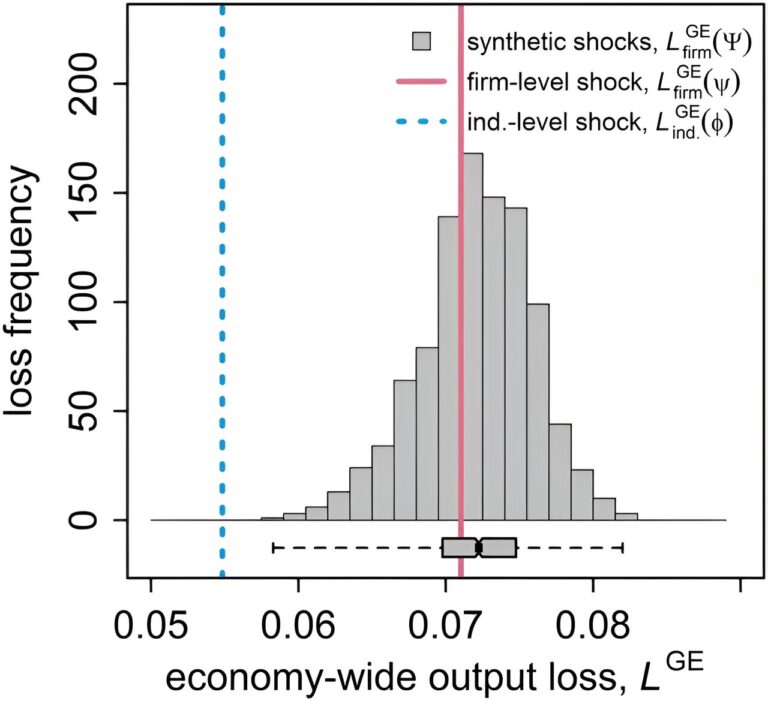

production loss for the general equilibrium economy as a whole; LG.E., obtained from 1,000 empirically calibrated synthetic COVID-19 shocks propagating on the aggregated IPN (dashed blue line) and FPN (red line, histogram). credit: PNAS Nexus (2024). DOI: 10.1093/pnasnexus/pgae064

× close

production loss for the general equilibrium economy as a whole; LG.E., obtained from 1,000 empirically calibrated synthetic COVID-19 shocks propagating on the aggregated IPN (dashed blue line) and FPN (red line, histogram). credit: PNAS Nexus (2024). DOI: 10.1093/pnasnexus/pgae064

How do armed conflicts, epidemics, and floods affect economies? Christian Diem from the Complexity Science Hub It is also essential to be able to assess and even predict the impact on

According to a recent study published in PNAS Nexus, countries seeking to better prepare for crises could benefit from a unique dataset of detailed supply chain data. CSH researchers found that widely used sector-level economic data can underestimate the economic impact of a crisis by up to 37% compared to highly detailed company-level data. Reported for the first time.

VAT data

“For this study, we had access to a unique dataset of Value Added Tax (VAT) information (a general tax that applies in principle to all goods and services) from Hungary, which included 243,399 companies. This includes 1,104,141 companies that can be restructured.”The supply relationships represent virtually the entire national economy,” explains CSH’s Stefan Sarner.

This allows researchers to compare the impact of the crisis when data is available only on the 88 economic sectors defined by the European Union versus when detailed supply chain data is available at the company level, including all companies. We were able to systematically analyze and compare how impacts are assessed in different ways. and customer-supplier relationships.

A total of 1,000 hypothetical crisis scenarios were simulated for this purpose. To ensure that the scenario replicates the real crisis, the hypothetical crisis is based on real empirical data on the economic impact of the COVID-19 crisis in early 2020.

“We were very surprised to find that using only sector-wide data, as has been the case, systematically underestimated the economic impact of each of the 1,000 simulated crises. By up to 37 %,” explains Diem.

Moreover, the company-level results were very close to the actual recession results in Q2 2020. Thus, the impact of a crisis is always underestimated at the departmental level than it actually is at the corporate level. .

economic atom

“Traditionally, a country’s economy has been explained primarily at the level of whole economic sectors,” Cerner explains. “In other words, we’re talking about how severely the entire auto industry is being affected by supply bottlenecks. New data on the entire supply chain at the enterprise level will help us understand the atoms of the economy, the companies, and how they This is a new area of science, and it’s very interesting. ”

“Rather than just accounting for averages across sectors, we can now calculate how companies within an economic sector are individually affected by the crisis.”

“For example, whether we can simply say that a sector of the economy will suffer a 20% loss and whether simulations can reveal which companies are actually likely to be affected by the crisis and which are not. More importantly, it shows how this spreads through the supply network and how it impacts direct and indirect trading partners. ‘ added Mr Diem.

More than 160 countries have introduced VAT systems and, in principle, can be used to restructure supply networks, but one notable exception is the United States. Currently, only 12 countries collect data that can be used to rebuild supply links. The list includes EU member states such as Spain, Belgium and Hungary, as well as India, China and some countries in Africa and Latin America.

In countries that do not collect VAT data in an appropriate manner (for example, Germany or Austria), small adjustments to a company’s VAT reporting can be effective with minimal additional bureaucratic effort for the company. . “This could be automated by a company’s accounting software,” he explains. It may also reduce forms of VAT fraud.

“This study examines the extent to which estimates based on aggregate sector data can differ from estimates based on detailed data and actual economic impacts, and the We wanted to show how important it is,” Diem said.Whether it’s water damage or any other threat, carbon dioxide2 Accurately assessing the consequences of emissions and political intervention can help us predict outcomes and, above all, respond quickly and accurately.

For more information:

Christian Diem et al., Estimating the loss of economic predictability due to aggregation of firm-level production networks, PNAS Nexus (2024). DOI: 10.1093/pnasnexus/pgae064

Magazine information:

PNAS Nexus

Provided by Complexity Science Hub