A study on the number of online banking fraud incidents in the in-memory data grid market

DUBLIN, March 22, 2024 (Globe Newswire) — The “In-Memory Data Grids – Market Share Analysis, Industry Trends and Statistics, Growth Forecast 2019-2029” report has been added. ResearchAndMarkets.com Recruitment.

In-memory data grid market size is estimated at USD 3.8 billion in 2024 and is projected to reach USD 9.17 billion by 2029, at a CAGR of 19.23% during the forecast period (2024-2029). grow in

As the need for real-time fraud and risk management capabilities increases, adoption of in-memory data grid solutions is expected to increase.

Main highlights

-

In-memory data grid solutions are increasingly being adopted because they can provide high-speed data processing and analysis capabilities. With the growth of cloud computing, enterprises are adopting cloud-based in-memory data grid solutions that provide the flexibility and scalability needed to process large amounts of data without the need for on-premises infrastructure. is increasing.

-

Additionally, the pandemic has highlighted the importance of real-time data processing and analysis, which is a key feature of in-memory data grid solutions. As a result, companies across industries have started investing in these solutions to enable faster decision-making and improve overall operational efficiency driving market demand.

-

Implementing and managing in-memory data grid solutions is complex and requires technical expertise, hindering market growth from adoption by companies with limited technology resources. Also, factors such as high cost and data security are further restraining the market growth.

-

The pandemic led to a rapid shift to remote work, e-commerce, and online services, leading to a surge in demand for in-memory data grid solutions. As more people work remotely, the need for reliable and efficient data processing and analysis solutions increases, increasing the demand for in-memory data grid products.

-

However, supply chain disruptions caused delays in product launches and deliveries, impacting market growth. Additionally, reduced IT budgets and financial constraints faced by enterprises have reduced the adoption of in-memory data grid solutions.

Rising need for real-time data processing in BFSI drives market growth

-

Increasing digitalization is forcing financial firms to develop lean, flexible and efficient approaches to serving their customers. Financial institutions handle sensitive information that, if not handled properly, can have serious financial and ethical implications. Therefore, financial institutions around the world are looking for in-memory data grid solutions to process data in real-time and improve business-critical applications.

-

The increasing adoption of cloud computing in the BFSI industry is also driving the adoption of in-memory data grids, as cloud-based in-memory data grid solutions offer greater flexibility, scalability, and cost efficiency compared to on-premises traditional solutions. is driving demand for. These are good options for BFSI organizations.

-

Additionally, the growing need for real-time data processing in the BFSI industry is driving demand for in-memory data grids for storing and processing large amounts of data in memory, high-speed data access, and suitability for cloud-based deployments. Masu.

-

Leading banks rely heavily on GridGain Systems Inc., one of the leading providers of in-memory data grids, to help deliver an integrated omnichannel banking experience. With GridGain solutions, organizations can increase the speed and scale of their digital channels, open and share previously siled data seamlessly across channels, and enable real-time streaming analytics, machine, and deep learning. Use to implement in-process HTAP to proactively deliver an end-to-end banking experience.

-

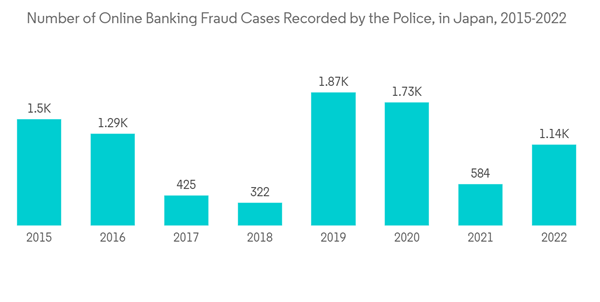

Additionally, banks have seen a sharp increase in the number of internal and external fraud cases due to the COVID-19 outbreak. COVID-19 pandemic relief measures have led to an increase in fraud, false claims, and other scams. Many of the systems in place by financial institutions and government agencies required proper verification of applicant identity and claims. For example, according to the National Police Agency, Japanese police recorded 1,136 online banking fraud cases in 2022, a significant increase compared to the previous year.

Some of the companies mentioned in this report include:

For more information on this report, please visit https://www.researchandmarkets.com/r/a6kav7.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900