Olivier Le Moal

Investment Overview

The share price of Intra-Cellular Therapies (NASDAQ:ITCI) – the New York based central nervous system focused biotech – is up by 450% across a five-year period, and >50% over a 12-month period.

The company completed its initial public offering (“IPO”) back in 2014, raising ~$100m via the issuance of ~$6.15m shares priced at $17.5 per share. In short, Intra-Cellular has rewarded its shareholders handsomely since becoming a public company.

Intra-Cellular’s success is largely down to its only approved drug to date, Caplyta (lumateperone). Prior to the drug’s first approval in late 2019, Intra-Cellular shares had sunk to a low of $7.5, a near 60% discount to IPO price.

According to the company’s 2022 10K submission / annual report:

In December 2019, CAPLYTA was approved by the FDA for the treatment of schizophrenia in adults (42mg/day) and we initiated the commercial launch of CAPLYTA in March 2020. In support of our commercialization efforts, we employ a national salesforce consisting of approximately 370 sales representatives.

In December 2021, CAPLYTA was approved by the FDA for the treatment of bipolar depression in adults (42mg/day). CAPLYTA is the only FDA-approved treatment for depressive episodes associated with bipolar I or II disorder (bipolar depression) in adults as monotherapy and as adjunctive therapy with lithium or valproate.

We initiated the commercial launch of CAPLYTA for the treatment of bipolar depression in December 2021. In addition, the FDA approved new dosage strengths, 10.5mg and 21mg, for special populations of patients, in April 2022. We initiated the commercial launch for these special population doses in August 2022.

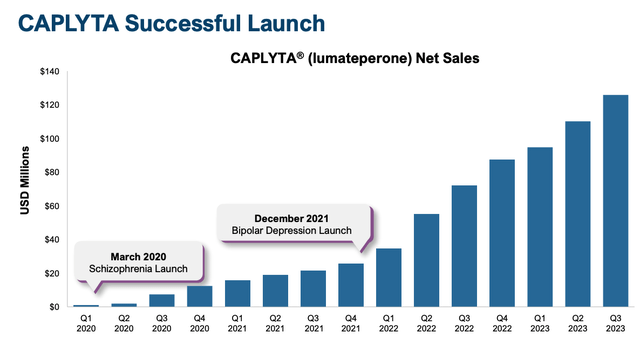

In 2020, Caplyta drove revenues of $22.4m, in 2021, $81.7m, and in 2022, $249m. As impressive as the growth in revenues is, and the growth in the share price over the same period – it should be noted that net losses in 2020, 2021, and 2022 respectively were $(227m), $(284m), and $(256m).

Across the first nine months of 2023, Caplyta revenues were $331m, but the company reported a net loss of $(111m). Ultimately, if Intra-Cellular shares are to keep tracking upward, these losses will eventually need to be converted into profits. Nevertheless, it’s clear that in lumateperone, Intra-Cellular has a powerful and important drug in its stable.

Lumateperone’s Journey To Pre-Eminence In CNS Disorders

Not unusually for a drug addressing difficult to diagnose, let alone treat, a condition such as Schizophrenia, lumateperone’s path to approval involved numerous setbacks – a failed Phase 3 study in 2016, which management blamed on an unusually high placebo response (although risperidone, a drug approved to treat Schizophrenia since 1993 was able to outperform placebo), a cancelled FDA Advisory Committee meeting, and a 3-month postponement to the initial Prescription Drug User Fee Act (“PDUFA”) date – when the FDA announces its decision on whether the drug has been approved or rejected for commercial use.

The drug – licensed from Bristol Myers Squibb in 2014 – was eventually approved in December 2019 – according to a press release at the time:

The efficacy of CAPLYTA 42 mg was demonstrated in two placebo-controlled trials, showing a statistically significant separation from placebo on the primary endpoint, the Positive and Negative Syndrome Scale (PANSS) total score. The most common adverse reactions (≥5% and twice the rate of placebo) for the recommended dose of CAPLYTA vs placebo were somnolence/sedation (24% vs.10%) and dry mouth (6% vs. 2%).

The efficacy of the drug is explained as follows in Intra-Cellular’s 2022 10K:

The efficacy of lumateperone could be mediated through a combination of antagonist activity at central serotonin 5-HT2A receptors and postsynaptic antagonist activity at central dopamine D2 receptors.

In terms of pharmacodynamics, lumateperone has high binding affinity for serotonin 5-HT2A receptors and moderate binding affinity for dopamine D2 receptors, serotonin transporters, dopamine D1 receptors, dopamine D4 receptors and adrenergic alpha 1A and alpha 1B receptors.

It lacks biologically relevant interactions with other receptors including muscarinic and histaminergic receptors. As a result, we believe lumateperone may represent a potential treatment across multiple therapeutic indications.

