The world of artificial intelligence (AI) investing is huge. From hardware to software to application plays, there are multiple ways to invest in trends. Each of these segments has advantages and disadvantages. Still, the two most common ways to invest in AI from a hardware and software perspective are: Nvidia (NASDAQ:NVDA) and Palantir (NYSE:PLTR)Each.

But which one is better to buy between these two? Let’s find out.

These companies are making different types of AI investments

Nvidia’s GPU (graphics processing unit) is the building block of AI computing. GPUs are great at handling complex computing loads such as training AI models. Nvidia’s GPUs are often recognized as best-in-class, making it the go-to company for GPUs destined for AI applications.

Palantir’s software was originally designed to help governments ingest large amounts of data and provide actionable insights. Although the company’s software has since expanded into commercial use, government revenue remains the bulk of the company’s business. Palantir’s software is highly adaptable and can be customized to meet the needs of hospitals, insurance companies, manufacturing companies, and more.

The two markets they serve are completely different, as are their other attributes.

different types of income

Nvidia is a hardware company, so its revenue streams are not recurring. Growing the business will require selling additional GPUs, and without demand he could see Nvidia’s revenue decline.

Palantir’s software model requires customers to renew within a given period of time (often years or months), and customers must pay to continue using Palantir products.

Therefore, if a recession occurs, Nvidia’s revenue stream could come under pressure as customers may choose to postpone some projects. Conversely, if Palantir’s software is highly integrated into a customer’s systems, the customer may have no choice but to continue paying her Palantir.

Winner: Palantir

Nvidia is growing at a faster pace

Considering full growth, Nvidia is much better than Palantir. His Nvidia’s revenue for the fiscal third quarter of 2024 (ending Oct. 30) increased 206% year-over-year. By comparison, Palantir’s growth rate for his fourth quarter of fiscal 2023 (ending Dec. 31) was 20%.

Nvidia’s growth has far outpaced Palantir’s, but Palantir is still growing fairly fast for a software company.

