LOS ANGELES (AP) — Nvidia may have beaten Wall Street expectations with a surge in profits, buoyed by a chip-making advantage that cemented its position as a poster child for the artificial intelligence boom, but investors seem less than impressed.

The company reported net income of $16.6 billion. Adjusting for one-time items, net income would have been $16.95 billion. Revenue increased to $30 billion, up 122% year over year and 15% quarter over quarter.

In contrast, S&P 500 companies overall are expected to see quarterly revenue growth of just 5%, according to FactSet.

However, Nvidia shares fell nearly 4% in after-hours trading.

Nvidia artificial intelligence Stock Market The largest companyTech giants continue to invest heavily in the company’s chips and the data centers needed to train and run AI systems.

The company said its adjusted earnings per share for the second quarter rose to 68 cents from 27 cents in the same period last year.

Demand for generative AI products that can write documents, create images and act as personal assistants has driven sales of Nvidia’s specialized chips over the past year. In June, Nvidia said it Temporarily increased It will be the most valuable company in the S&P 500. The company is currently Worth over $3 trillion.

In the first six months of this year, Nvidia’s shares soared nearly 150%. At the time, the company was trading at just over 100 times its earnings over the past 12 months, far more than either its historical or the S&P 500 index as a whole. That’s why analysts are warning of a sell-off on Wall Street if it sees signs of a slowdown in demand for AI.

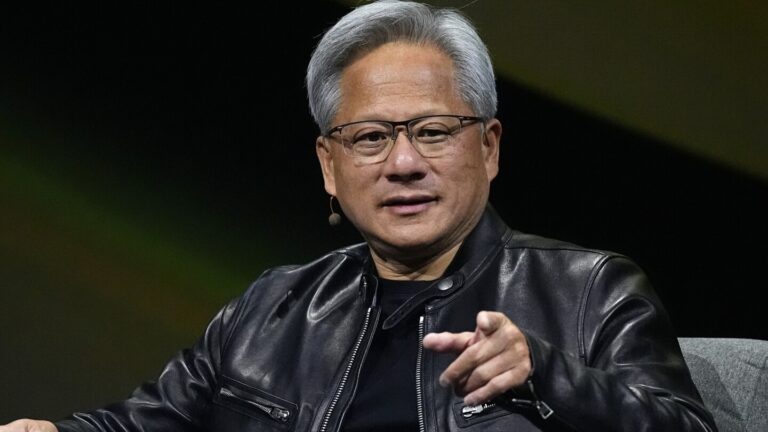

The Santa Clara, California-based company built an early lead in the race for AI applications in part because founder and CEO Jensen Huang made a successful bet on industry-leading chip technology. The company has made some big bets: Nvidia’s invention of the graphics processor unit (GPU) in 1999 helped fuel the growth of the PC gaming market and redefined computer graphics.