SOPA Image/LightRocket (via Getty Images)

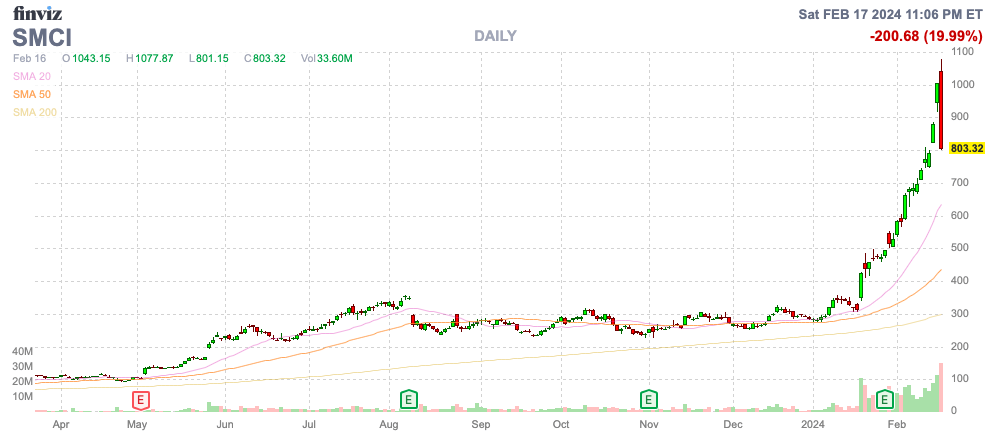

meanwhile super microcomputer (NASDAQ:SMCI) is not developing the advanced chips leading the AI revolution, server and storage solution providers are still participating in the same level of growth, if not faster.stock It’s had a great month recently, with Super Micro surpassing $1,000 per share. My investment thesis is neutral on the stock, especially after Supermicro plunged $200 to end the trading week at $803, about $275 below its February 16th all-time high.

Source: Finviz

Riding the AI wave

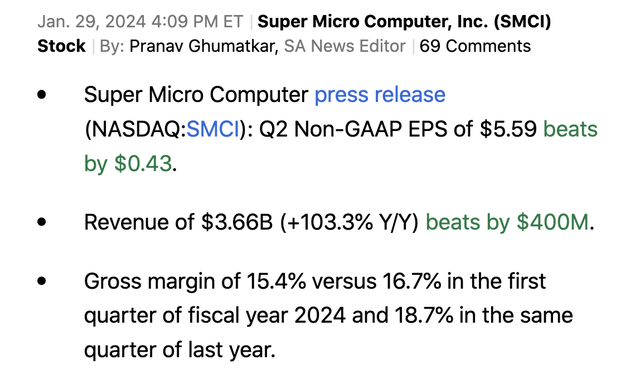

A few weeks ago, Super Micro reported second quarter 2024 numbers that saw sales jump more than 100%.

Source: In Search of Alpha

Therefore, investors should immediately consider that the majority of Supermicro’s recent gains are justified based on strong sales growth. Also, what was in stock was Shares remained flat for nearly a year until the company significantly raised its earnings outlook in mid-January, sparking a massive stock rally.

Despite revenue growth of just over 100%, the AI infrastructure company reported earnings growth of just 70%, reaching $5.59 per share. Most importantly, the March guidance does not include the sales slump that occurred in the previous third quarter, with the revenue target updated to his $4.1 billion high and the EPS target reaching $6. That’s what I did.

Super Micro currently expects revenue to increase by nearly 200% and EPS to increase by at least 250% this quarter. The stock price increase from $250 to $800 is actually in line with expected EPS growth for the March quarter.

Quarterly revenue for the Server Infrastructure business is expected to approach $4 billion, but the business will exceed $1 billion in revenue for the first time in Q4 2021 and remain above $2 billion through Q4 2022. did not. The stock price would need to rise significantly to match the reported growth rate.

What’s interesting about Super Micro is that the company offers racking solutions for data centers. Investors need to choose which GPU AI chip companies to invest in; Nvidia (NVDA) or AMD (AMD), Super Micro has solutions for all relevant chips from both providers. The AI infrastructure company also uses his Gaudi 2 and Gaudi 3 chips: intel (INTC) provides customers with a complete AI server solution for inference and LLM.

Competitive pricing for GPUs will only increase demand for Super Micro’s infrastructure solutions as enterprises and hyperscalers buy more and more chips. The company offers innovative racking solutions with the latest technology, including water-cooled racks with direct-connect cooling to manage heat and reduce energy costs with high-performance AI solutions.

The company has a production capacity of 5,000 lacs per month, but despite significant growth rates, current production utilization is only 65%. Super Micro is increasing its production capacity in both Silicon Valley and Malaysia to accommodate the continued proliferation of AI data center server solutions expected in the coming years.

