Despite the strong performance, Foxconn Industrial Internet Co., Ltd. (SHSE:601138)’s share price hasn’t moved much, and our analysis suggests this could be because shareholders are concerned about a number of underlying factors.

Check out our latest analysis for Foxconn Industrial Internet

How rare items affect profits

To properly understand Foxconn Industrial Internet’s profit results, one must take into account the RMB 1.9 billion increase from special items. There is no denying that increasing profits inspire optimism, especially if the profits are sustainable. In our analysis of most publicly listed companies around the world, we found that significant special items are often not repeated. This is not surprising, given that these profit increases are described as “extraordinary.” Assuming that these special items do not reappear this year, we expect profits to decline next year (i.e., in the absence of business growth).

You might be wondering what analysts are forecasting in terms of future profitability, and luckily, you can click here to see an interactive graph depicting future profitability based on analyst forecasts.

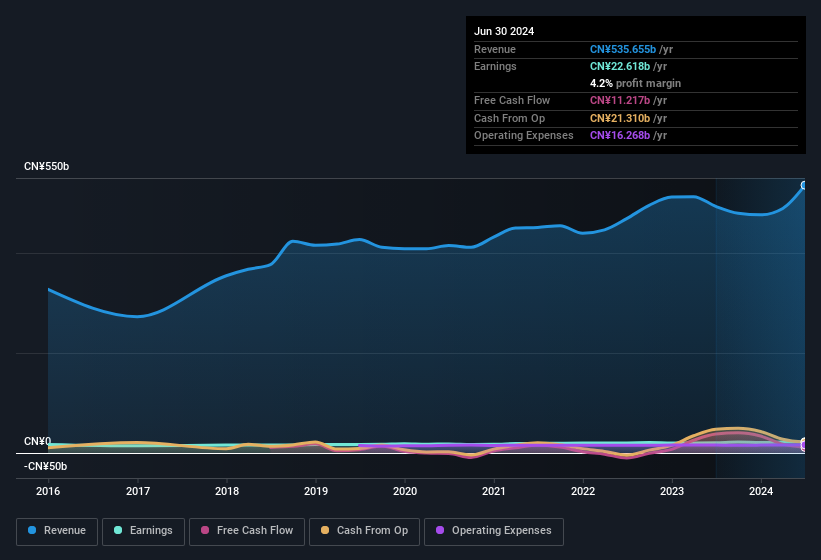

Our take on Foxconn Industrial Internet’s earnings performance

We believe that Foxconn Industrial Internet’s statutory profits are not an accurate representation of ongoing productivity due to the presence of large unusual items. Therefore, Foxconn Industrial Internet’s true underlying earnings power may actually be lower than the statutory profits. That said, it’s worth noting that earnings per share have grown by 17% over the last three years. The purpose of this article is to assess how reliable statutory profits are to reflect the company’s potential, but there is much more to take into account. With this in mind, we wouldn’t consider investing in the stock unless we fully understood the risks involved. At Simply Wall St, 2 warning signs for Foxconn Industrial Internet And we think they are worthy of your attention.

In this note, we’ve only looked at one factor that sheds light on the nature of Foxconn Industrial Internet’s profits. But there are plenty of other ways to form an opinion of a company. For example, many people consider a high return on equity to be a sign of a strong economy, while others “follow the money” and look for stocks that insiders are buying. It may take a bit of digging, but this free A collection of companies boasting high return on equity, or a list of significant insider holdings could be useful.

new: AI Stock Screener and Alerts

Our new AI stock screener scans the market daily to find opportunities.

• Companies with strong dividend yields (yields of 3% or more)

• Undervalued small cap stocks due to insider buying

• Fast-growing technology and AI companies

Or you can build your own indicator from over 50 available.

Try it free now

Have feedback about this article? Concerns about the content? Stay in touch Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.