Presentation by our research team Monthly Housing Trends ReportThese regular reports break down inventory metrics such as active listings and market pace. Additionally, as part of an initiative we began to respond to the rapid changes in the economy and housing, we continue to provide our readers with timely weekly updates. In general, we provide weekly housing trend views and the latest Weekly Housing Data Thursday and Monthly video updates Our economists share how the housing market has performed over the past week.

What this week’s data means

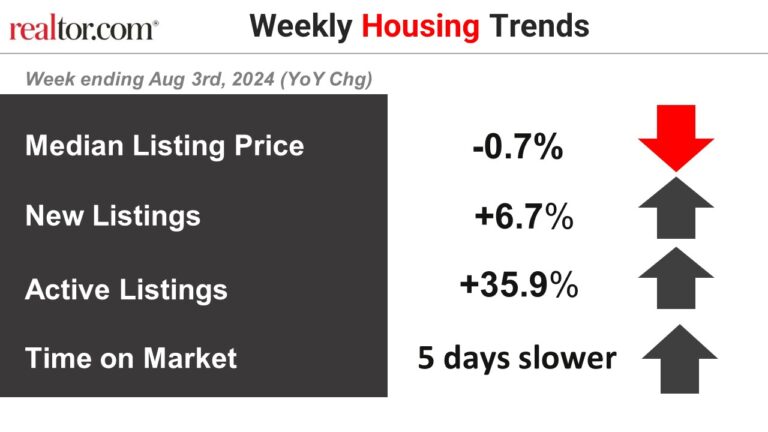

The housing market has been a bit lackluster this summer, but lower mortgage rates may still be providing some energy. Home prices are down slightly from a year ago, but the decline is smaller than last week. Active inventory is still well above last year’s levels, and new listings are up from a year ago.

The buyer, lowest mortgage rates They’re building their first home in more than a year and hoping to have one secured by fall. Home sales slowed again this week, giving buyers more time and space to get ready. Recent Analysis He suggests there are some clear ways buyers can ensure they get the lowest possible interest rate, including comparing lenders and improving their credit scores.

Key findings

- The average listing price fell 0.2% year over year.

This is the 13th consecutive week that the median home price in the U.S. has been at or below the same week in 2023. Prices have been consistently stable this summer since the June 1 data. Percentage of properties that have been reduced in price Real estate prices are closer to pre-pandemic levels than in recent years as sellers adjust their asking prices to better suit buyers’ desires.

- New listings — a measure of the number of sellers with homes on the market — rose 2.2% this week from a year ago.

Weak buyer demand and still-high mortgage rates have made many homeowners reluctant to sell recently. But lower mortgage rates have brought some much-needed life to the market, with new listings posting their biggest one-month increase year-over-year. We expect mortgage rates to continue to ease for the rest of the year, which could help “unleash” seller activity.

- The inventory of homes for sale increased 33.6% year over year, resulting in an increase in inventory.

Year-over-year listings have increased for 42 consecutive weeks dating back to November 2023, and this week continues a growth rate in the mid-30% range that began in April. This week has seen the most active listings since May 2020. Homes are no longer selling like hotcakes like they did during the pandemic, as buyers struggle to find the property they want at an affordable price.

Despite recent improvements, there were roughly 320,000 fewer homes for sale this week compared to the same week in 2019.

- Homes stayed on the market for eight days more than at the same time last year.

While the market continues to shift in buyers’ favor, homes are taking longer to sell than they did a year ago. The annual increase in time on market is the largest since July 2023. The summer months are typically the fastest-moving time of the year, but time on market slowed to February levels this week, highlighting the slower pace this summer.

Sellers are likely to continue adjusting their prices to see some movement on their listed properties, but mortgage rates have eased slightly, which is good news for buyers looking to secure a home now.

Data Overview

| Year-over-year change | As of 2024 | Week ending August 10, 2024 | Week ending August 17, 2024 | Week ending August 24, 2024 |

| Median Listing Price | -0.1% | -1.4% | -1.2% | -0.2% |

| New Arrivals List | 7.8% | -0.9% | -0.2% | 2.2% |

| Active List | 27.6% | 35.5% | 34.8% | 33.6% |

| Time spent in the market | One day late | 7 days late | 7 days late | 8 days late |