Jim Long, CEO of Genesus, explains pork

I had a discussion with producers last week. We had a good discussion about current productivity. It got me thinking about the myths and reality of productivity claims. As a result, I looked at the latest MetaFarms database. It’s a database of 1.1 million sows in the US, Canada and Australia. 3,000 farms have been closed and 8 million pigs have been put into grow-out and fattening. The large database reflects reality.

The average weight of growing pigs is 53.6 lbs. The average weight of fattening pigs is 286.6 lbs.

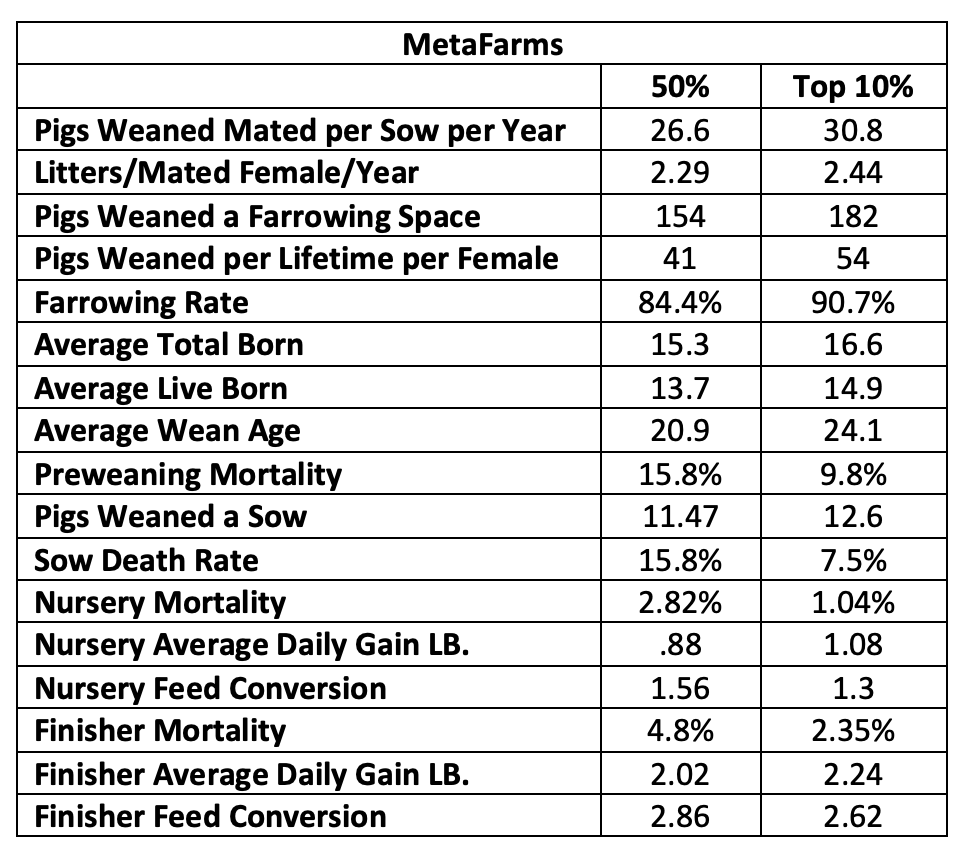

Let’s check it out. MetaFarms’ average number of pigs bred per sow is 26.6. Average sow mortality is 15.3%, grower mortality is 2.82%, finisher mortality is 4.8% (total 7.6%), and finisher feed conversion is 2.86. Actual results from a large database. The top 10% weaned pigs per sow is 30.8, sow mortality is 7.5%, grower mortality is 1.04%, finisher mortality is 2.35% (total 3.4%), and feed conversion is 2.62.

The MetaFarms data is a clear snapshot of production. We expect it to be generally better than the industry-wide average, likely due to producers’ efforts in participating in databases like MetaFarms. The MetaFarms data reflects the problem of sow mortality, which continues to occur at an average of 15.8%. As more sows are in the pig farm, it is clear that there are genetics that cannot survive pregnancy in the pig farm. This is further amplified by the problem of egression being propagated by certain genetic companies.

feed

If the USDA’s current projections for the 2024 U.S. crop are correct, we can expect relatively low feed costs next year. USDA is predicting a record soybean harvest and a corn harvest of over 15 billion bushels, the first time in history that two consecutive years will exceed 15 billion bushels. Average U.S. cash corn is currently less than $3.60 per bushel and soybeans are at $9.18 per bushel, a far cry from the $8 for corn and just over $17 per bushel for soybeans. Piglet production costs are at 87 cents per pound, down from over $1 per pound.

Lower U.S. grain and oilseed prices are having a ripple effect around the world, lowering breakeven prices for all hog producers.

Even with lower feed costs for hog producers due to lower quality feed prices, pork futures prices over the next few months will be in the low 70s, putting losses per head in the $30s (cost of production is 87 cents per pound). We expect there to be factors supporting pork prices, such as Mexican and Chinese exports and higher beef prices, but the reality is that consumers do not appear willing to pay profitable prices, even with cuts at $3.15 per pound for U.S. beef and $1 per pound for pork.

According to the latest American Pork Board data, consumer protein choices are driven by taste, nutrition, and convenience. Keep in mind that taste comes first. As an industry, we continue to produce pork that can be improved in taste. I don’t know why we can’t accept this reality. Even with low feed costs, it doesn’t look like it will be profitable for the next 6+ months. I’m glad the Pork Board is addressing the taste issue, but unfortunately, if producers continue to use genes that produce pork that tastes like paper, demand and profits will suffer.