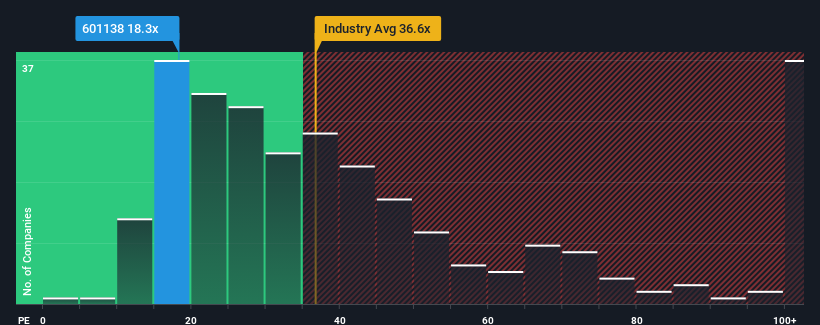

Nearly half of Chinese companies trade at a price-to-earnings ratio (or “P/E”) of 28 or more. Foxconn Industrial Internet Co., Ltd. (SHSE:601138) is an attractive investment with a P/E ratio of 18.3x, however it would be unwise to take the P/E at face value as there may be reasons why the P/E is limited.

Foxconn Industrial Internet has certainly been doing well lately, with earnings growing faster than most other companies. Many are expecting this strong earnings performance to worsen significantly, which may be keeping the P/E in check. If you’re interested in the company, you’ll hope that’s not the case, so you can buy shares while they’re out of favor.

Check out our latest analysis for Foxconn Industrial Internet

Want to know what analysts think about Foxconn Industrial Internet’s future compared to the industry? free The report is a great place to start.

Is the growth worth the low P/E?

Foxconn Industrial Internet’s P/E ratio is typical for a company that is expected to have limited growth and, importantly, underperform the market.

Looking back at revenue growth over the last year, the company recorded a respectable increase of 11%. EPS has also risen a total of 17% from three years ago, thanks in part to growth in the past 12 months. Therefore, it’s fair to say that recent revenue growth has been respectable for the company.

Turning to the outlook, analysts watching the company are predicting 15% annual growth over the next three years, while the rest of the market is expected to grow at 24% per year, which is obviously more attractive.

This information explains why Foxconn Industrial Internet’s P/E ratio is lower than the market, as many shareholders were likely uneasy about holding on while looking at a less prosperous future for the company.

Final Words

While it would be unwise to use the price-to-earnings ratio alone to decide whether or not you should sell a stock, it can be a useful indicator of a company’s future prospects.

Foxconn Industrial Internet has been found to maintain a low P/E ratio due to weaker growth forecasts, which are predictably lower than the overall market. At the moment, investors feel that the potential for earnings improvement is not great enough to justify an increase in the P/E ratio. In this climate, it is difficult to see the stock price rising significantly in the near future.

Before proceeding to the next step, 2 warning signs for Foxconn Industrial Internet What we discovered.

of course, By considering a few good candidates, you may find a great investment. Take a look at this free A list of companies trading at low P/Es and with strong growth track records.

new: AI Stock Screener and Alerts

Our new AI stock screener scans the market daily to find opportunities.

• Companies with strong dividend yields (yields of 3% or more)

• Undervalued small cap stocks due to insider buying

• Fast-growing technology and AI companies

Or you can build your own indicator from over 50 available.

Try it free now

Have feedback about this article? Concerns about the content? Stay in touch Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.