Chip stocks are in the spotlight amid a recent boom in the artificial intelligence (AI) market as demand for graphics processing units (GPUs) soars. These high-performance chips are essential for training and running AI models. As a GPU leader, Nvidia has been the most successful in the space so far, enjoying a surge in profits and seeing its stock rise more than 280% in the past 12 months as chip sales soar.

However, two other chipmakers are moving to challenge Nvidia’s dominance, and could see significant gains in the coming years as competing GPUs grow in the market. Advanced Micro Devices (NASDAQ: AMD) and intel (NASDAQ:INTC). In the long run, he may have more room to play in the market than Nvidia, as these companies have invested heavily in AI and are in the early stages of their AI ventures.

So let’s compare the businesses of these companies and decide whether AMD or Intel is the better AI stock this month.

Advanced Micro Devices

AMD is probably Nvidia’s biggest threat in the AI space and has the second-largest market share in GPUs, but the company has lagged slightly behind the AI party compared to its rivals. But AMD is restructuring its business to prioritize emerging industries, and meeting the surge in demand for GPUs could lead to big profits in the coming years.

Last December, the company announced the MI300X AI GPU. The new chip is designed to compete directly with Nvidia’s products and has already attracted the attention and contracts of some of the technology industry’s most prominent players. microsoft and meta platform as a client.

Additionally, AMD isn’t just looking to steal GPU market share. Chipmakers hope to lead their own space in the AI space by ramping up the development of AI-powered PCs. According to research firm IDC, PC shipments are expected to increase significantly this year, with AI integration acting as a key catalyst. Additionally, a report from Canalys predicts that 60% of all PCs shipped in 2027 will be AI-enabled.

AMD has a bright future in the AI field. Meanwhile, Intel’s free cash flow was just over $1 billion last year, compared to Intel’s -$14 billion. This number suggests that AMD’s financial health is improving and it has more cash to continue investing in AI.

intel

Intel announced a range of AI chips in December, including Gaudi3, a GPU designed to compete with Nvidia and AMD hardware. Intel also showcased new Core Ultra processors and Xeon server chips. These chips contain neural processing units to run AI programs more efficiently.

But the company has hit some roadblocks since then. Intel’s stock price has fallen more than 9% since January 25, when the company announced its 2023 fourth-quarter results. The tech giant benefited from an improving PC market, posting 10% year-over-year revenue growth and beating Wall Street expectations by $230 million.

But it wasn’t enough to mask the weak guidance that caused Intel’s stock price to plummet. The company expects first-quarter 2024 earnings to be $0.13 per share. Analysts had expected $0.42 per share.

Changes in the chip market are causing demand for central processing units (CPUs) to decline, while GPU sales are skyrocketing. As the leader in CPUs, Intel’s business is in trouble.

Intel has the infrastructure and brand power to ultimately succeed in AI, but prospective investors should be prepared to hold for the very long term.

Which is a better AI stock for March 2024: AMD or Intel?

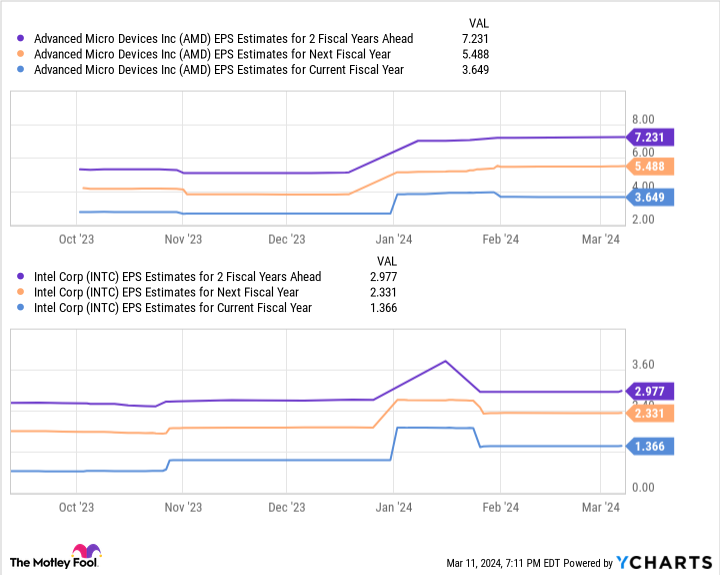

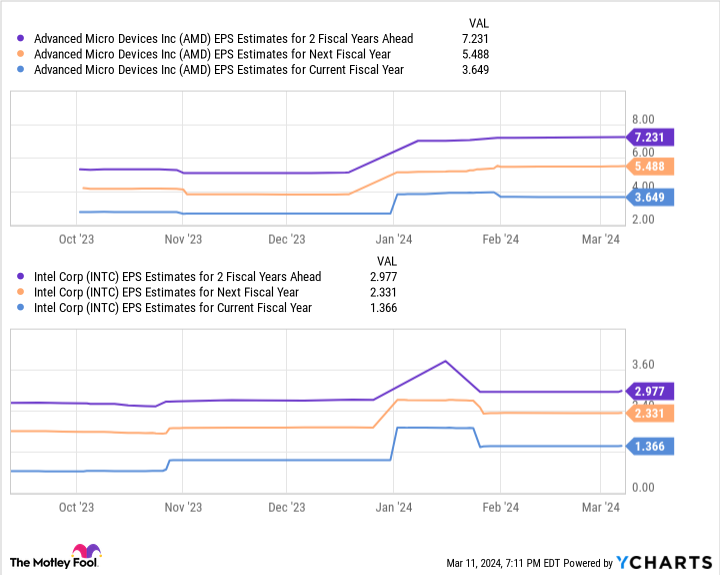

AMD and Intel are both attractive stocks to buy now and hold indefinitely. Additionally, the earnings per share (EPS) estimates support strong growth potential in the coming years.

This chart shows that AMD’s earnings could reach just over $7 per share over the next two fiscal years, while Intel’s earnings are expected to reach just under $3 per share. There is. Multiplying these numbers by both companies’ expected price-to-earnings ratios (AMD 55, Intel 33) yields a stock price of $396 for AMD and $99 for Intel.

Considering both companies’ current positions, these projections would increase AMD’s stock price by 97% and Intel’s stock price by 120% by fiscal year 2026. These are lofty goals, but they are based on reasonable financial metrics.

Intel looks like the clear winner here, but AMD could almost double in price with a more financially stable business, so it’s too good to pass up. So far, AMD has been in a more reliable position in the AI space, making AMD stock a better buy than Intel this month.

Where to invest $1,000 right now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks Advanced Micro Devices made the list of stocks that investors should buy right now. But there are nine other stocks he has that you may have overlooked.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Dani Cook has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: Long January 2023 $57.50 calls on Intel, Long January 2025 $45 calls on Intel, Long January 2026 $395 calls on Microsoft, Short January 2026 $405 calls on Microsoft. call, and a May 2024 $47 short call. Intel. The Motley Fool has a disclosure policy.

“Better Artificial Intelligence (AI) Stocks: AMD vs. Intel” was originally published by The Motley Fool.