New Delhi: Vodafone Idea has said that delaying the introduction of fifth generation or 5G will enable it to deploy the technology cost-effectively. Vi, the country’s third-largest telco, said in its latest investor presentation that it has completed 5G minimum deployment obligations (MRO) in four circles with four vendors.

Vi said 90% of its TDD (time division duplex) radios are 5G-capable and all new basebands are 5G-capable.

The joint venture between Aditya Birla Group and Britain’s Vodafone Group Plc is the only telco yet to commercially launch its latest generation network. According to the presentation, Vi rolled out new roadmap architectures for virtualized radio access networks (vRAN) and open radio access networks (Open RAN) and tested the Vi AirFiber home broadband solution with multiple partners.

“5G NSA-enabled core networks across India are being deployed to handle high-throughput enhanced mobile broadband, data, voice and enterprise services,” the telco said in a presentation.

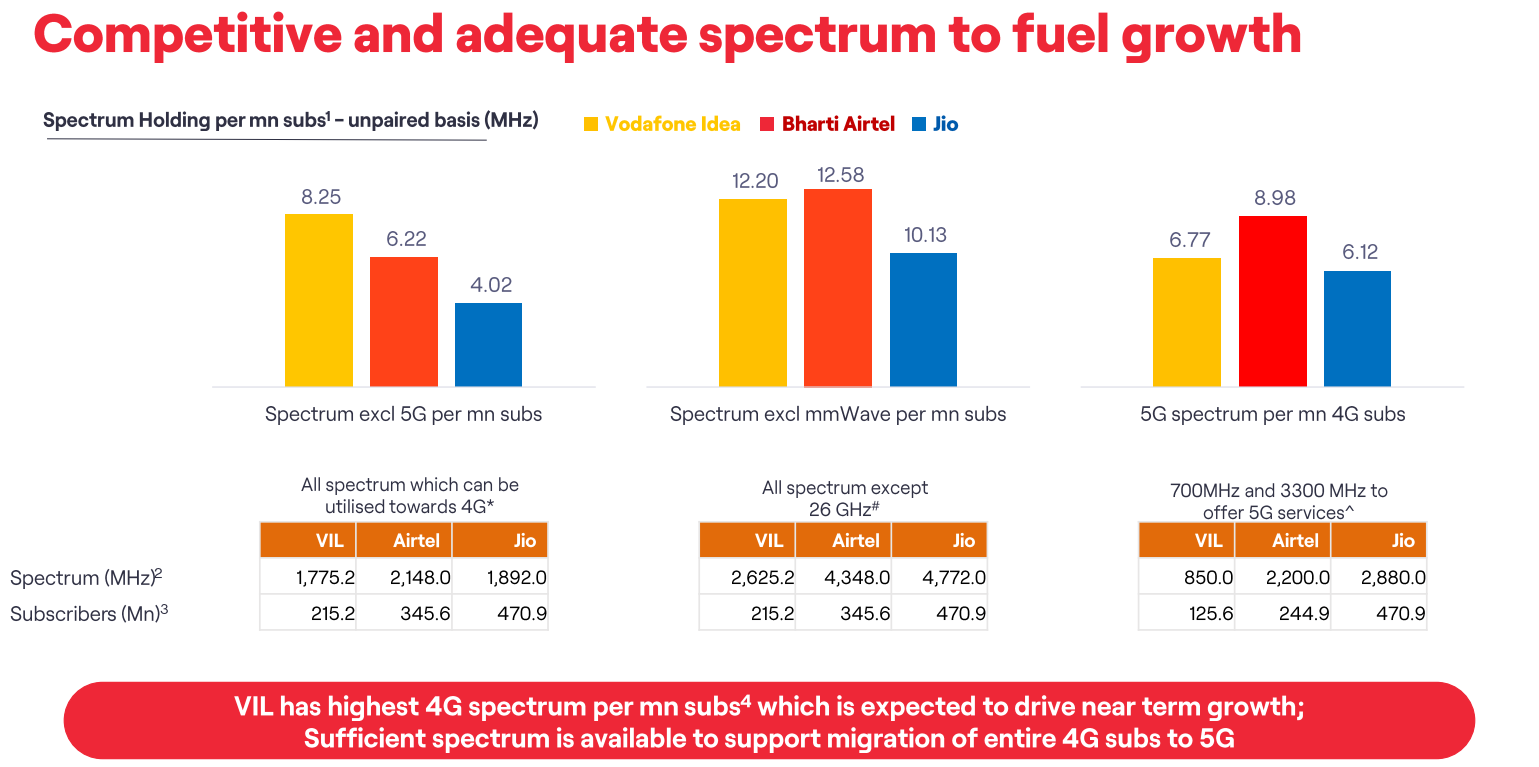

Vi said it has enough spectrum to support the migration of its entire 4G subscriber base to 5G networks.