For those (like me) who find the above analysis somewhat technical and tricky to get to grips with, I came across a more layman-friendly analysis provided by an article in Psychiatry Online in an article from 2020:

The agent (lumateperone) has attracted some optimism as a possible breakthrough in schizophrenia treatment because it acts on glutamate receptors in the brain as well as dopamine and serotonin receptors.

Many of the so-called “me-too” second-generation antipsychotics (“SGAS”) manufactured in recent years have acted on serotonin and dopamine only; experts agree that what is needed to make a dramatic improvement in the lives of people with schizophrenia are medications that work on the brain in entirely novel ways.

Clearly, prescribing physicians have seen positive results in patients, as, according to a January investor presentation released by Intra-Cellular, Caplyta experienced “exceptional Rx growth of ~85% in ’23 versus ’22”, and its sales performance since launch has also been exceptional, with growth in every consecutive quarter since launch.

Caplyta sales growth since launch (Intra-Cellular presentation)

The growth has been supercharged by the subsequent approvals the drug was able to secure in bi-polar disorder. In its approval statement, the FDA noted:

the efficacy of Caplyta 42 mg was established by demonstrating statistically significant improvements over placebo for the change from baseline in the Montgomery-Asberg Depression Rating scale (MADRS) total score at week 6. Caplyta 42 mg also showed a statistically significant improvement in the key secondary endpoint relating to clinical global impression of bipolar disorder in each study.

Major Depressive Disorder – A Chance To Expand Label, Chase “Blockbuster” Sales

Management’s guidance for full-year 2024 Caplyta revenues issued as of Q3 was for $460m – $470m of revenues, meaning Q4 revenues ought to come in ~$135m, representing another sequential gain, albeit only by ~$10m, as revenues reported in Q3 were $126.2m.

Full-year 2023 SG&A guidance was lowered to $405 – $420m, and R&D expense guidance to $185 – $200m, meaning overall losses will likely exceed $(150m), but will at least be an improvement on prior years.

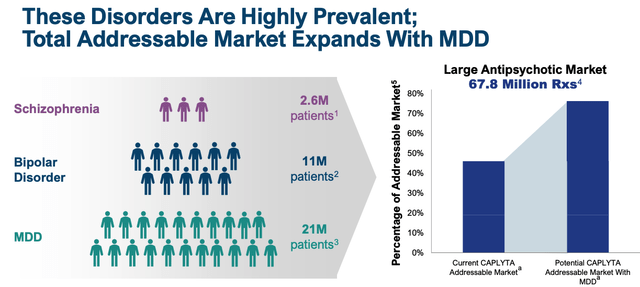

Intra-Cellular management will likely feel the SG&A spend is justified, given that there is intense competition in the schizophrenia space and national advertising campaigns are required to maintain awareness and keep pace with the competition. The R&D spend is even easier to justify, as management runs studies intended to secure approval in major depressive disorder (“MDD”), an indication and market that is an order of magnitude larger than Schizophrenia and Bipolar.

addressable market expansion with MDD (intra-cellular presentation)

Intra-Cellular is running three Phase 3 studies intended to collect the data required for a label expansion into MDD, and data from these three, whose endpoints are all the same, being change in Montgomery–Åsberg Depression Rating Scale (“MADRS”) total score at week 6, will be available this quarter and next, management has promised, introducing an intriguing near-term data catalyst for prospective investors to consider.

Last year, Intra-Cellular secured a notable win in a study evaluating lumateperone as a monotherapy in patients with MDD, with mixed features and bi-polar depression with mixed features, recording a statistically significant improvement on its primary endpoint of improvement on MADRS, and on the secondary endpoint of Global Impression of Severity Scale (CGI-S).

Wall Street was delighted with the data, and the market sent Intra-Cellular stock surging from ~$45, to $65, when it was announced last March. Analysts have speculated that Caplyta has peak sales potential of $4.3bn, with $1.3bn available in MDD alone.

Competitive Threats – Deep-Pocketed Rivals Could Hamper Growth, Challenge On Efficacy

With its current market cap of ~$7bn, it’s clear that, if Caplyta fulfils Wall Street’s expectations and become a multi-billion selling asset, the company would almost certainly merit a double-digit billion valuation, and finally realise some profits. For example, a 10% net profit margin on $4.3bn of revenues would be $430m, and if we speculate around a price to earnings ratio of 25x, we are looking at a market cap of close to $11bn.

The depression market is estimated to be worth ~$16bn by 2030, therefore Caplyta would need a 25% share in order to fulfil optimist’s expectations, but is this a genuine possibility?

In its 2022 10K, Intra-Cellular lists its closest competitors as Vanda Pharmaceuticals (VNDA), and its schizophrenia drug Fanapt, Alkermes (ALKS) (my Seeking Alpha note here), and schizophrenia / bipolar drug Lybalvi, Otsuka Pharma’s Rexulti, and AbbVie’s (ABBV) Vraylar, indicated for MDD, schizophrenia, and bipolar.

