In the business world, life often comes full circle: In 1997, British Telecom bought a 21% stake in Bharti Airtel, before divesting from the investment in 2001. More than two decades later, Bharti Global, the international investment arm of Bharti Enterprises, is set to acquire a 24.5% stake in what is now known as BT Group from Altice UK, a major investor in British companies, for an estimated $4 billion.

In May, Altice, the telecoms group founded by Patrick Dry, increased its stake in BT Group from 18% to 24.5%. Interestingly, the move came before the company announced restructuring plans that will see it cut 55,000 jobs by the end of the decade.

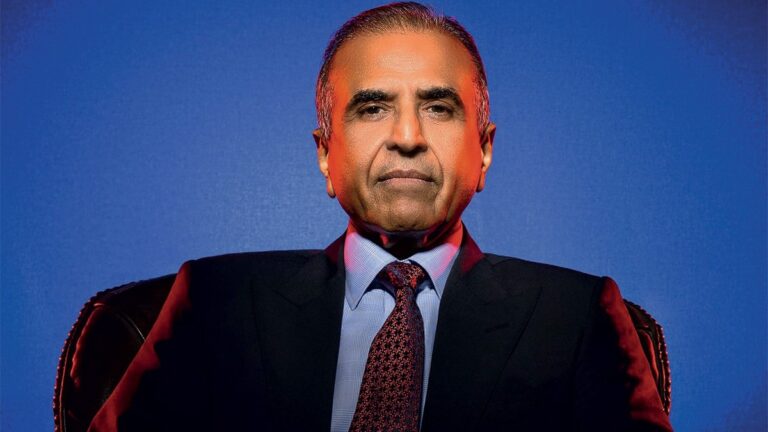

In India, Bharti Airtel, a listed company of Sunil Bharti Mittal’s Bharti Enterprises, offers mobile and broadband services. The company also has a strong presence in Africa. However, the deal with BT Group has raised some curiosity, especially given that Bharti is currently struggling with stagnant revenues and profit margins. Also, the mobile services market in the UK, BT’s main market, is saturated, leaving little room for growth. Other shareholders in BT Group include Deutsche Telekom and T-Mobile Holdings, which each hold 12%.

Analysts tracking the sector believe it is clear that Bharti is taking a long-term view with its investment in BT Group. According to Satish Meena, principal analyst at Datum Intel, Bharti will gain access to technology and infrastructure through its entry into the UK market. “Furthermore, there is an opportunity in the UK to retool its cost structure. In terms of investments, it will take a cautious approach in a market where the consumer sector is slow but the enterprise sector has potential,” he said.

Another interesting thing is 5G and how the insights from the UK can be leveraged in India. “The value here comes from premium customers, and that’s where technology makes the difference,” Meena explains. Clearly, this investment means more than just writing a cheque.

Krishnagopalan