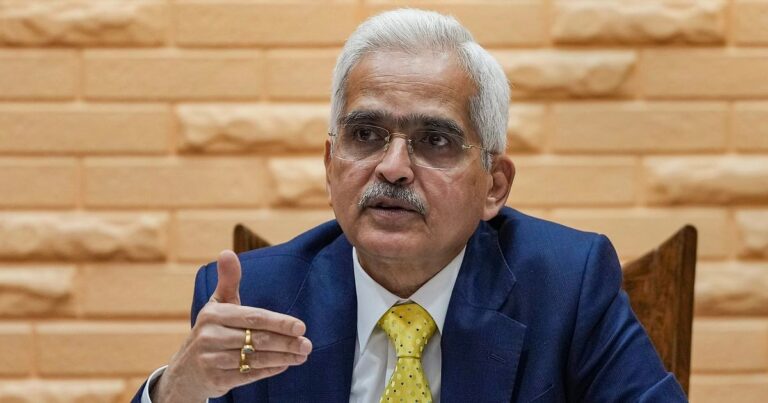

NEW DELHI: The Reserve Bank of India (RBI) is likely to launch an interoperable payment system for internet banking during the current calendar year, which will speed up the settlement of funds for merchants and further facilitate online transactions. Governor Shaktikanta Das said on Monday. .

Speaking at the ‘Digital Payments Awareness Week’ celebrations in Mumbai, Das said that the central bank will provide such interoperability to NPCI Bharat Billpay Limited (NBBL), a wholly-owned subsidiary of National Payments Corporation of India (NPCI). He said he had approved the introduction of a possible system. .

“This interoperable payment system for internet banking is expected to be launched during this financial year. The new system will facilitate quick settlement of funds for merchants,” he said.

The proposed system will allow customers to make payments to businesses through netbanking, regardless of whether the bank and merchant payment aggregators are integrated or not.

Currently, online merchant payment transactions are processed through payment aggregators and are not interoperable. Therefore, banks must integrate with each payment aggregator of different online merchants separately.

If a customer wants to pay a particular merchant from their bank account, an arrangement must be made between the merchant’s payment aggregator and the customer’s bank. Given that there are multiple payment aggregators, it is difficult for each bank to integrate with each payment aggregator.

“The lack of a payment system and set of rules for these transactions results in delays in merchants actually receiving payments, creating payment risks,” Das said, adding that this is a bottleneck for digital payment systems. He said that it has become.

“As the regulator, we are committed to playing our part in India’s digital payments journey,” he said.

(issued March 5, 2024, 05:04 IST)