As networks evolve to 5G, base station antennas have become an increasingly complex and essential part of mobile networks. The evolution from 3G to 4G and now 5G has enabled higher sector throughput rates, and it is the base station antennas that pass the traffic to the airwaves. The rollout of 5G mobile networks in the 3.5 GHz band (C-band) has highlighted the importance of active antennas, especially Massive Multi-Input Multi-Output (MIMO) active antennas, to deliver data throughput performance in terms of capacity expansion, ultra-precise beamforming, and individual end-user throughput. Three-dimensional (3D) beamforming, which can provide steerable beams with high gain, not only improves signal coverage, but also reduces costs as subarrays require less power and high-power amplifiers are cheaper. ABI Research predicts that global mobile data traffic will reach 2,700 exabytes per year by 2025. As data traffic grows exponentially, ABI Research expects active antennas to become an increasingly important tool for communications service providers (CSPs).

The development and standardization of active antennas has been contributed by the communications industry, including original equipment manufacturers (OEMs) such as Ericsson, Huawei, Nokia, and ZTE, as well as standards and industry groups such as the Institute of Electrical and Electronics Engineers (IEEE), ITU Radiocommunications Sector (ITU-R), 5G Americas, and NGMN Alliance. Currently, based on information available from industry participants, definitions of “active antennas” vary widely. In terminology, active antennas have been variously referred to as “active base station antennas,” “active antenna systems,” “advanced antenna systems,” or simply “active antennas.” ABI Research feels that a clear definition and distinction between active and passive antennas is needed to ensure consistency of terminology and references across the industry.

what What is the difference between active and passive antennas?

