Looks like a bright start to an uneasy February as investors ignore a hawkish Federal Reserve and put their faith in Big Tech companies’ final financial results, which will be released after the close.

“A perfect landing is fully priced in, with only downside risks remaining,” we warn. today’s call Wealth manager Billem Capital discusses persistently high inflation and “unsustainable” fiscal policy in a just-published December letter to investors.

But Bireme, founded in 2016 by MIT classmates Ryan Valentine and Evan Tindell, stands out even more for attacking Big Tech holdings.

In late 2020, executives hailed Apple, Amazon, Microsoft, Facebook, and Alphabet as “transcendent companies,” expressing dismay at the fact that many had lower earnings multiples and often lower valuations than the Nasdaq 100. is reminiscing. In 2023, they jumped at the chance to acquire META.

Same as Netflix NFLX at $110 per share,

Many transcendents were shredded along with even more speculative business.

But “the large gap between intrinsic value and market price is almost a reality,” they say, rattling off new changes.

“We have sold Netflix NFLX.

We have significantly reduced our positions, and we have significantly reduced our meta positions.Tesla TSLA still in short supply

– Auto companies with car company margins are finding it increasingly difficult to pretend to be technology companies with technology company margins – and added short positions in Apple AAPL

– Low-growth companies trading at high-growth valuations,” says Bireme.

They explain that “The Magnificent 7 and its friends are still doing transcendent business,” but the valuations are no longer so reasonable.

“Given today’s unprecedented concentration, the fate of major stock indexes, and the wealth of hundreds of millions of Americans in their retirement savings and pensions, increasingly depends on the performance of a small number of stocks that are increasingly overextended. It’s tied together.”

Apple’s short interest occurred in the third quarter of last year, meaning Birem missed out on the year-end rally in many tech stocks. Apple rose 48% in 2023, but is down 4% so far this year.They also bet on Arm Holdings ARM.

In the second half of last year, he said valuations were too high and his bid to raise chip prices could backfire.

The team also took a short position in C3 ai AI,

It accused AI enterprise software providers of wasting money and changed their names to align with “hot new trends they would have been capitalizing on.”A better option is Snowflake SNOW,

GitLab GTLB

or Datadog DDOG,

they say. C3.ai soared 156% in 2023, but is down 13% so far this year.

Apart from technology, Bireme also looked at consumer staples and highlighted the new position in British American Tobacco BTI.

UK: Bats,

They say it’s cheap and can do a lot when it comes to next generation products.They shorted Clorox CLX.,

It cited long-term headwinds and rising prices as fewer products are sold, as well as an “overpriced” Tootsie Roll Industries TR..

“Consumer trends do not bode well for a preference for sweet treats that are harmful to teeth,” they say. “With consumer staples stocks still less than 10% off their all-time highs, we expect the sector to continue to underperform.”

market

stock

Once trading begins, government bond yields will rise, while

Push it down. Gold GC00

Pound GBPUSD continues to decline

The Bank of England has recouped its losses by keeping interest rates on hold, but has signaled it is in no hurry to cut rates.

|

Key asset performance |

last |

5d |

1m |

YTD |

1 year old |

|

S&P500 |

4,845.65 |

-0.99% |

3.35% |

1.59% |

15.93% |

|

Nasdaq Composite |

15,164.01 |

-2.23% |

4.51% |

1.02% |

24.29% |

|

10 year treasury |

3.946 |

-17.51 |

-5.26 |

6.53 |

54.80 |

|

Money |

2,060.10 |

1.93% |

0.44% |

-0.56% |

6.90% |

|

oil |

75.96 |

-1.48% |

4.92% |

6.49% |

-0.05% |

|

Data: MarketWatch.Changes in government bond yields expressed in basis points |

|||||

buzz

After the close, Amazon AMZN

has the potential to deliver spectacular growth, while expectations are high for META

and Apple AAPL.

Merck & Co. MRK

Shell SHEL exceeded earnings expectations

Exxon’s gains on Friday were determined by new buybacks and a beat. Royal Caribbean RCL

Stock prices are rising on the back of better-than-expected results and a positive outlook.Canada Goose stock price also goes GOOS with solid guidance

taller than.

plus: Big tech companies faced harsh criticism on Capitol Hill over children’s online safety

Following New York Community Bancorp’s NYCB

Japan’s Aozora Bank JP:8304 warns of profits partly related to US office loan problem

The company sank as it reduced the value of some of its loans in the sector. NYCB stock is attempting to rebound following additional guidance on net interest income.

Weekly jobless claims rose 224,000, more than expected, and productivity rose 3.2% at the end of the fourth quarter, also better than expected. At 10 a.m., the Supply Management Association’s manufacturing survey and construction spending will be released, with auto sales also released before that.

Tesla TSLA

has reduced the prices of several Model Y EVs in China, following recent price cuts in China. Separately, Tesla CEO Elon Musk announced that Tesla will incorporate in Texas after a Delaware court ordered him to forgo his $55 billion compensation package. He said he plans to hold a shareholder vote on whether to do so.

read: Tesla stock had its worst month in a year, but Cathie Wood’s ETF kept buying

best of the web

Flextirements could be the answer to the looming Boomer/Gen X brain drain

Spain’s Catalonia region is spending $2.6 billion to survive without rain.

Steakhouses are being asked to serve less meat.

Get these CD rates now in the wake of the Fed’s comments.

chart

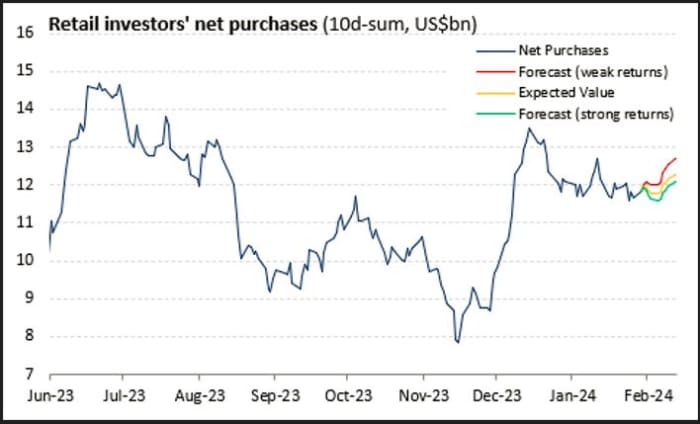

Can private investors help?

As of January 30, 2024. Source VandaTrack, Vanda Research

Vanda Research analysts used machine learning algorithms and years of data to predict future retail flows. They say the graph above showing retail flows in the coming weeks is likely to remain strong. “Thus, given the elevated starting point, downside flow risk from systematic institutional investors is currently a concern, but even if trading becomes volatile, stocks are likely to remain private in the short term. We can rely on demand.”

top ticker

The most searched tickers on MarketWatch as of 6 a.m. are:

random read

Price-cutting airlines propose “free shipping” to the European agreement.

Nails choose. A Queensland toddler has been rescued from a Hello Kitty prize machine.

X’s confession. “Elmo opened the faucet and darkness poured out.”

Need to Know starts early and updates until the opening bell, but Sign up here Delivered once to your mailbox. The email version will be sent around 7:30 a.m. ET.

check out Monitored by MarketWatch, a weekly podcast about the financial news we’re all paying attention to and how it’s impacting the economy and your wallet. MarketWatch’s Jeremy Owens looks at what’s moving the markets and provides insights to help you make more informed money decisions.subscribe spotify and apple.