Latest Earnings Report Data Image Co., Ltd. (TWSE:3168) was a disappointing result for shareholders, as the headline figures were weak but we think investors may have missed out on some positives.

See Data Image’s latest analysis

Eyes on DataImage’s revenue

Many investors are Accrual rate from cash flowBut in reality, it’s a useful metric to gauge how well a company’s profits are backed by its free cash flow (FCF) over a given period. Simply put, this ratio subtracts FCF from net income and divides that number by the company’s average operating assets over that period. This ratio tells us how much of a company’s profits are not backed by free cash flow.

As a result, negative accrual ratios are positive for a company, while positive accrual ratios are negative. While an accrual ratio greater than zero isn’t much of a problem, we think it’s worth noting if a company has a relatively high accrual ratio. In particular, there is some academic evidence suggesting that, generally speaking, a high accrual ratio is a bad sign for near-term earnings.

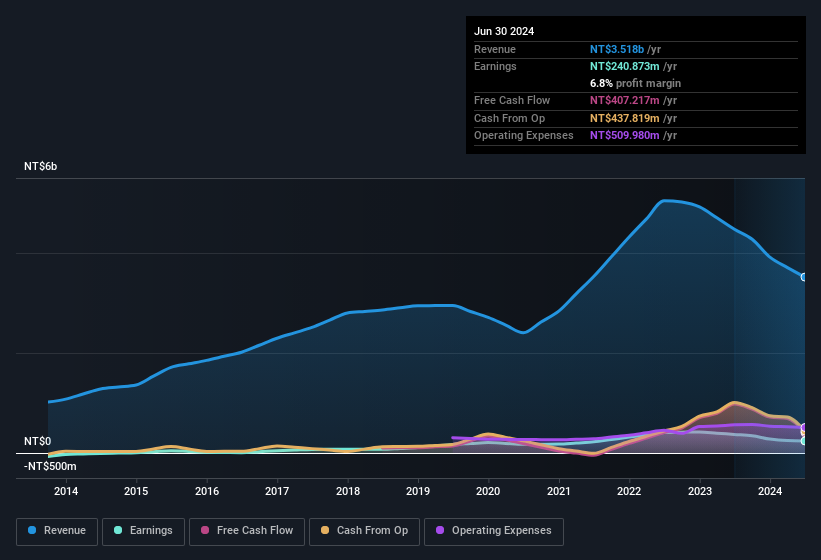

For the 12 months ending June 2024, Data Image recorded an accrual ratio of -0.14. This means that cash conversion is good, meaning that free cash flow significantly exceeded last year’s profits. In fact, for the past 12 months, the company reported free cash flow of NT$407 million, significantly exceeding its profits of NT$240.9 million. Data Image’s free cash flow decreased year-on-year, which is less than ideal and feels like an episode of The Simpsons without Groundskeeper Willie. Notably, the company issued new shares, which diluted existing shareholders’ shares and reduced their share of future profits.

Notes: Investors are always advised to check the strength of their balance sheet, and you can click here to see Data Image’s balance sheet analysis.

To understand earnings per share potential, it’s essential to consider how much a company is diluting shareholders. In fact, Data Image has increased its outstanding shares by 13% in the last 12 months by issuing new shares, resulting in a decline in earnings per share percentage. Per share metrics such as EPS help us understand how much actual shareholders are getting out of a company’s earnings, while net income levels help us get a better idea of the absolute size of a company. Click this link to see Data Image’s historical EPS growth.

How will dilution affect Data Image’s earnings per share (EPS)?

DataImage has improved its profits over the past three years, growing at an annualized rate of 8.2% over that time. Net income fell 35% last year. However, EPS results were even worse, with the company posting a 37% decline. So we can see that dilution has had some impact on shareholders.

If Data Image’s EPS were to grow over time, the chances of the share price moving in the same direction would be significantly increased. On the other hand, we probably wouldn’t be as pleased to know that profits (but not EPS) were improving. So, assuming your goal is to assess whether the company’s share price will rise, we’d say that EPS is more important than net income in the long term.

Our take on DataImage’s profit performance

In conclusion, Data Image has strong cash flow relative to its earnings, which indicates good quality earnings, but due to dilution, its earnings per share are declining faster than its profits. Taking the aforementioned into account, we think Data Image’s earnings are probably a reasonable reflection of its underlying profitability; however, we can have more confidence in our conclusions once we see clearer results. With this in mind, if you want to analyse this company further, it’s important to be aware of the risks involved. At Simply Wall St, we Two Warning Signs in Data Images And we think they are worthy of your attention.

In this article, we’ve looked at some of the factors that can undermine the usefulness of profit figures to guide a business. But there are plenty of other ways to form an opinion of a company. For example, many people consider a high return on equity to be a sign of a booming economy, while others ‘follow the money’ and look for stocks that insiders are buying. It may take a bit of digging to find out. free A collection of companies boasting high return on equity, or a list of significant insider holdings could be useful.

new: Manage your entire stock portfolio in one place

we The ultimate portfolio companion For stock investors, And it’s free.

• Connect an unlimited number of portfolios and view the totals in one currency

• Get notified of new warning signs and risks via email and mobile

• Track the fair value of your stock

Try our demo portfolio for free

Have feedback about this article? Concerns about the content? Stay in touch Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.