Nvidia (NVDA) released its fourth quarter results after the bell on Wednesday, with revenue and bottom line numbers beating analysts’ expectations.

For the quarter, Nvidia reported adjusted earnings per share (EPS) of $5.16 on revenue of $22.1 billion. Analysts had expected EPS of $4.60 and revenue of $20.4 billion. This is a significant increase from his $6.1 billion in the year-ago quarter, when Nvidia reported his EPS of $0.88. Elaborating on Nvidia’s performance, the company reported $27 billion in revenue for all of 2022.

The company also said it expected first-quarter sales of $24 billion, plus or minus 2%, beating analyst expectations. Wall Street had expected $21.9 billion for the quarter.

However, Nvidia’s stock price rose more than 5% following the news.

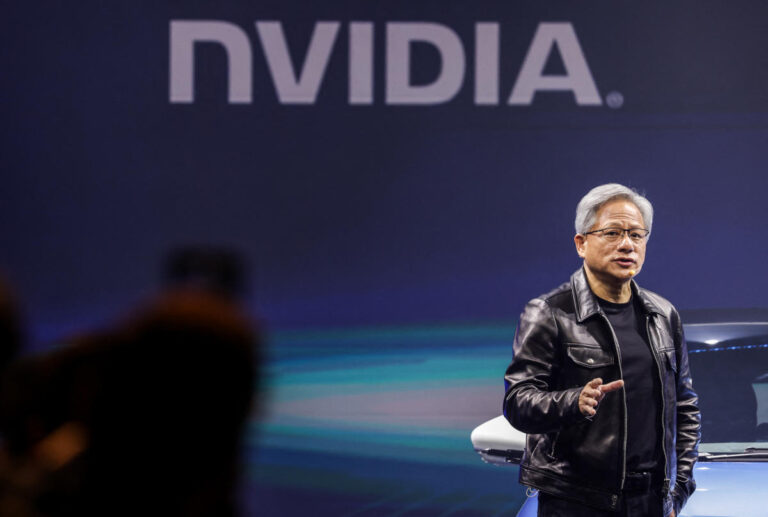

“Accelerated computing and generative AI are reaching a tipping point. Demand is surging across companies, industries, and nations around the world,” NVIDIA CEO Jensen Huang said in a statement after the report. Ta.

“Our data center platform is supported by increasingly diverse drivers, including demand for data processing, training, and inference from large cloud service providers and GPU specialist providers, as well as enterprise software and consumer internet companies. “Vertical industries centered around automotive, financial services and healthcare are now reaching multi-billion dollar levels,” he added.

Despite the overall strong performance, NVIDIA included at least one negative comment in the report, with CFO Colette Kress stating that due to U.S. licensing requirements, NVIDIA closed its data centers from China in the fourth quarter. It warned that revenue had fallen “significantly”. The United States has blacklisted the sale of certain Nvidia chips to China because they could be used for military purposes.

Nvidia’s most important data center business, which includes sales of high-performance GPUs for AI applications, had revenue of $18.4 billion, beating analysts’ expectations of $17.2 billion. The company reported revenue of $3.62 billion in the same period last year.

Nvidia’s data center division is leading the ship, but its gaming business remains an important part of the company. The division’s sales reached $2.9 billion. Investors had expected sales of $2.7 billion, up from $1.8 billion a year earlier.

Nvidia’s stock has soared more than 200% in the past 12 months, easily outpacing rivals AMD (AMD) and Intel (INTC), thanks to its status as the world’s leading AI chip maker.

Daniel Howley I’m the technology editor at Yahoo Finance. He has been covering the technology industry since his 2011. You can follow him on Twitter. @Daniel Howley.

Click here for the latest earnings report and analysis, earnings whispers and expectations, and company earnings news.

Read the latest financial and business news from Yahoo Finance