pepiphoto

Vanguard US Quality Factor ETF (Bat:VFQY) is an actively managed fund that evaluates companies based on factors considered to be indicative of high quality returns. The fund uses the Russell 3000 as its benchmark, and the manager looks at the overall market. Cap your spectrum and build your portfolio.

We believe that quality factors generally increase long-term returns, and we believe VFQY is an attractive option to unlock this factor in our portfolio.

Background on quality factor and VFQY

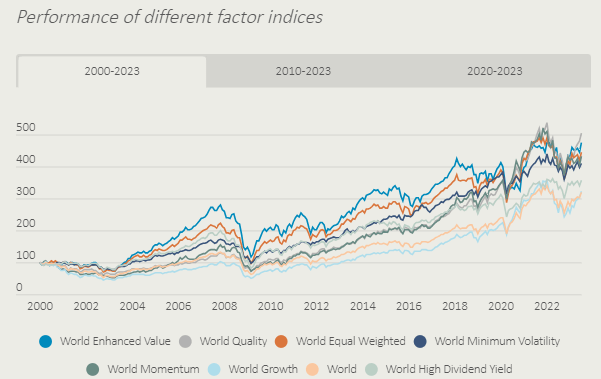

Quality is one of the many factor anomalies we see when examining a stock’s historical returns, including size, value, and momentum, to name a few. The discovery of these factors was first identified in 1992 by Eugene Fama and Kenneth French, who first identified size, value, and momentum factors to create the “Fama-French three-factor model.” Since then, further research has been conducted to identify profitability. factors (also called quality) and investment factors. Among these factors, quality has been shown to outperform the others over time, as seen in the graph below.

Bloomberg, Kaiser Partner Privatbank

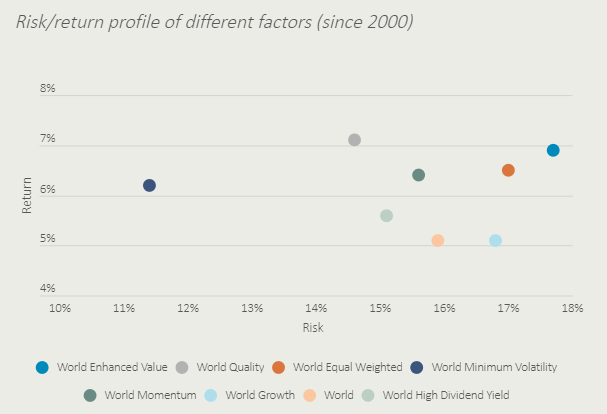

This is also seen on a risk-adjusted basis, as is evident from the table below, where the risk-return ratio outperforms all other factors, except for lower volatility.

Bloomberg, Kaiser Partner Privatbank

However, what makes investing in quality factors more difficult than other factors is that what constitutes a “quality” company is loosely defined and practitioners have not established a rigorous methodology. This is in contrast to, for example, value factors, which are defined as companies with low price-to-earnings ratios or price-to-book multiples.

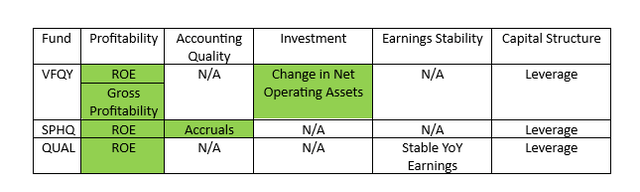

VFQY uses return on equity, gross profit margin, change in net operating assets, and leverage to measure the quality factor. SPHQ, the Invesco S&P 500 Quality ETF, uses return on equity, accruals, and leverage. Meanwhile, QUAL, the iShares MSCI USA Quality Factor ETF, uses return on equity, stable year-over-year returns, and leverage to measure quality. Definitions of quality vary, so when comparing quality ETFs, it’s important to focus on which definitions have proven to be most effective.

The Financial Analysts Journal study breaks down quality factors into seven categories, including profitability, earnings stability, capital structure, profitability growth, accounting quality, dividends/dilution, and investments. Their analysis found that profitability, dividends/dilution, accounting quality, and investments performed better based on multiple types of statistical analysis. Looking at their study as well as previous studies conducted, we found little evidence that improved earnings stability, capital structure, and profitability are associated with superior business performance. Therefore, we believe that high-quality funds should use metrics related to profitability, dividends/dilution, accounting quality, and investments to outperform.

The table below shows which category each metric that VFQY, SPHQ and QUAL use to select securities falls into. A green cell indicates that the metric has been shown to produce superior returns. Profitability growth and dividend/dilution metrics are not used as metrics in any fund and are therefore not included in the table.