Winner: Nvidia

Both companies are profitable

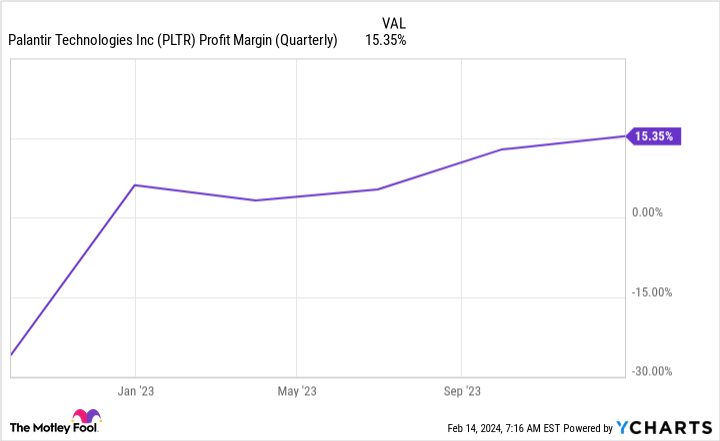

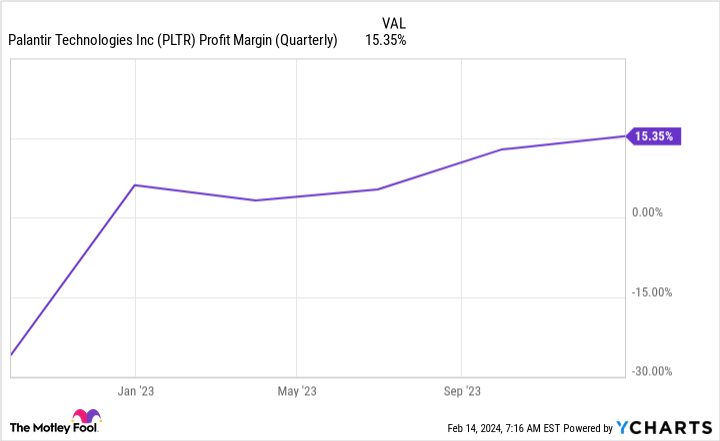

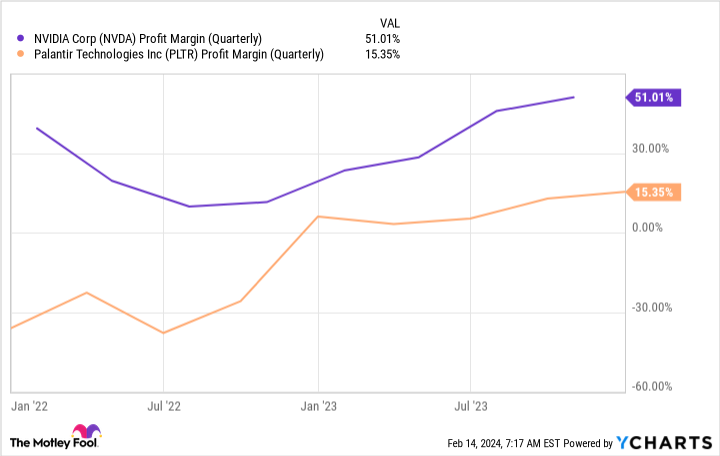

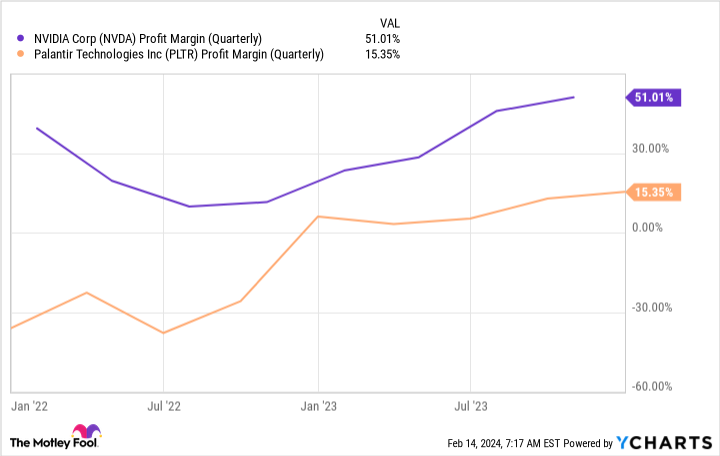

Unlike many growing companies, Palantir knows how to make a profit. The company posted a 15% profit margin in the fourth quarter.

Palantir’s profit margins have been steadily rising over the past few years, but they’re not done yet. However, Nvidia is a mature business, so its profit margins are much better than his Palantir.

If Nvidia goes into recession again due to demand drying up, don’t be surprised if Nvidia’s profit margins fall below Palantir’s. But for now, Nvidia is far ahead of Palantir in this regard.

Winner: Nvidia

Difficult to compare Nvidia and Palantir based on ratings

Because Palantir has not reached maximum profitability, it is problematic to use valuation measures such as price-to-earnings (P/E) ratios, and often earnings-based measures such as price-to-earnings (P/S) ratios scale is used. Already used. Similarly, a mature company like Nvidia should not use his P/S ratio. Instead, you should use P/E ratio.

Therefore, it is difficult to directly compare the two. Therefore, you should compare them with other products.

Palantir is a very expensive stock at 25 times sales. But it’s not in unprecedented territory.I like my friends cloud strike, snowflakeand cloudflare All are trading within this range, but revenue growth is in the 30% year-over-year range, not Palantir’s 20%. As a result, we think Palantir is an incredibly expensive stock.

Nvidia’s P/E ratio is trading at nearly 100x, and its price-to-earnings ratio hasn’t improved. However, if you use future earnings (factoring in growth over the next 12 months), NVIDIA’s stock doesn’t look that expensive, as it trades at his 35x forward earnings.with friends like microsoft and apple Trading at 35x and 28x forward earnings, NVIDIA’s price doesn’t look too bad, especially considering its warp-speed growth rate.

Nvidia wins this round as it is more highly rated by its peers than Palantir.

Winner: Nvidia

verdict

Nvidia defeated Palantir by a final score of 3-1. However, his one category (earnings type) where Palantir won could be a better stock in all four areas if NVIDIA suffers from weak demand.

But for now, it looks like you’re better off buying Nvidia.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 12, 2024

Keithen Drury has positions at Cloudflare, CrowdStrike, and Snowflake. The Motley Fool has positions in and recommends Apple, Cloudflare, CrowdStrike, Microsoft, Nvidia, Palantir Technologies, and Snowflake. The Motley Fool recommends the following options: His January 2026 $395 long call on Microsoft and his January 2026 $405 short call on Microsoft. The Motley Fool has a disclosure policy.

The first edition of Improving AI Stocks: Nvidia vs. Palantir was published by The Motley Fool.