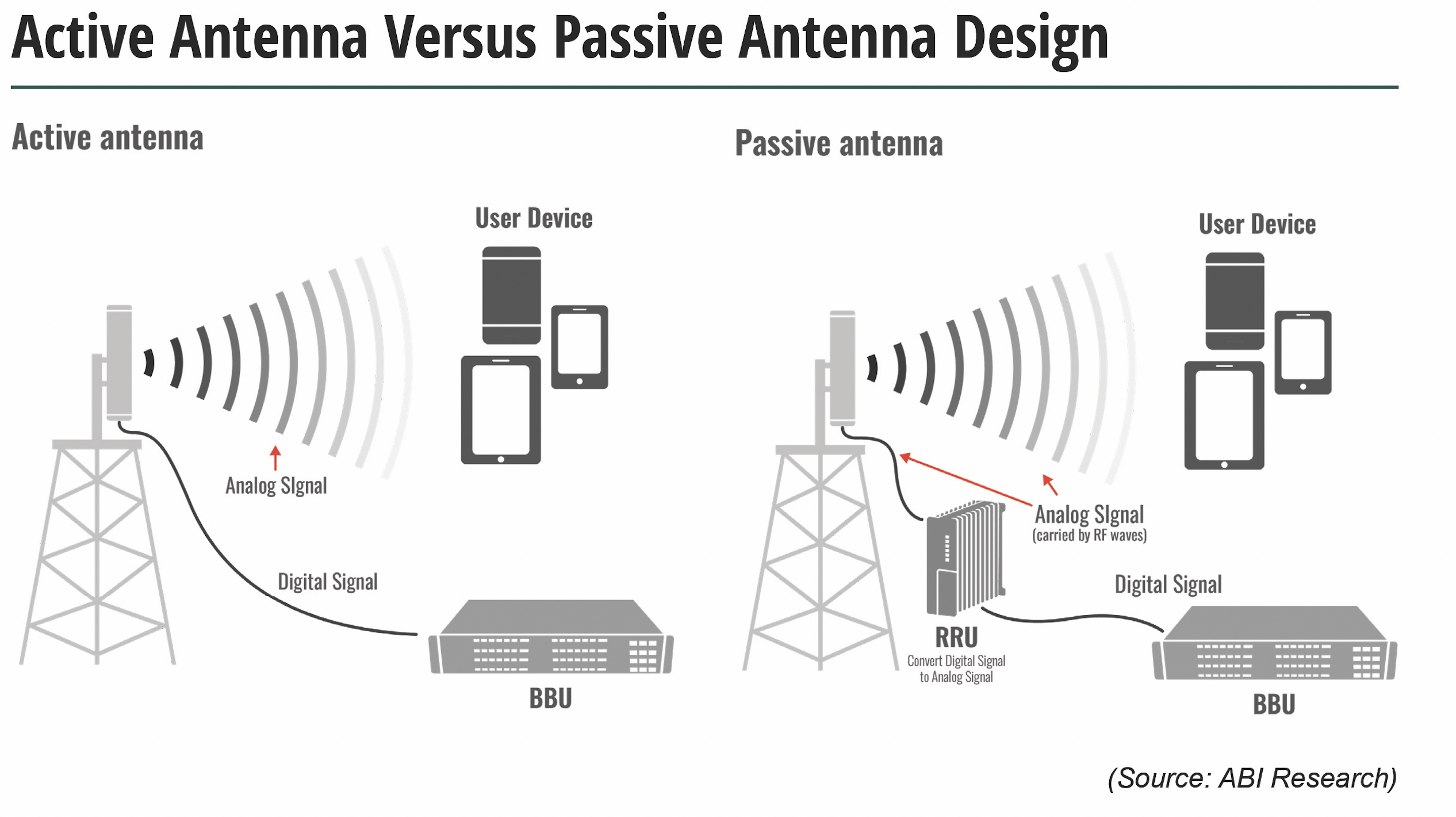

Organizations such as 5G Americas define an active antenna as “integrated radio and antenna,” while the NGMN Alliance defines an Active Antenna System (AAS) as an antenna that contains active electronic components in addition to the passive components found in a passive antenna. Reviewing the various definitions from telecom industry players, it is clear that an active antenna is an antenna that requires the integration of a passive antenna with active elements (radio unit/transceiver, amplifier, baseband, etc.). The difference between active and passive antennas becomes even clearer when analyzing vendor CSP value chains, components, and capabilities.

Value Chain

A typical base station antenna value chain involves three parties: 1) CSPs, 2) OEMs, and 3) antenna manufacturers. For passive antennas, CSPs can either purchase antennas directly from the base station antenna manufacturer and purchase the rest of the base station equipment separately, or purchase a turnkey base station solution from the OEM that includes both passive antennas and base station equipment. For active antennas, the OEM must purchase the passive antenna components from the antenna manufacturer and integrate them with their own “active” electronic radio units. As a result, CSPs can only purchase active antennas from the OEM.

component

It is also worth understanding how active and passive antennas differ based on the components inside the antenna radome. Passive Antennas By design, the Remote Radio Unit (RRU), which houses the transceiver and amplifiers (radio frequency power amplifier and low noise amplifier), is mounted separately on a tower that is connected to a passive antenna via a feeder cable and then to the baseband unit via optical fiber. Active AntennaThe RRU is integrated with passive antenna components, so the transceiver array and amplifiers are placed inside the radome. Additionally, components such as filters and shielding covers are used to minimize or prevent interference.

Figure 1: Active vs. passive antenna designs

function

Another difference between passive and active antennas is the operational functions that the antennas can perform. Active antennas can both amplify and convert radio frequency waves in addition to radiating and receiving signals. This is because the active components of the RRU are integrated with passive antennas. On the other hand, passive antennas can only radiate and receive radio frequency waves through the air interface.

In terms of deployment and implementation, passive antennas have historically been deployed in 2G, 3G, 4G and 5G in rural, suburban and urban areas. However, especially with 5G technology, active antennas are well suited for deployment in both urban and dense urban areas.

High population density, high data consumption, high throughput requirements, space constraints and challenges posed by tall buildings mean that internet penetration in the region is low.

Market Drivers and Restraints

Active antennas enable CSPs to enhance their operations through reduced operational costs due to network efficiency while at the same time ensuring optimal user experience. Apart from the benefits of active antennas, there are several market factors driving their further adoption. These include increasing access to spectrum asset bands such as the 3.5 GHz band, growing global demand for cellular data traffic, technical advantages of active antennas that provide lower latency and improved energy efficiency, massive MIMO capabilities, development of solutions to overcome physical cell site space limitations, and implementation of cost-effective and power-efficient signal processing algorithms.

However, there are some potential inhibitors to be aware of. On the technical side, the occurrence of pilot contamination can limit the throughput that can be achieved in practice and also poses challenges with regards to channel estimation. Also, interference is introduced by the large number of massive MIMO radio antennas and the various user equipments (UE) sending signals along different transmission paths. On the market side, the choice of frequency bands, the cost of active antenna products with a large number of antenna array combinations (e.g. 32T32R or 64T64R), and the technical aspects of the cell site such as physical space, power and wind load requirements are considerations that must be taken into account in the implementation of active antennas.

