Raymond James says two chip stocks stand to benefit most from rising demand for artificial intelligence semiconductors.

On Friday, analyst Srini Pajri reiterated her “strong buy” rating on NVIDIA and ASML.

,

He cited how major technology companies appear to be making progress in capturing revenue from generative AI projects. “Strong Buy” is Raymond James’ highest rating for the stock.

“We remain bullish on AI adoption across the industry and see it as a long road ahead for component suppliers,” he wrote. “We estimate Gen AI-related Semi revenue to grow 200% in 2023 and expect it to double in 2024.”

In Monday trading, NVIDIA stock rose 3.6% to $685.19, while ASML stock fell 0.2% to $887.78.

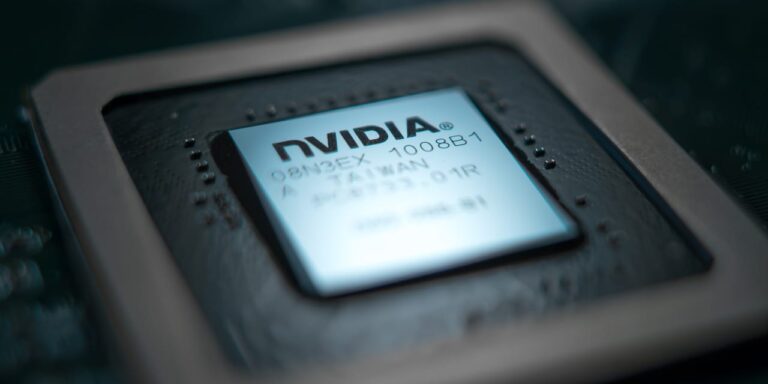

Nvidia is a leading manufacturer of AI chips for data centers. Both startups and enterprises prefer the company’s products because the company has a robust programming platform CUDA that provides tools that facilitate the development of AI applications.

Advertisement – SCROLL TO CONTINUE

Meanwhile, ASML manufactures extreme ultraviolet lithography equipment, which is essential for the production of AI semiconductors.The Dutch company’s customers include Taiwan Semiconductor Manufacturing Co., Ltd. and Samsung Electronics Co., Ltd.

,

And Intel.

“The impact of AI monetization[on hyperscalers’ revenues]has become even more pronounced this financial year,” he wrote, referring to major cloud computing vendors.

The analyst noted that these cloud computing companies made positive comments about spending when they announced their earnings last week. Microsoft said it expects capital spending to increase “significantly” this quarter and intends to continue investing aggressively. Alphabet said capital spending in 2024 will be “significantly larger” than in 2023.

Advertisement – SCROLL TO CONTINUE

According to both companies, trends in AI demand are behind these infrastructure investments.

Email Tae Kim at tae.kim@barrons.com.