As IT technology rapidly evolves and grows toward mainstream implementation of 5G networks, the Internet of Things, and cloud computing, the components that facilitate network connectivity for service providers and enterprise users have also evolved. Statista Market Insights predicts that “hardware resources that enable wired and wireless network connectivity, communications, operation and management, and access to communications networks and the Internet” will be worth approximately $192 billion worldwide in 2023. It is expected to be valuable.

The majority of this value is estimated to be associated with service provider networks, including routers and switches, carrier IP phones, broadband access, and microwave transmission. When you look at the companies that control the biggest parts of the market, one company does better than the others, although it’s not without scrutiny.

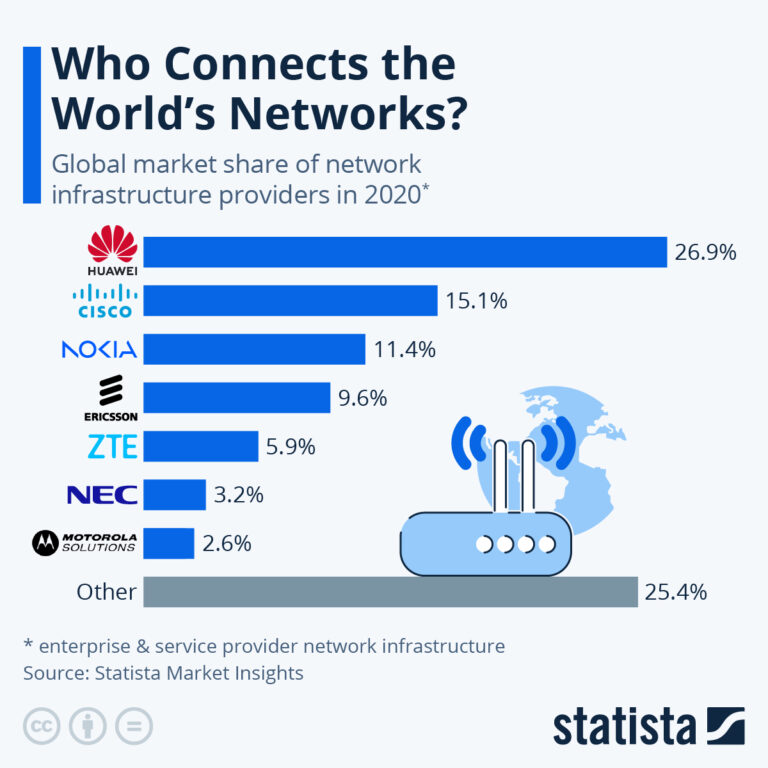

With a 27 percent market share in network infrastructure, Huawei beat its European and American competitors by more than 10 percent in 2020. Chinese companies have been at the forefront of developing robust 5G technology for some time, but in some countries the United States has imposed export license bans, banned or strongly recommended the sale of Huawei smartphones, and China Just as it excluded the company from plans to expand and build out 5G network capacity for fear of government espionage or allowing foreign agents access to critical infrastructure. .

Other major players in the network infrastructure market include US telecom giants Cisco and Motorola Solutions, and Japan’s NEC. In Europe, Finland’s Nokia and Sweden’s Ericsson are also on the list. Although market share may suggest otherwise, European communications and network infrastructure providers are facing a difficult situation. On October 19, Nokia announced plans to lay off 14,000 employees, or 16% of its workforce, amid disappointing third-quarter results, and announced plans to lay off 14,000 employees, or 16% of its workforce, following disappointing third-quarter results. Companies are laying off employees on a large scale. Ericsson, which ranks fourth in global market share, laid off 8,500 employees in February and another 750 in July.