Liftr’s analysis shows that for compute instance types with larger RAM, Azure prices are cheaper than AWS.

AUSTIN, Texas, Aug. 28, 2024 /PRNewswire/ — Liftr Insights, a pioneer in proprietary data-driven market intelligence, has uncovered the pricing differences between cloud providers Azure, AWS and GCP.

Liftr data shows that for higher RAM instances, Azure prices are lower than AWS, and GCP is lower than both.

According to Liftr data, Azure compute instance prices are, on average, higher than the equivalent price in AWS. This is true not only regionally but globally. However, Liftr data also shows that consumers can get a larger RAM allocation for a lower total price in Azure compared to AWS. In other words, going from 32 GB RAM to 64 GB RAM will cost more in AWS than the equivalent change in Azure.

“Pricing is not simple and clear,” says Tab Schadt, CEO of Liftr Insights. “With more workloads now running on multi-cloud strategies, understanding the price differences between cloud providers is critical for financial management.”

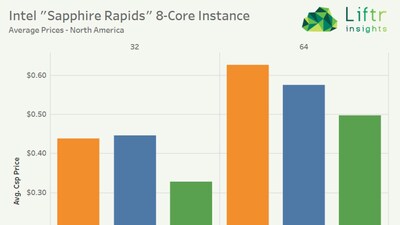

Take an 8-core Intel v4 (“Sapphire Rapids”) instance in North America. According to Liftr data, Azure is 6.2% more expensive than AWS for this instance on average. AWS offers more instance types with 32GB RAM than Azure, and on average, Azure prices are 1.6% higher than AWS prices. Move to 64GB memory and AWS becomes more expensive; the average price for a 64GB instance type on AWS is 8.0% higher than the comparable Azure price.

In contrast, GCP prices tend to be lower than both providers: in North America, for 32 GB instances, GCP’s average price is 25.2% lower than AWS, and 20.5% lower than AWS 64 GB instances, although Azure can also be less expensive than GCP for larger RAM allocations.

Prices tracked by Liftr Insights are higher globally compared to rates in North America, but cloud provider pricing trends are broadly consistent across other countries and regions.

Liftr’s data tracks nine cloud providers that account for more than 75% of the public cloud space and provides detailed information on cloud configurations and on-demand pricing.

“Prices can change as new services come online in different locations,” Schadt says, “so having a consistent source for tracking prices across the major cloud providers is important.”

About Liftr Insights

Liftr Insights uses proprietary data that includes details on configuration, components, deployment regions, pricing, and more to generate reliable market intelligence.

- Server Processors: Intel Xeon, AMD EPYC, Aliyun Yitian, AWS Graviton, Ampere Computing Altra

- Data Center Computing Accelerators: GPUs, FPGAs, TPUs, and AI chips from NVIDIA, Xilinx, Intel, AMD, AWS, Google, and Qualcomm.

As shown on the Liftr Cloud Regions Map (https://bit.ly/LiftrCloudRegionsMap), Companies tracked include Amazon Web Services and Microsoft Azure., Alibaba Cloud, Google Cloud, Oracle Cloud, Tencent Cloud, CoreWeave, Lambda, Vultr, and semiconductor vendors AMD, Ampere, Intel, Qualcomm, and NVIDIA. Liftr Insights experts transform enterprise-specific service provider data into actionable alternative data.

Contact Us@LiftrInsights.com

Liftr and the Liftr logo are registered service marks of Liftr Insights. Liftr Insights, Cloud Components Tracker, Intelligence Compute Tracker and Liftr Cloud Regions Map are trademarks and/or service marks of Liftr Insights.

The following are registered intellectual property marks, trademarks, or service marks of each company:

Amazon Web Services

Microsoft Azure

Alibaba Cloud

Google Cloud

Oracle Cloud

Tencent Cloud

Core Weave

lambda

Vortle

Intel Corporation

Ampere Computing

Qualcomm

NVIDIA

Am

arm

SOURCE Liftr Insights