ETF investors

We can see that VQFY achieves superior returns using three metrics associated with the categories shown, whereas SPHQ and QUAL use only two and one metrics, respectively. We believe this is evidence that VFQY has a better stock selection process than his other two funds.

Continuous comparison of excellent ETFs

The table below compares these funds based on some of the more interesting metrics.

|

symbol |

Total assets under management |

start date |

Weighted average market capitalization |

Percentage of assets held by top 10 companies |

weighted average PER |

dividend yield |

|

VFQY |

$283,408,800 |

February 13, 2018 |

$19,258 |

15% |

14.7 |

1.40% |

|

SPHQ |

$7,189,288,905 |

December 6, 2005 |

$267,203 |

45% |

twenty three |

1.40% |

|

Qual |

$37,469,157,217 |

2013/7/16 |

$215,611 |

38% |

26.2 |

1.20% |

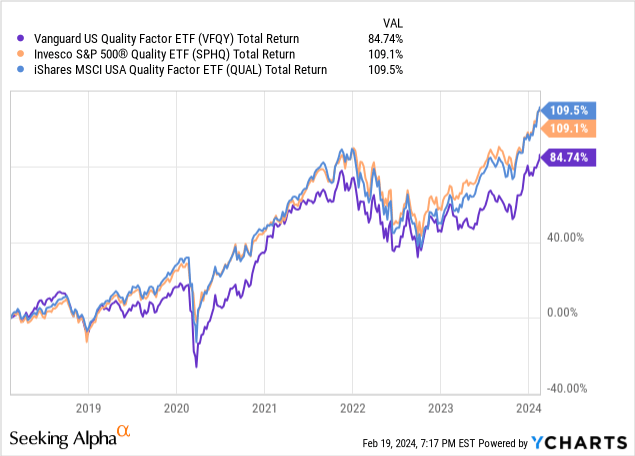

VFQY’s AUM and weighted average market cap are by far the lowest. The low number of assets is likely due to the fund’s relative newness compared to other funds and its relative underperformance.

As for the significantly lower weighted average market capitalization, this will definitely increase the fund’s volatility and probably cause it to underperform even more than the large-cap performance. However, the fund’s benchmark is the Russell 3000, so the size difference is not surprising. VFQY is much more diversified than the other two funds and is much cheaper with a P/E of less than 15. The funds’ dividends and expenses are all relatively equal, with expense ratios ranging from 13 to 15 bps.

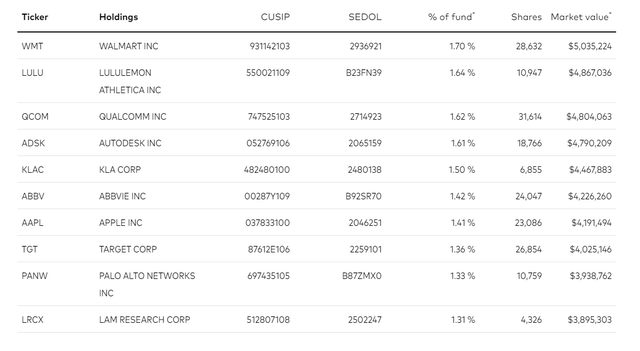

Holdings

See below for the fund’s top 10 holdings.

top ten holdings (Vanguard)

Quality investments and VFQY risks

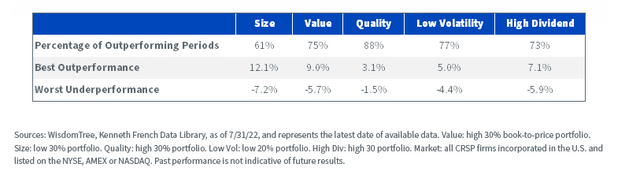

High-quality investments may experience periods of significant underperformance relative to the market and other factors. The table below from WisdomTree shows that over a 10-year rolling period, quality’s best performance relative to market is the lowest of all factors, at only 3.1%. However, this compensates for the fact that the worst underperformance in quality was only -1.5%. Quality also exceeded the highest percentage of periods (88%).

WisdomTree, Kenneth French Data Library

conclusion

We view quality as an important allocation to our portfolio because of its historically superior performance on both a return and risk-adjusted basis. Based on the referenced empirical studies, we find that among the funds studied, VFQY uses the most metrics shown to provide superior returns in its security selection process. Additionally, this fund has a much more attractive valuation than other funds. For these reasons, we rate VFQY a “buy.”