Just to muddy the already muddled waters of competing analyst forecasts. According to estimates by research firm Analysis Mason, the number of private LTE/5G networks around the world will increase from more than 4,000 in 2022 to more than 60,000 in 2028. According to the report, corporate spending on private networks will increase from $1 billion in 2022 to $9.2 billion in 2028. These numbers alone represent a 1,400 percent increase in total network deployment and an 800 percent increase in annual network spending during this period.

This is probably the analyst firm’s biggest forecast to date, with the latter scoring at a compound annual growth rate (CAGR) of 48 percent. However, Analysis Mason notes that its own market forecasts for the public mobile phone market suggest that such spending will be less than 5 percent of equivalent spending on public networks in 2028. Therefore, it was suggested that the private network game would have been a failure of sorts.

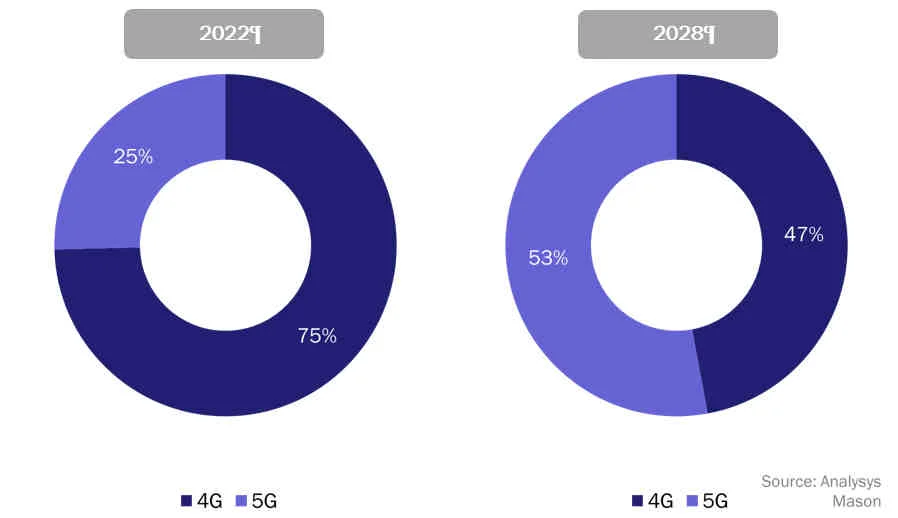

“The market will not reach its potential,” the company said in a press note, adding that “despite a relatively modest long-term opportunity, interest remains high.” By 2028, almost half (47 percent) of all private networks will be based on his 5G. The majority (53 percent) will be LTE-based by the end of the period. This is down from about three-quarters (75%) at the end of 2022. “Interest in private 5G is high, but devices and costs are hindering adoption,” the report said.

Analysys Mason explained his perception of the market opportunity from the perspective of mobile carriers, as well as traditional and emerging network vendors, such as Nokia and Ericsson and Celona, Athonet/HPE, and even Siemens, among others. . “Private networks will provide a modest boost to carriers’ corporate earnings,” the company said. Traditional vendors, on the other hand, will see that revenue as “useful incremental revenue,” while newbies will think “even a multi-billion dollar market is very attractive.”

The new study identifies private LTE/5G networks as those “built specifically for individual enterprises, where at least one network element (packet core or radio access network) is deployed on-site.” It notes that virtual private networks delivered over public infrastructure do not count. Forecast network deployments and associated capital and operational expenditures (operating costs and capital expenditures) by region, sector, and technology.

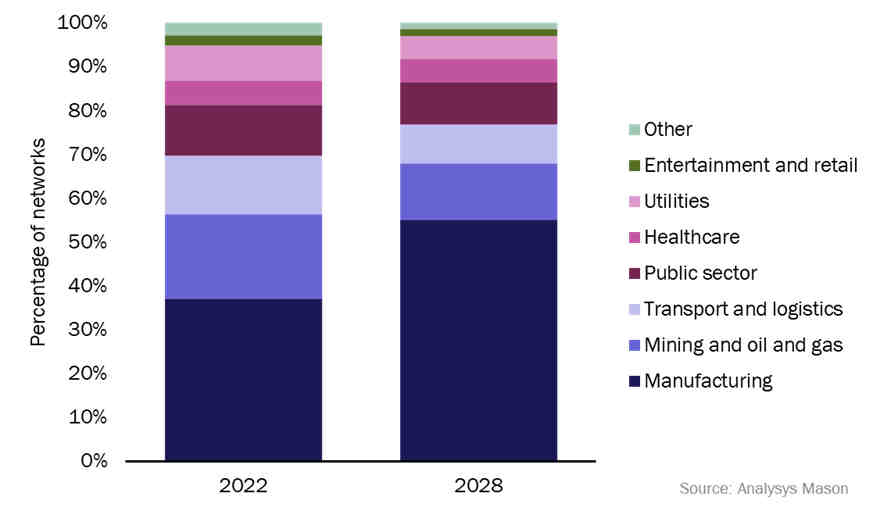

Industrial sectors such as manufacturing, transportation and mining are said to be leading the competition. “The manufacturing industry is particularly driving the market… [and] By 2028, they will account for more than half of all private networks deployed.” The main drivers for private networks are primarily operational efficiency (“automation and cost reduction”, supporting enterprises’ digital transformation projects) and the replacement of “legacy/fixed networks” (“enabling applications such as automated guided vehicles”). and “to supplement”). “Wi-Fi Restrictions”).

At the same time, it also notes that, contrary to some ephemeral myths in the mobile phone market, “private LTE/5G is rarely deployed to fully replace existing Wi-Fi networks.” Additionally, “the two technologies coexist, and private cellular supports applications where Wi-Fi performance is limited. coverage and indoor sites such as factories where dedicated spectrum can perform better than Wi-Fi in “noisy” signal environments. ”

Analysys Mason cites cost (“can be expensive”) and complexity (“highly bespoke requirements”) as barriers to adoption. “Complexity is difficult for private network players to grapple with. Enterprises ideally want private networks to be as easy to deploy and manage as Wi-Fi, but private cellular currently requires extensive network planning, System integration, ongoing support is required.” Another major barrier is the lack of 5G-IoT devices, which are said to be “expensive and not widely available.”

Analysys Mason concludes: “The size of the long-term opportunity will depend on providers being able to reduce cost and complexity. Private LTE/5G networks have been deployed primarily by large enterprises and organizations, and this trend will continue. We expect the market to change significantly as these opportunities slow and providers target SMEs. Suppliers will adapt their offers to be cheap and simple enough for SMEs to adopt. Private network providers are gradually taking steps to make this happen, with flexible pricing options and hybrid deployment models, but market-wide adoption will take several years. .”