Vraylar racked up nearly $2.7bn of revenues in 2023, up 29% from the $1.97bn earned in the prior year. AbbVie management is confident Vraylar can achieve peak revenues of ~$5bn per annum, and with its much larger sales and marketing infrastructure, the Big Pharma will likely be able to significantly outspend Intra-Cellular when it comes to TV ad campaigns, physician and patient awareness programs etc.

Furthermore, AbbVie recently spent $8.7bn acquiring Cerevel Therapeutics and its portfolio of CBS drugs, including emraclidine, which AbbVie refers to as “a positive allosteric modulator (PAM) of the muscarinic M4 receptor, a potential best-in-class, next-generation antipsychotic that may be effective in treating schizophrenia patients”.

Sage Therapeutics (SAGE), despite multiple late-stage mishaps, is still attempting to bring zuranolone to market in MDD, while Axsome Therapeutics’ (AXSM) auvelity was approved in late 2022 for treatment of depression.

Finally, lower priced generic competition remains a threat to Caplyta sales (and indeed Vraylar sales) – Intra-Cellular mentions in its 10K that “lumateperone has five years of new chemical entity data exclusivity with the FDA, until December 2024”, which suggests generic versions of the drug may become available next year, although the company has many more patents, with the earliest expiration mentioned being 2028.

Either way, eventually, Intra-Cellular will need to diverse away from its highly successful drug Caplyta, and that will be extremely challenging.

Intra-Cellular’s Pipeline – No Obvious Near-Term Support For Lead Drug

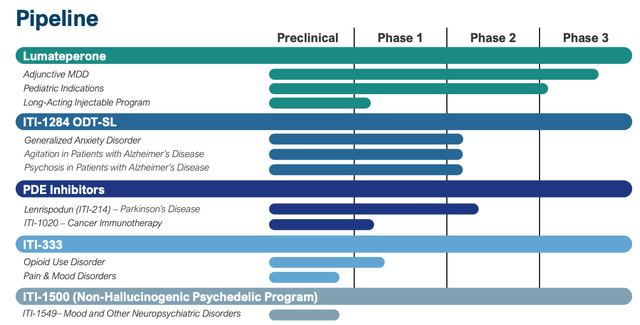

Intra-Cellular does have a diverse drug development pipeline, as we can see below:

Intra-Cellular pipeline (presentation)

There are undoubtedly some intriguing assets here – my attention is drawn to its PDE inhibitors, and Parkinson’s Disease – an area where current treatment options are broadly unsatisfactory – however it ought to be acknowledged that none of Intra-Cellular’s assets are undergoing pivotal studies, and many of the target indications are extremely challenging to treat e.g. Alzheimer’s agitation and psychosis and cancer – a field in which the company has limited experience.

Perhaps the most intriguing asset in Intra-Cellular’s pipeline is its long-acting version of lumateperone, which, if approved, would not only improve on its existing drug, which is administered orally on a daily basis, but also open up the possibility of a fresh period of patent exclusivity, protecting Caplyta revenues long-term.

Concluding Thoughts – A Buy Today On Approval Catalysts, Growing Sales, But Long-Term Future Looks Uncertain

One pivotal trial miss in 2016 aside, Caplyta has performed well in multiple late stage clinical studies which has resulted in several major approvals and a market opportunity that raises the prospect not only of “blockbuster” sales (>$1bn per annum), but in Wall Street’s eyes, annual revenues in the multi-billions of dollars.

It’s clear that Intra-Cellular is struggling to unlock profitability from an asset that is delivering strong growth in its target markets, although losses are narrowing, and if an approval in MDD is secured, the boost to revenues will be even more significant than that provided by the bipolar approval.

Competition is fierce, but Caplyta looks as if it can hold its own against all approved current challengers in its market, even if that means maintaining a high marketing spend, and with MDD study readouts imminent, this does not look a bad time to be holding Intra-Cellular stock. With its track record of positive data readouts, there is a good chance that shares can explore even more upside as Wall Street celebrates a clear route to market in MDD.

Longer-term, I harbour some doubts about Intra-Cellular’s ability to guide its pipeline assets through the approval process, and remain competitive into the next decade, and it seems that, from an M&A perspective, Big Pharma has shied away from making a bid for the company, preferring the likes of Cerevel, or Biohaven, for example (acquired for $12bn by Pfizer last year), which might suggest it does not see long-term blockbuster revenue potential, perhaps after patents expire.

In the here and now, however, bolstered by nearly $500m in cash and no debt, the temptation to take a position in the company as it prepares to release MDD data is high – although I am not sure I’d rate the company as a long-term “buy and hold”.