SOPA Image/LightRocket (via Getty Images)

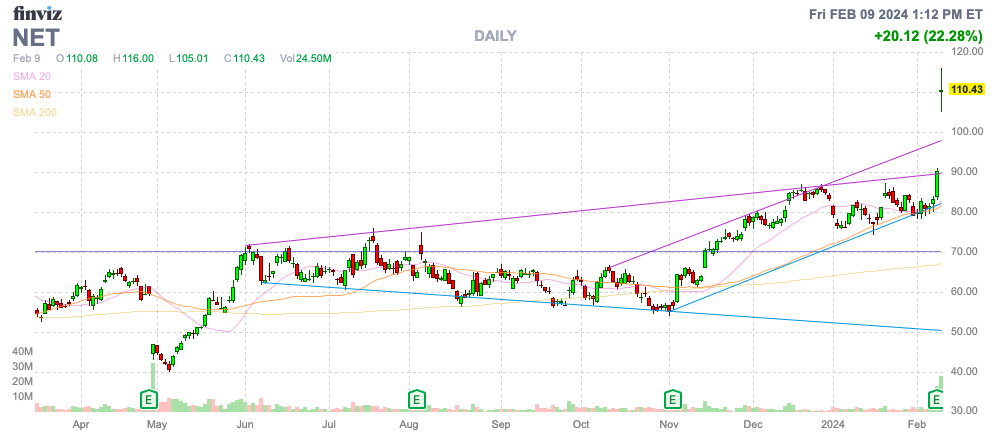

meanwhile Cloudflare Co., Ltd. (New York Stock Exchange:Net) is a little-known, but this cloud security company is a potential leader in edge AI applications. The stock price soared after a strong quarter, with growth exceeding 30%.my investment thesis While the stock remains neutral after soaring above $110, edge AI companies will remain in the driver’s seat for the next decade.

Source: Finviz

Cloudflare – A Fast-Growing Sales Pipeline

Unlike other hot AI stocks, Cloudflare actually has growth to go with its stock price. The company reported the following numbers for his third quarter of 2023:

Source: In Search of Alpha

Revenue rose 32% in the December quarter, with Cloudflare beating consensus estimates by $9.5 million to $362.5 million. Although the company is slightly profitable, the real story is that its sales pipeline is booming.

cloudflare Sales plummeted to the $40 range last year as the company struggled to achieve results and missed its sales targets for the first quarter of 2023. The company still grew sales by nearly 37% in the quarter, but the market was concerned that sales would continue to slow.

In the fourth quarter 2023 earnings call, CFO Thomas Seifert highlighted how sales pipeline momentum increased at the end of the year.

…The positive momentum from our go-to-market strategy and focus on operational improvements continued in the fourth quarter. As Matthew mentioned earlier, pipeline growth, sales productivity, average deal size, and linearity all improved compared to last quarter.

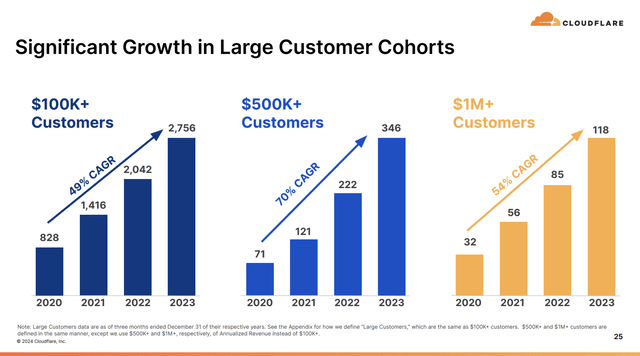

Cloudflare has experienced significant growth with large customers ranging in size from $100,000, $500,000, and $1 million+. In the $500,000+ cohort alone, the number of customers increased by 51% to 346 in 2023.

Source: Cloudflare Q4 2023 Presentation

The company increased its total number of paying customers by 17% year over year to 189,791, but the real key lies in the big customers mentioned above. These customers accounted for 66% of his revenue in the fourth quarter, and this growth supports his continued rapid sales growth through 2024 and beyond.

Cloudflare spent a year adding AI GPUs to its network in 2023, reaching servers in 120 cities, exceeding its goal of 100 cities by the end of the year. The cloud company is poised to fully connect its network to GPUs by the end of 2024, helping push AI inference to the edge as smartphones and PCs transition to AI CPUs this year.

The company plans to increase capital spending to 10% to 12% of revenue in 2024. Still, Cloudflare is not a capital-heavy company and is already able to generate solid cash flow.

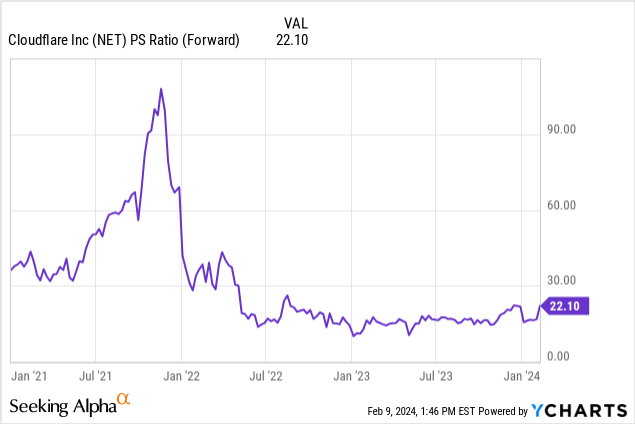

Pure Equity – Stretch Valuation

Cloudflare’s business has been strong, but its stock price has soared in the last year. Since we first covered Cloudflare at the end of September, the stock is already up over 80%.

Guidance for Q1 2024 was slightly positive, but consensus estimates predict revenue growth of about 29%. With 2024 and 2025 targets, Cloudflare is still growing revenue at a 28% clip, with constant beat reported growth rates that he could rise to 30% or more.

The problem here is that a 30% growth stock should trade at 10x forward sales with some flexibility to deliver software-type gross margins typically near 80%. That is to say. Cloudflare already exceeds this P/S multiple by more than 2x, with the stock trading at about 22x its 2024 revenue target of $1.65 billion and its annual diluted share count target of 358 million. Using stocks, this is close to 24 times the sales target.

Cloudflare has a 2024 EPS target of ~$0.59, meaning its stock is trading at 186x estimates today. The AI edge cloud leader should definitely trade at a premium valuation, but the current multiple will require years of growth to warrant this valuation.

As an example, Cloudflare doesn’t think its P/S multiple will drop towards 10x until the market starts leveraging its 2027 earnings. Consensus analysts expect expected revenue to be $3.5 billion, or more than 11 times its current market cap of $39 billion.

The company is cash flow positive, generating $120 million in free cash flow last year, leaving Cloudflare with nearly $1.7 billion in cash. Although the company has a balance sheet and business operations that increase business value over the long term, the market has already priced in several years of growth at current prices, and there is a disconnect between the true business value and the current stock price. It suggests something.

remove

Importantly for investors, Cloudflare, Inc.’s stock price has skyrocketed to irrational levels. The cloud security and AI edge company beat revenue targets by a few percentage points, but its already expensive stock rose another 20%. While the stock price is likely to rise further after this big break above $100, investors believe that valuations have reached a critical limit and now is not the time to invest further, but rather to consider an exit strategy. You need to understand something.