Global data center liquid cooling market

DUBLIN, March 8, 2024 (GLOBE NEWSWIRE) — “Data Center Liquid Cooling Market – Global and Regional Analysis: Focus on Products, Applications and Country Analysis – Analysis and Forecast, 2023-2033 2019 report added. ResearchAndMarkets.com Recruitment.

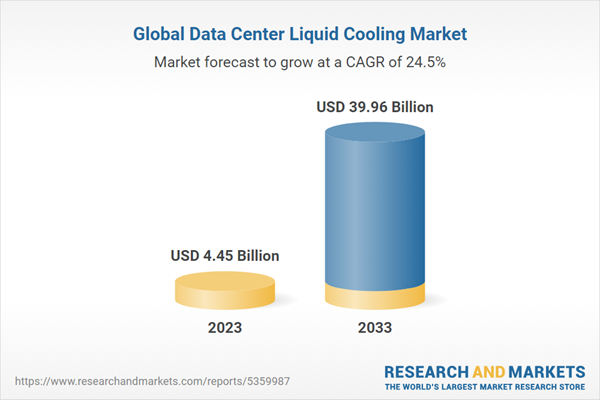

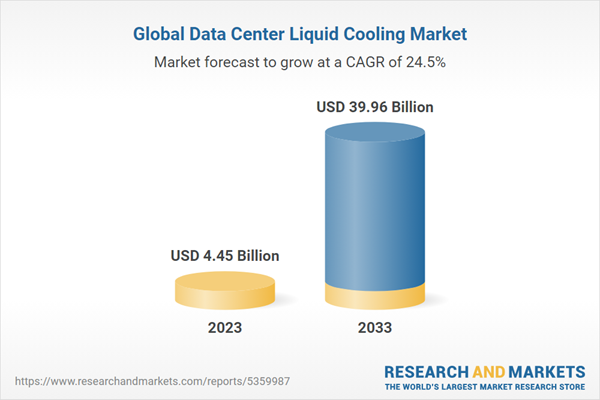

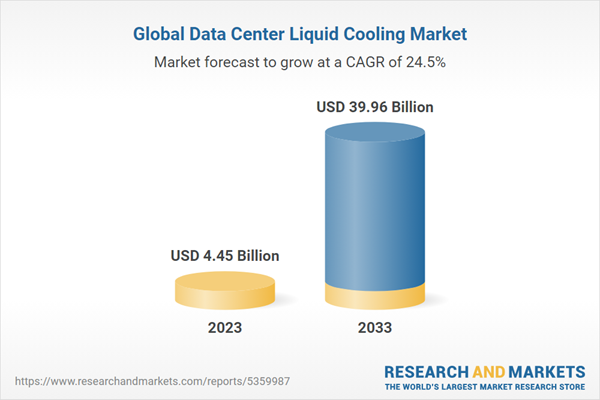

The global data center liquid cooling market was valued at $4,457.2 million in 2023 and is expected to reach $39.9 billion by 2033, registering a steady growth of 24.53% during the forecast period 2023-2033. CAGR. The growth of the global data center liquid cooling market is expected to be driven by increasing data center spending and decreasing data center operating costs.

In today’s digitally driven world, data centers are the backbone of the global economy, powering everything from cloud computing to online services. However, the exponential growth in data processing and storage demands has created unprecedented thermal management challenges. To address this, the data center liquid cooling market has emerged as a dynamic and essential sector within the technology industry.

In data centers, heat generated by IT equipment is absorbed by a cooling fluid that circulates through the cooling system and releases the heat to the outside environment.

Liquid cooling solutions are revolutionizing data centers by efficiently dissipating heat generated by high-performance servers and equipment. This market is driven by the critical need for energy-efficient and sustainable cooling methods to optimize data center operations. As data demand continues to soar, enterprises and data center operators are turning to innovative liquid cooling technologies to improve performance, reduce operating costs, and minimize environmental impact. .

Market expansion is influenced by a number of important factors. This includes the growing global need for energy-efficient and robust data center cooling solutions, and the proliferation of technologies such as the internet, cloud computing, AI, IoT, and big data. As a cumulative effect, these factors are predicted to drive increased adoption of liquid cooling in data centers.

IT and Telecommunications Industry Dominates Global Data Center Liquid Cooling Market (by End-Use Industry)

The IT and telecommunication segment is expected to dominate the market during the forecast period 2023-2033. With the introduction of new technologies such as 5G, IoT, virtual and augmented reality, and artificial intelligence, the IT and communications industries are evolving to handle massive amounts of data. As a result, communications data centers are also changing to accommodate the need for large amounts of data and low latency. The Banking, Financial Services and Insurance (BFSI) sector is expected to witness the highest growth rate due to digitalization with the use of cutting-edge technologies, which will lead to increased data center usage and Cooling will be enhanced. market.

During the forecast period, Europe, North America and Asia Pacific are expected to witness significant demand for data center liquid cooling. Tightening government regulations and the resulting expansion of the data center industry are expected to create favorable conditions for the adoption of liquid cooling.

The use of liquid cooling is growing significantly in Europe, North America, Asia Pacific, and China. This growth is driven by increased research and development activity, as well as a competitive environment that fosters innovation, infrastructure modernization projects, climate change challenges, energy efficiency demands, the expansion of AI and HPC, the development of the digital economy, and a competitive environment that fosters innovation. Data privacy and security requirements are all likely contributing. Data growth driven by smartphones and the Internet of Things is driving the adoption of water cooling in data centers, thereby stimulating market growth.

Market Drivers: Rising Data Center Spending

The exponential growth in data generation and usage across various sectors has led to a significant increase in the demand for data servers and data centers. According to CloudScene data, as of January 2021, there were approximately 8,000 data centers operating in 110 countries. The United States leads the way with 33% of these centers, followed by the United Kingdom (5.7%), Germany (5.5%), China (5.2%), Canada (3.3%) and the Netherlands (3.4%). Approximately 77% of these data centers are located in Organization for Economic Cooperation and Development (OECD) countries, such as France, Greece, Hungary, Iceland, and Ireland. Additionally, approximately 64% are located in North Atlantic Treaty Organization (NATO) countries, including Denmark, Croatia, and the Czech Republic.

The U.S. market has seen a significant increase in data center capacity, reaching a record absorption of 493.4 megawatts (MW) in 2021, according to a report by Coldwell Banker’s Richard Ellis (CBRE). This is a 31% increase from the previous high in 2019 and a 50% increase from 2020. Jones Lang LaSalle (JLL) also noted that data center absorption increased significantly, reaching 885.7MW in 14 domestic markets in 2021. This is mainly due to the expansion of large cloud and technology companies. This represents an increase of 44.3% compared to the same period last year.

With data usage surging, the future outlook for data centers remains bright. Factors such as streaming services, virtual collaboration tools, and the continued popularity of remote work drove unprecedented demand for data centers from 2020 to 2021. This resurgence in demand is particularly evident among the world’s top data center operators, who are witnessing an increase at the enterprise level. Demand from sectors such as technology, finance, and healthcare.

Market challenges: high investment costs

Investing in liquid cooling technology for data centers presents significant financial challenges that often prevent operators currently relying on traditional cooling methods from adopting liquid cooling technology. The large initial investment required for liquid cooling systems, including the need for specialized infrastructure and equipment, is a major barrier for many companies looking to upgrade their data center cooling systems.

The cost implications are:

-

In traditional data centers, electricity costs can account for more than half of the operating costs.

-

Cooling operations alone can account for up to 43% of a data center’s total power usage.

-

Transitioning to more efficient cooling solutions, such as liquid cooling, incurs high initial costs (capital expenditures or CAPEX) and increases operating costs (operating expenditures), especially due to the use of expensive coolants such as dielectric fluids and fluorocarbons. or OPEX).

Market Opportunity: Improving the efficiency of existing data centers

Data centers typically have a useful lifespan of about 9 to 10 years, after which they tend to become obsolete, but upgrades can extend their useful life. Many older data centers may not be fully compatible with modern liquid cooling technology. However, the opportunity to retrofit these aging infrastructures creates a significant market for liquid cooling solutions in data centers.

Key factors driving data center retrofits include increased IT density, new technology developments, aging hardware, need for improved cooling systems, and demand for energy efficiency and power-saving solutions. . Recently built cloud or hyperscale data centers are also being retrofitted to meet these needs. The process of updating an operational data center is very complex, often more complex than designing and building a new facility. As a result, retrofitting becomes an increasingly attractive option for data center operators over the forecast period.

Many data centers built in the past decade are currently being modernized to increase efficiency and adapt to innovations from AI, IoT, and other digital advances. For retrofits, upgrading electrical components is often more feasible than the costly and labor-intensive server virtualization. Switching to liquid cooling systems in your data center provides immediate benefits, including reduced electrical failures and heat emissions. Efficiency improvements are often achieved through relatively simple changes that can reduce cooling costs and power consumption by up to 40%.

Overview of key market players and competition

The global data center liquid cooling market is a dynamic and rapidly evolving market characterized by a convergence of established players and emerging innovators, with each company aiming to improve We bring unique technology and strategies to meet the growing demand for performance cooling solutions. World wide. Driven primarily by technological innovation, these companies continue to develop new and improved cooling systems to increase efficiency and minimize environmental impact.

Both companies are focused on providing customizable and scalable solutions to meet a variety of data center requirements, from small operations to large, complex facilities. Additionally, as companies look to expand their market presence and leverage their collective technological expertise, the market is witnessing a trend towards strategic partnerships and collaborations, further intensifying competition and driving growth in the sector. is being promoted.

Prominent companies in this market include:

-

Vertive Group Co., Ltd.

-

GRC Co., Ltd.

-

isotope

-

liquid stack holding

-

Submer

-

cool centric

-

motivere

-

PEZY Computing Co., Ltd.

-

DCX Co., Ltd.

-

Acetech Co., Ltd.

-

tildine

Key attributes:

|

report attributes |

detail |

|

number of pages |

187 |

|

Forecast period |

2023-2033 |

|

Estimated market value in 2023 (USD) |

$4.45 billion |

|

Projected market value to 2033 (USD) |

$39.96 billion |

|

compound annual growth rate |

24.5% |

|

Target area |

global |

Main topics covered:

1 Market: Industry Outlook

1.1 Trends: Current and future impact assessments

1.1.1 Trends Shaping the Data Center Liquid Cooling Market

-

efficient cooling system

-

Renewable energy for data centers

-

Increased data requirements

-

Rapid increase in investment in data center cooling innovations

-

Data center power consumption scenarios

1.2 Supply chain overview

1.3 Market Trends: Overview

market drivers

-

Increase in data center spending

-

The growing need for hyperscale data centers

-

Reduce operational costs

market constraints

market opportunity

1.4 Data Center Dielectric Liquid Market Outlook

1.5 Data Center Liquid Cooling – Case Study

-

Comparative analysis of air cooling systems and liquid cooling systems in large-capacity data centers

-

Comparison of capital expenditures – equipment and IT loads for both air-cooled and liquid-cooled data centers

-

Optimizing data center efficiency, strategies using AMD EPYC processors, and immersion cooling

-

Colovore introduces liquid cooling solution to deliver up to 50 kW of rack capacity

-

PeaSoup Sustainable Data Center Solutions

2 applications

2.1 Application Segmentation

2.2 Application overview

2.3 Global Data Center Liquid Cooling Market (by Application)

3 products

3.1 Product segmentation

3.2 Product overview

3.3 Global Data Center Liquid Cooling Market (by product)

4 regions

4.1 Regional overview

4.2 North America

4.3 Europe

4.4 UK

4.5 Asia Pacific

4.6 China

4.7 Other countries

Five Markets — Competitive Benchmarks and Company Profile

5.1 Strategic initiatives, 2020-2023

5.2 Market share

5.3 Company Profile

-

Acetech

-

asperitas

-

tildine

-

coolit systems

-

DCX

-

G.R.C.

-

isotope

-

liquid stack holding

-

Submer

-

vertive group

-

Zutacore Co., Ltd.

-

cool centric

-

Midas immersion cooling

-

Motibear Co., Ltd.

-

PEZY Computing

-

Micros Technologies

-

Nortech Air Solution

-

TMG Core Co., Ltd.

-

Courance Co., Ltd.

-

Farmus Technologies

-

Shenzhen MicroBT Electronic Technology Co., Ltd.

-

Super Micro Computer Co., Ltd.

-

liquid cool solution

-

schneider electric

-

Rittal

-

Acelius

-

Legrand

-

Stulz

For more information on this report, please visit https://www.researchandmarkets.com/r/jpapnt.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900