During an earnings call in January, Vi CEO Akshaya Moondra said the telco aims to launch 5G services within about six to seven months. “Although there is already significant investment in 5G (by Reliance Jio and Bharti Airtel), monetization is yet to materialize, but it should be right around the corner. We hope to have a better idea of monetizing 5G by then,” he said.

US telecommunications equipment manufacturer Mavenir announced in February that it is in the advanced commercial stage of piloting Vi’s ORAN network. The implementation will begin in September 2023 and is already underway. It covers major launch sites and is currently carrying live commercial traffic ahead of a planned large-scale deployment.

In his presentation, Vi emphasized that average revenue per user (ARPU), a key metric for telecom businesses, needs to increase further in India and that ARPU is lower than in major countries in the world. The telco said the last round of rate hikes took place in November 2021.

“We have significant headroom in ARPU as usage has increased significantly, but ARPU has not increased in line with usage and the ability of customers to pay higher amounts has already been established.” the company said, adding that “further price increases are required to generate reasonable returns and future support for investments”.

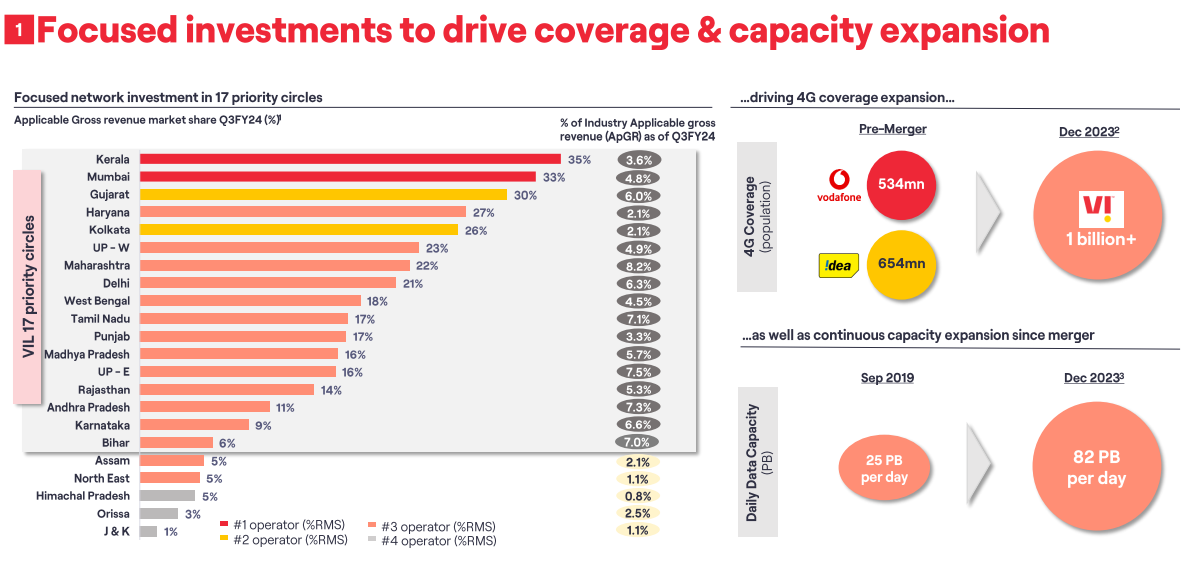

According to the presentation, the company is focusing investments on 17 areas to improve its competitiveness in priority markets.

Vi’s strategic focus areas include: Capacity expansion to meet growing data demands. Reconfiguring the 900MHz and 2100MHz spectrum bands to provide 4G. According to the presentation, small cells will be deployed in hotspot locations in metropolitan areas/metro cities to improve customer experience. Vi estimates that almost 42% of subscribers could potentially upgrade to his 4G network.

Vodafone Idea recently announced a major refinancing plan of up to Rs 45,000 crore to be raised through a mix of equity and debt, including promoter financing.

Vi’s board has approved equity financing of up to Rs 20,000 crore in equity-related instruments such as equity shares, global depositary receipts, American depositary receipts or convertible debentures, warrants or other securities convertible into foreign currency convertible debentures. . The phone company said in a regulatory filing.