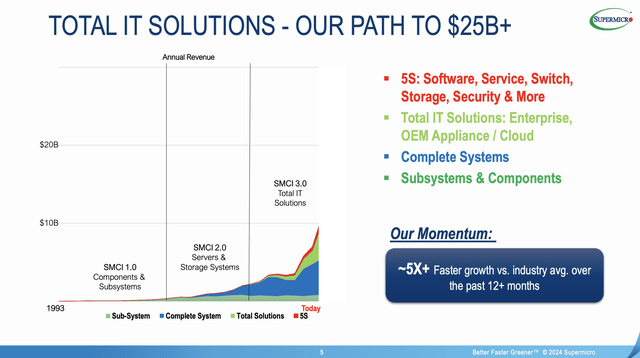

Supermicro is significantly outpacing an industry that has grown less than 20% throughout the COVID-19 period. The company’s growth has accelerated on the back of its AI infrastructure solutions work with Nvidia, and Super Micro now predicts that total IT solutions for software, services, storage, and security will lead to his more than $25 billion in sales. I am.

Source: Super Micro FQ2’24 presentation

The data center solutions company projects fiscal 2024 revenue in the range of $14.5 billion, with revenue upside of more than $10 billion. The company is expected to grow an additional 70% to meet this internal goal.

one red flag

The biggest red flag is the limited gross margins from the hardware business. Supermicro reported gross profit margin for the second quarter was just 15.4%, down from 18.7% in the same period last year. The company is currently chasing business at the expense of profits.

AI chip companies are those with gross profit margins in the 60% to 70% range due to the complexity of their chips and lack of competition. But ultimately what matters to investors is the stock’s valuation and the growth rate of the business, whether its gross margin is higher than his Nvidia’s 75% or Super Micro’s 15%.

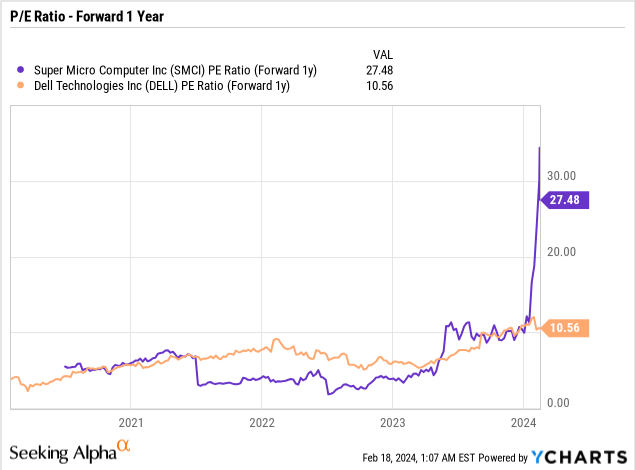

The only risk is that low-margin hardware businesses typically face more competition because the company doesn’t have the expertise to warrant premium prices.Other computer hardware companies include Dell Technologies (DELL) generated twice as much gross margin at 32% due to its higher mix of services, despite not achieving similar growth rates. However, the stock is trading at a minimal P/E ratio due to growth issues.

After a $200 drop, Supermicro is no longer an expensive stock, and the rally simply reflects strong earnings growth. The company is already well into Q3 FY24, and investors will soon start focusing on its FY25 EPS target. The company’s stock is trading at just $29.22, which is 27.5 times its fiscal 2025 EPS target, and EPS is expected to expand at an even faster pace.

The stock, like Dell Technologies, previously traded at less than 10 times its forward EPS target. In addition to the risk of low gross profit margins, these hardware-type companies also tend to have low P/E ratios.

The question investors need to answer is how long the AI revolution will last. AMD claims that the AI chip market will surge to $400 billion by 2027, leading to several more years of massive growth, and under that scenario, Super Micro will help drive growth in data center demand. It will likely maintain these high P/E ratios with supporting growth rates.

The company only needs to increase its gross margin by 100 basis points in FY2025, increasing operating profit by up to $200 million based on a revenue target of nearly $20 billion. Even after tax, Supermicro will boost his EPS by $2-3 per share, based on the current diluted share count of just 58 million shares.

The stock is cheap and Super Micro could easily start generating higher gross margins through total IT solutions as opposed to its current hardware solutions.

remove

The important takeaway for investors is that Supermicro is definitely a difficult stock to value right now. This strong growth rate doesn’t seem sustainable, and the company is hurting its gross margins in order to gain market share as competition is fierce. However, over time, Super Micro will be able to leverage its additional market share and comprehensive IT solutions to crowd out the competition, boost margins, and significantly boost EPS.

Despite the massive rally, the stock isn’t exactly expensive here at $800. Investors should be cautious given the volatile trading, but the weakness is likely an opportunity to pick up AI’s big growth story over the next few years at a reasonable price.