The story of artificial intelligence (AI) is in full swing. While mega-cap technology companies are sparking his AI revolution, investors see several other companies playing a leading role.

super micro computing (NASDAQ:SMCI) is an IT architecture firm specializing in server rack design and storage clusters.The company works closely with the following companies Nvidiais a representative example of current AI.

Demand for Super Micro’s services is high, and investors are buying up shares en masse. Despite its meteoric rise and recent inclusion in the world; S&P500I think we have a better chance.

Let’s dig into Supermicro’s investment outlook compared to its peers and assess what other options investors have.

Things are going well for Supermicro, but…

A surge in demand for Nvidia’s graphics processing units (GPUs) and data center services has served as a bellwether for Supermicro, with its revenue increasing more than 100% annually. And the momentum doesn’t seem to be slowing down.

But one thing I find strange about Supermicro’s price movement is that the stock trades eerily in tandem with Nvidia. Although Supermicro and Nvidia have an important relationship with each other, their businesses are very different.

Additionally, I find myself scratching my head as to why the stock is rising more and more, given that Supermicro’s profit margins are actually declining during a period of such strong revenue growth. Ta.

…This other AI stock could be a hidden gem…

Supermicro competes with other IT architects including: IBM, hewlett packard enterprise, lenovo groupand Dell Technologies (NYSE:Dell). The common thread that unites all of these competitors is that they are all diversified businesses and probably offer more than Supermicro.

Dell recently reported its full fiscal year 2024 earnings, which ended on February 2nd. Overall revenue was $88 billion, down 14% year over year. Revenue from the Infrastructure Solutions Group (which includes storage, servers and networking) decreased 12% year over year to $33.9 billion.

Given that Dell’s IT architecture business is in decline and Supermicro is growing like a weed, why do we think Dell is a better investment option?

…The disparity in ratings is clear.

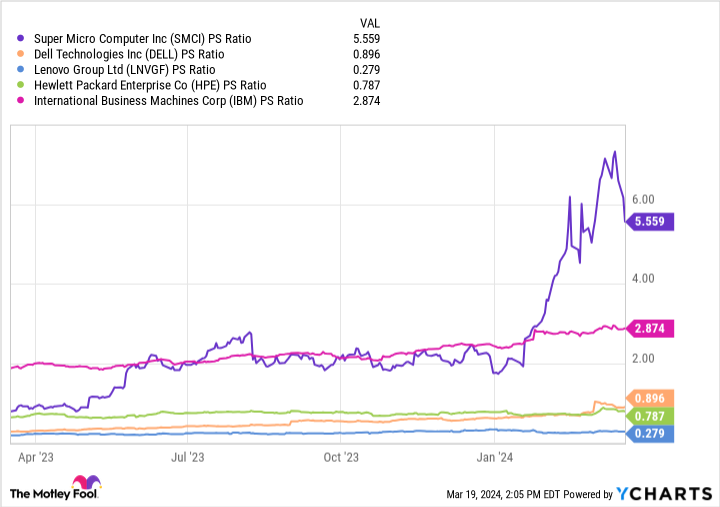

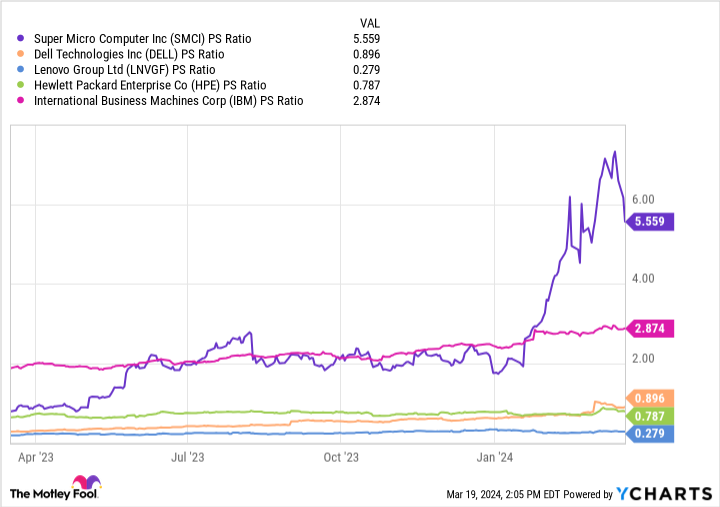

The chart below shows price-to-sales (P/S) multiples for a number of companies competing in IT networking solutions.

Based on this metric, with a P/S of 5.5, Supermicro is the most expensive stock in this peer group. The next closest is IBM, whose P/S is nearly half that of Supermicro.

The disparity in valuation multiples between Supermicro and its peers is difficult to ignore. But even with a P/S of 0.9, investors need to realize that this is much higher than Dell’s five-year average.

Like many companies even remotely connected to AI, Dell’s stock price is clearly gaining momentum. I don’t think the stock itself is cheap, but I’m more optimistic about its long-term outlook than Super Micro.

My biggest concern with Supermicro is its heavy dependence on Nvidia. The chipmaker has a strong interest in accelerated computing, but competition is likely to increase in the coming years.

So I think it makes sense for companies to outsource their data center and chip needs to multiple providers. This could lead to Nvidia’s growth slowing down, which could also affect Supermicro.

So while I don’t necessarily think Dell will grow exponentially in the near term, I do think its role in integrated IT services will start to increase. As such, Dell may experience a positive leap forward and return to more respectable sustainable growth levels in the long term.

Considering Dell stock is trading at a discount compared to Supermicro, I would at least consider buying the former. A smart strategy may be to monitor Dell’s performance over the next few quarters, keeping in mind that AI is a long-term game.

If Dell is looking to compete against its competitors, dollar-cost averaging could be a good way to enter this unique area of the AI space.

Should you invest $1,000 in Dell Technologies right now?

Before buying Dell Technologies stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Dell Technologies wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Adam Spatacco holds a position at Nvidia. The Motley Fool has a position in and recommends Nvidia. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

Forget about supermicrocomputing. Here’s one artificial intelligence (AI) stock to buy instead.Originally published by The Motley Fool