G SA core that will enter commercial operations at the end of H1 2023, including market share by region, vendor, and popularity for deployment. frequency bands included. Apart from that, it also touches on the potential monetization opportunities for carriers across different domains and use cases.

Over the past year, commercial deployment of 5G Standalone (SA) has grown steadily, with more than 20 carriers migrating to 5G Standalone Core. However, the pace slowed in the first half of 2023, and the number of carriers launching commercial 5G SA was in the single digit range. The main reasons for the slowdown in the commercial deployment of 5G SA were restraints arising from global macroeconomic factors and the lack of a clear picture of 5G monetization for carriers. Although the pace of commercial deployment will slow in 2023, carriers are working on monetization avenues and SA-specific use cases such as on-demand network slicing and FWA.

Most of the commercial deployments of 5G SA are taking place in developed countries, and Counterpoint Research expects the next bulk of network deployments to take place in emerging markets. This will facilitate the continued transition from 5G NSA to 5G SA.

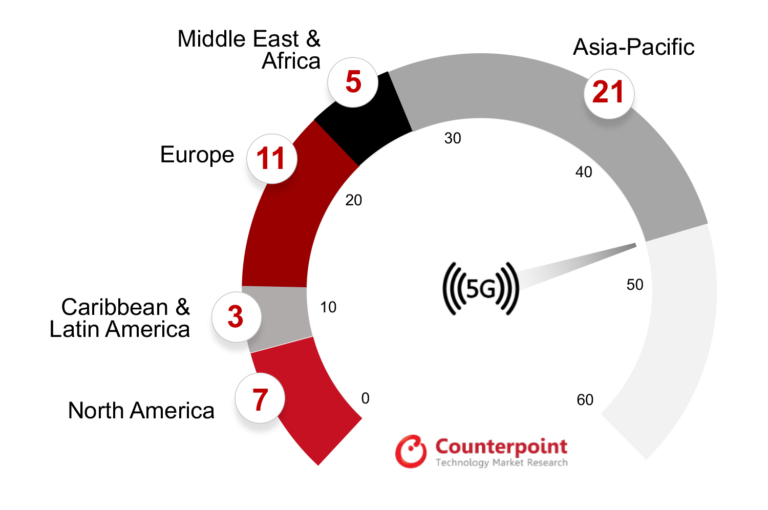

Exhibit 1: 5G SA deployment status by region, first half of 2023

As shown in Exhibit 1, Asia-Pacific leads this segment, followed by Europe and North America, with other regions (Middle East, Africa, and Latin America) lagging behind.

Key Point

Key points discussed in the report include:

- operator – 47 carriers have commercially deployed 5G SA, and many more are in testing and trial stages. Globally, most adoption has taken place in developed countries, with emerging countries lagging behind. While the pace of deployment has been steady in developed markets, it has been slower in emerging markets, with evidence of successful use cases in some markets where carriers have taken the time to switch from 5G NSA to SA. I’m looking for. Continued economic headwinds also delayed SA’s commercial rollout, seen in the first half of 2023.

- vendor – Ericsson and Nokia lead the global 5G SA core market, benefiting in some markets from geopolitical sanctions against Chinese vendors Huawei and ZTE. South Korea’s Samsung and Japan’s NEC are primarily focused on their respective domestic markets, but are also expanding their reach to Tier 2 carriers and emerging markets, while emerging vendors Parallel Wireless and Mavenir are expanding into Europe, the Middle East, We are working with major carriers in Africa.

- spectrum – Most carriers are deploying 5G on mid-band frequencies (N78) to provide faster speeds and better coverage. Some carriers have launched commercial services in the sub-GHz N28 and mmWave N258 bands. FWA seems to be the most popular use case right now, but there’s also a lot of interest in edge services and network slicing.

- Example of use – Telecom operators are struggling to get ROI from their 5G investments and are looking for ways to monetize their 5G services. Although FWA is a promising application for 5G SA monetization, there are many other use cases that a carrier can consider to increase his RoI, such as network slicing, live broadcasts, XR applications, and private networks. Although eMBB is currently the most widely used 5G use case, MNOs must migrate to 5G SA to take advantage of URLLC and mMTC use cases.

Report overview

Counterpoint Research 5G SA Core Tracker, July 2023 provides an overview of the 5G Standalone (SA) market, highlighting the key trends and drivers shaping the market, and details commercial launches by vendor, region, and frequency band. Additionally, this tracker provides details about the 5G SA vendor ecosystem divided into his two categories: Utilities and Private Networks market.

table of contents:

- overview

- Market Latest Information

- 5G SA market development

- Commercial deployment by carriers

- Network engagement by region

- Network engagement by deployment status

- Major 5G core vendors

- Mobile core vendor ecosystem

- 5G core vendor market status

- Outlook

- 5G standalone use case

background

Counterpoint Technology Market Research is a global research company specializing in products in the TMT (Technology, Media, and Telecommunications) industry. We provide leading technology and financial companies with a combination of monthly reports, customized projects, and in-depth analysis of mobile and technology markets. The lead analysts are experienced professionals in the high-tech industry.

Follow Counterpoint Research

press@counterpointresearch.com

Related reports: