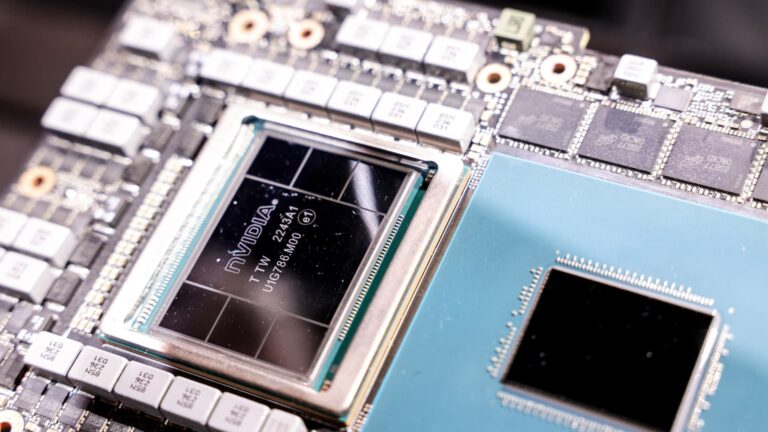

While the hype around AI shows little sign of slowing down, one analyst has identified several warning signs that a correction may be underway. Richard Windsor, a veteran tech stock analyst and founder of the research firm Radio Free Mobile, wrote in a research note titled “Magic Money Tree” that “pay little attention to company fundamentals.” is not being paid, and funds are flowing into the AI sector.” Be sure to indicate that there will be fewer chairs available when the music stops. ” He outlined three recent incidents with him that are cause for concern. Cohere Valuation First, generative AI company Cohere is reportedly on track to raise funding at his $5 billion valuation. That’s nearly double what the startup was worth last June, when it raised $270 million at a valuation of $2.2 billion. Mr Windsor described this as “…the latest sign of reckless abandon”. “Kohia would now be worth $5 billion, even with annual revenue of only $13 million in 2023,” he said in a March 28 memo. He said the company’s “valuation is equal to its historical price-to-sales ratio.” 384x indicates that the investor is once again in a bad situation of his FOMO (fear of missing out) and is rushing into anything that could be remotely related to AI. Cohere, backed by Nvidia and founded by former Google AI researchers, is betting on generative AI for enterprises rather than chatbots, company President Martin Conn recently told CNBC. The deal with Inflection AI, which Windsor spent 11 years covering the global technology sector at Nomura Securities before founding his own company, raised another “red flag.” It’s an obvious deal with Microsoft and his Inflection AI. “Another red flag was whether Microsoft would be able to hire the CEO and 70 staff from AI startup Inflection AI,” he said. “Things weren’t going well at Inflection AI, because if the company had done very well, Microsoft’s progress would have been quickly reversed.” The deal has been described as an “unusual deal.” Now, tech giant Microsoft has reportedly agreed to pay Inflection AI about $650 million in cash to hire the startup’s staff and gain access to its technology. Investing in Amazon Windsor emphasized the “FOMO effect” surrounding AI, noting that even tech giant Amazon is immune. “Amazon has committed an additional $2.75 billion to Anthropic out of a total commitment of $4 billion. It is certain that Amazon will eventually acquire the company,” he said. Amazon’s largest investment in its history continues to pump money into the generative AI startup whose chatbot Claude competes with OpenAI’s ChatGPT. Stocks to buy if you’re ‘forced’ Windsor said of the current AI sector, “There’s a lot of excitement, but it’s an area I’m perfectly comfortable staying away from.” Windsor said he would buy Nvidia if it was “forced” to enter the space, noting that the U.S. chip manufacturing giant has been a major beneficiary of the AI hype so far. The stock is up about 80% since the beginning of the year and 240% in the past 12 months. “NVIDIA is the only company to benefit measurably from the current boom in interest in investing in generative AI, but if there is a correction, there will be no escape for NVIDIA.However, the damage done to NVIDIA “I think it’s much smaller,” he said. “There are many others.” He added that he already owns chip stock Qualcomm and is “very well positioned to benefit as generative AI begins to be implemented at the edge.” —CNBC’s Kate Rooney contributed to this report.