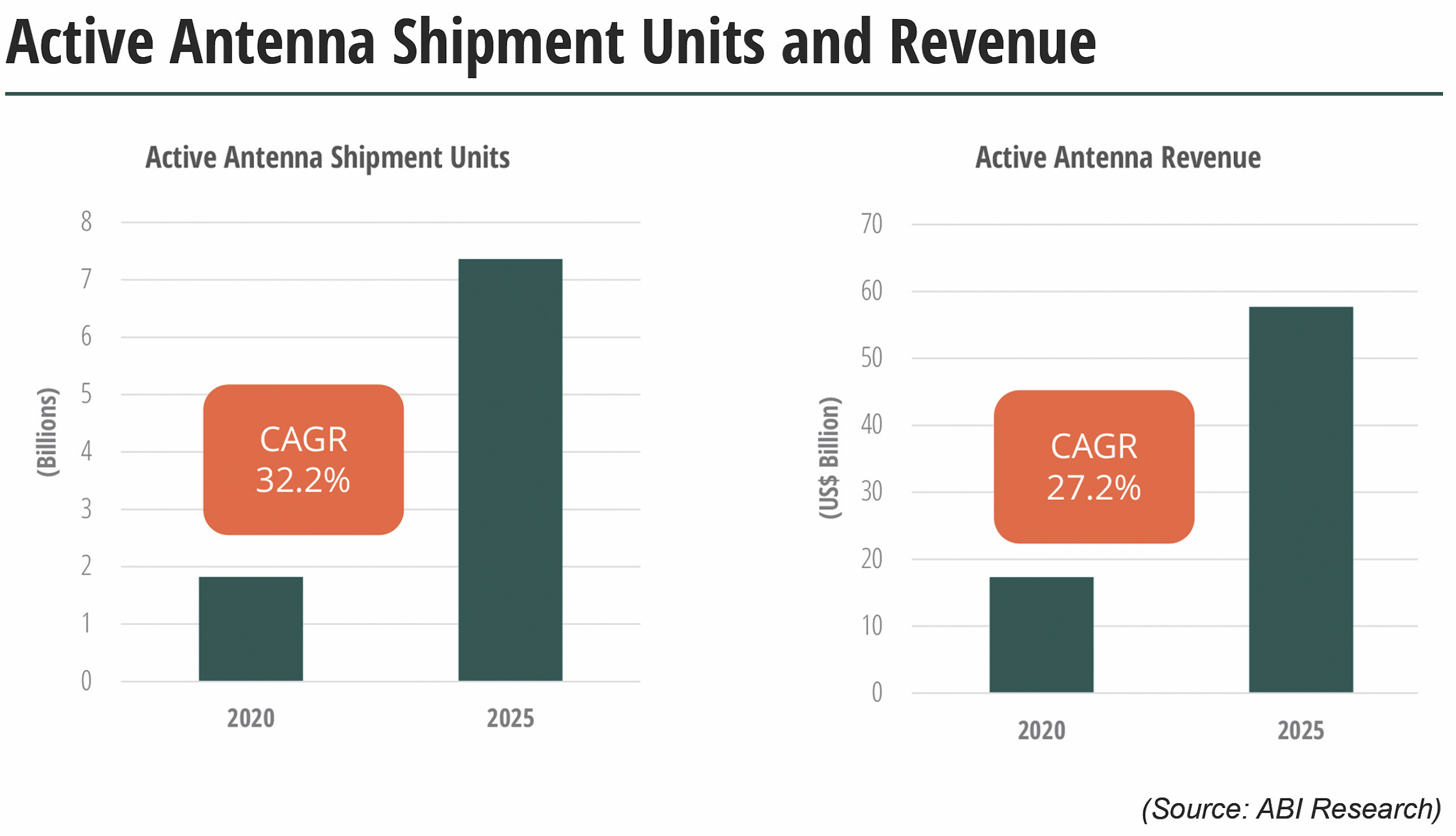

Despite technological and market impediments, active antennas, especially massive MIMO active antennas, are crucial to realizing the potential of 5G with beamforming capabilities and improving spectral efficiency. ABI Research forecasts that active antenna shipments will exceed 7.3 million units in 2025, growing at a CAGR of approximately 32.2%. Active antenna revenues are forecast to reach approximately USD 56 billion by 2025, growing at a five-year CAGR of 27.2% from 2020 to 2025. The average cost of active antennas will continue to decline, driving sales growth in the short to medium term, but sales volumes are expected to decline around 2025.

In summary, active antennas have the ability to further enhance 5G deployment and enrich customer experience. Moreover, the potential growth of the active antenna market provides opportunities for industry associations, CSPs, OEMs and other stakeholders to drive and capture that growth. However, for the telecommunications industry,Active AntennaThe difference between ” and “Passive AntennasThis will improve integration and implementation, accelerating the widespread adoption of active antennas.