Sakura Internet Co., Ltd. (TSE:3778) shareholders may be very concerned that the share price has fallen 48% in the last quarter. However, this is no substitute for the company’s excellent performance over three years. Looking longer term, the share price has risen 403% in that period. Some might therefore argue that the recent share price decline is not particularly noteworthy in light of the long-term performance. A consideration is whether there are still excessive expectations building up about the company’s prospects.

The stock has added $18 billion in market cap in the past week alone, so let’s take a look at whether fundamental performance is driving long-term returns.

View our latest analysis for SAKURA Internet

While markets are a powerful pricing mechanism, share price reflects investor sentiment as well as underlying business performance. One imperfect but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Sakura Internet has failed to grow its earnings per share over the past three years, falling 6.2% (annualized).

This means the market is unlikely to value the company based on its earnings growth, so it makes sense to look at other metrics as well.

A tiny 0.1% dividend yield is unlikely to boost the stock price. No one is particularly impressed with three-year earnings growth of just 1.6%. So, to be honest, there’s no easy answer to the stock’s performance, but maybe…

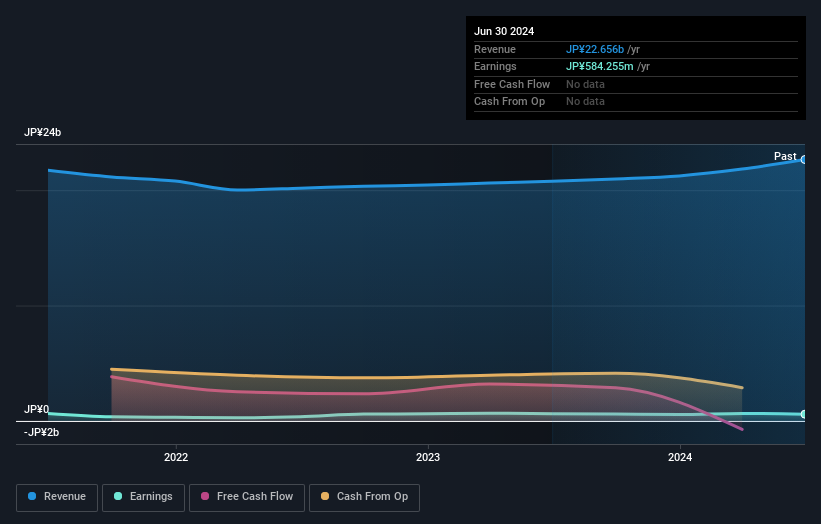

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Let’s take a closer look at Sakura Internet’s financial situation free Report the balance sheet.

What about dividends?

For any given stock, it is important to consider the total shareholder return, not just the price return. The TSR is a return calculation that factors in the value of cash dividends (assuming any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It is fair to say that the TSR gives a more complete picture for stocks that pay dividends. In the case of SAKURA Internet, the TSR for the past 3 years is 409%, which exceeds the price return mentioned earlier. This is mainly due to dividend payments.

A different perspective

It’s good to see that Sakura Internet has delivered a total shareholder return of 164% to shareholders over the past twelve months. Of course, this includes dividends. The share price performance appears to have improved recently, with the one-year TSR being better than the five-year TSR (the latter at 38% per year). An optimistic person might view the recent improvement in TSR as an indication that the business itself is getting better over time. I think it’s very interesting to look at share price over the long term as a proxy for business performance. But to gain true insight, other information needs to be considered as well. For example, consider risks. Every company has risks. We found that risks are lurking in companies. Two warning signs for Sakura Internet You should know.

If you want to check out another company that may be financially superior, don’t miss this one. free A list of companies that have proven they can grow revenue.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

new: Manage your entire stock portfolio in one place

we The ultimate portfolio companion For stock investors, And it’s free.

• Connect an unlimited number of portfolios and view the totals in one currency

• Get notified of new warning signs and risks via email and mobile

• Track the fair value of your stock

Try our demo portfolio for free

Have feedback about this article? Concerns about the content? Stay in touch Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.