(Bloomberg) — Asian stocks fell on cautious trading ahead of the end of the quarter and the Federal Reserve’s announcement of its preferred inflation policy later this week.

Most Read Articles on Bloomberg

MSCI’s Asian stock index fell for the third day in a row, with Taiwan, Australia and Indonesia the biggest decliners. U.S. stock futures also fell following Monday’s decline in the S&P 500 index. South Korea’s Kospi outperformed, supported by local chip stocks.

The offshore yuan rose for the second straight day after the People’s Bank of China once again strengthened its support for offshore yuan. The yen was little changed after falling to a four-month low against the dollar last week.

Kieran Calder, head of Asian equities research at Union Bancair Privy, said: “At the end of the first quarter, Taiwan and Japan, the best-performing markets of the year, particularly as investors look for new catalysts, There is a heightened sense of caution.”

Given the number of risk events that will occur in the coming days, there are many reasons for investors to be cautious. The U.S. government releases the Personal Consumption Expenditure Price Index on Good Friday, when local markets are closed. Federal Reserve Chairman Jerome Powell is scheduled to speak on the same day.

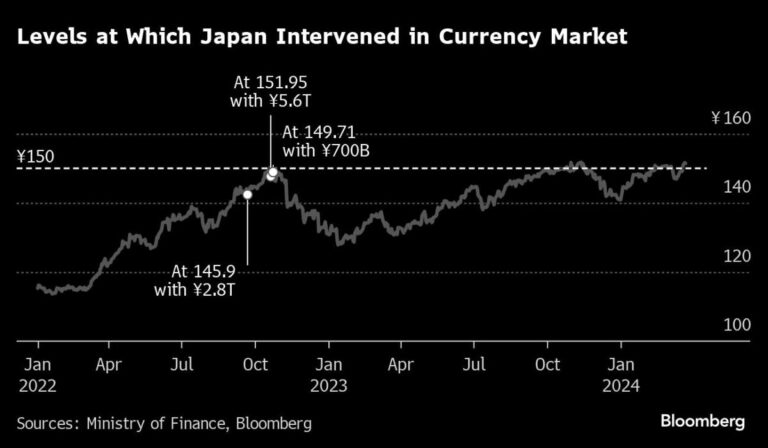

Partly due to uncertainty surrounding the yen, Japan’s Finance Minister Shunichi Suzuki said on Tuesday that the government would take appropriate measures against excessive currency fluctuations without ruling out any measures.

In Asian trade, US Treasuries rose slightly, while the dollar weakened against the Group of Ten (G10) countries.

Pullback “Expired”

At the beginning of this week, concerns about the discrepancy between profit forecasts and stock prices grew, and investors became cautious. Strategists at Morgan Stanley and JPMorgan Chase & Co. recently warned that unless earnings accelerate, it will be difficult to justify lofty valuations.

“We continue to see sentiment remain tense and think a U.S. stock market pullback is premature,” said Lori Calvasina of RBC Capital Markets.

In a sign of how overheated the stock market is, the S&P 500 ended last week 14% above its 200-day moving average. Still, a combination of strong U.S. economic data, expectations that the Federal Reserve will cut interest rates and optimism about artificial intelligence have helped propel the S&P 500 up nearly 10% this year.

Goldman Sachs Group Inc. strategists are sticking with their year-end forecast of 5,200, but envision a scenario in which tech giants lead the index to 6,000.

“Although AI optimism appears high, long-term growth expectations and valuations for the largest TMT companies remain far from ‘bubble’ territory,” strategists led by David Kostin wrote.

In other markets, oil prices firmed up after posting their biggest rise in a week as OPEC+ is expected to stick to its production cut policy due to tensions in the Middle East and Russia. Gold is hovering near all-time highs.

This week’s main events:

-

ECB Chief Economist Philip Lane attends an event in Dublin on Tuesday

-

US Durable Goods, Conference Board Consumer Confidence, Tuesday

-

China’s industrial profits Wednesday

-

Bank of England releases minutes of Monetary Policy Committee meeting on Wednesday

-

Eurozone economic confidence, consumer confidence, Wednesday

-

Fed Director Christopher Waller speaks on Wednesday

-

UK GDP revised figures Thursday

-

University of Michigan Consumer Sentiment, Number of New Unemployment Insurance Claims, GDP, Thursday

-

Japan’s unemployment rate, Tokyo CPI, industrial production, retail sales, Friday

-

US Personal Income and Expenditures, PCE Deflator, Friday

-

Good Friday. Exchanges in the United States and many other countries were closed due to public holidays. The US federal government is open.

-

San Francisco Fed President Mary Daley speaks on Friday

-

Federal Reserve Chairman Jerome Powell speaks on Friday

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 12:49 p.m. Tokyo time.

-

Nasdaq 100 futures little changed

-

Japan’s Topix index remains almost unchanged

-

Hong Kong’s Hang Seng Index remains almost unchanged

-

China’s Shanghai Composite Index fell 0.4%.

-

Australia’s S&P/ASX 200 index falls 0.4%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was unchanged at $1.0837.

-

The Japanese yen remains unchanged at 1 dollar = 151.42 yen.

-

The offshore yuan was almost unchanged at 7.2462 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6535.

cryptocurrency

-

Bitcoin fell 0.7% to $70,461.76.

-

Ether remains almost unchanged at $3,630.24

bond

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Rita Nazareth and Jason Scott.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP