Technology stocks have delivered impressive gains for investors since the start of 2023, with share prices up 69%. Nasdaq 100 Technology Sector Stock indexes have skyrocketed during this period, and artificial intelligence (AI) has played a central role in this incredible rise.

Technology companies, large and small, are benefiting from the adoption of AI. Super Microcomputer (NASDAQ:SMCI) and Taiwan Semiconductor Manufacturing (NYSE:TSM) Both are making great strides thanks to the widespread use of AI.

But tech stocks’ surge has recently halted: The Nasdaq 100 technology sector has fallen 11% over the past month due to a variety of factors, including growing fears of a U.S. recession following a weak jobs report and worries that AI may not live up to expectations after all.

However, the recent quarterly earnings of the companies mentioned above suggest that this is not the case. These technology companies indicate that AI-related infrastructure investments remain strong, so buying shares in these AI companies following the recent market sell-off may be a good idea. Let’s see why.

TSMC stock is too attractive to miss right now

AI has given the semiconductor industry a major boost, with the AI chip market expected to register an annual growth rate of 38% over the next decade, reaching $514 billion in annual revenue in 2033. Taiwan Semiconductor Manufacturing Co. (TSMC) is one of the best ways for investors to take advantage of this opportunity.

TSMC is a foundry that makes chips for fabless semiconductor companies. NVIDIA and AmThe company also makes chips for device makers such as: appleand even Intel Although the company has its own production lines, it outsources the production of its advanced chips to TSMC, which is well positioned to benefit from the proliferation of AI in multiple markets, including data centers, smartphones and personal computers.

TSMC’s growth is accelerating thanks to strong demand for advanced chips from the aforementioned customers. The Taiwan-based foundry giant reported that its second-quarter 2024 revenue grew 33% year-over-year to $20.8 billion. This was a much faster acceleration than the 13% year-over-year increase TSMC reported in the first quarter.

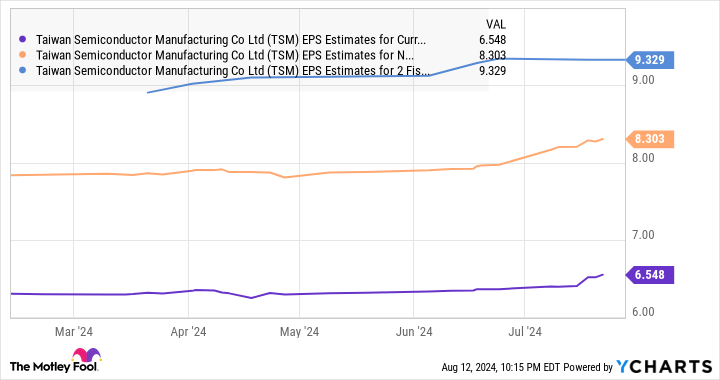

TSMC forecasts third-quarter revenue of $22.8 billion, the midpoint of its guidance range, which would represent growth of about 32% year-over-year and signal that demand for the company’s chips remains strong. As such, a 15% drop in TSMC shares over the past month represents a smart buying opportunity for investors, especially given that analysts have recently increased their revenue growth estimates for TSMC.

Also, TSMC is currently trading at 29 times its earnings over the past year, which is Nasdaq 100 The average earnings multiple for the index is 31x (using the index as a proxy for tech stocks). This AI stock has seen incredible growth and an attractive valuation, making it seem like a no-brainer to buy right now.

Demand for AI Servers Drives Incredible Growth for Supermicro

TSMC chips are being deployed in data centers to handle AI workloads, and as they need to fit into server racks, Supermicro’s products have seen huge demand over the past year.

Supermicro, which makes servers and storage solutions, has established itself in the AI server market with modular products that enable data center operators to reduce energy costs. Its revenue for the recently ended fiscal year 2024 more than doubled to $14.9 billion from $7.1 billion the previous fiscal year.

However, Supermicro’s shares fell 20% in one session after the earnings report as lower margins caused the company to miss Wall Street profit expectations. The company is investing aggressively to boost production capacity to meet surging demand for AI servers, which is exactly why its non-GAAP gross margins fell to 14.2% in fiscal 2024 from 18.1% last year.

The company is expanding manufacturing capacity at multiple locations around the world to ramp up production of liquid-cooled servers, which are gaining traction in AI data centers to reduce power consumption and improve performance. Mordor Intelligence predicts that liquid-cooled data centers could see annual growth of 23% through 2029.

So Supermicro is right to focus on expanding capacity now, as it should be able to grab a bigger share of this fast-growing opportunity. Moreover, the overall AI server market is expected to grow 30% annually through 2033, meaning Supermicro is growing much faster than the sector.

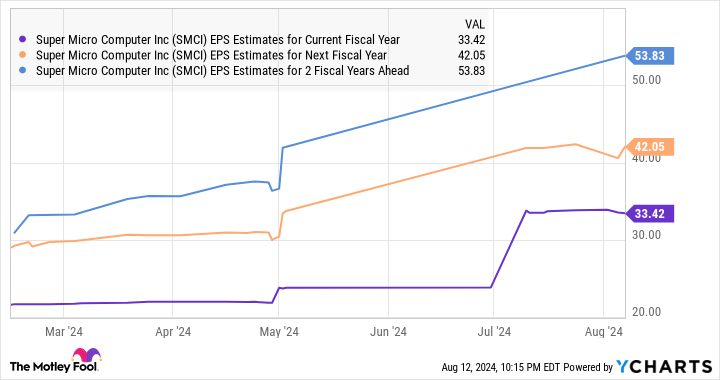

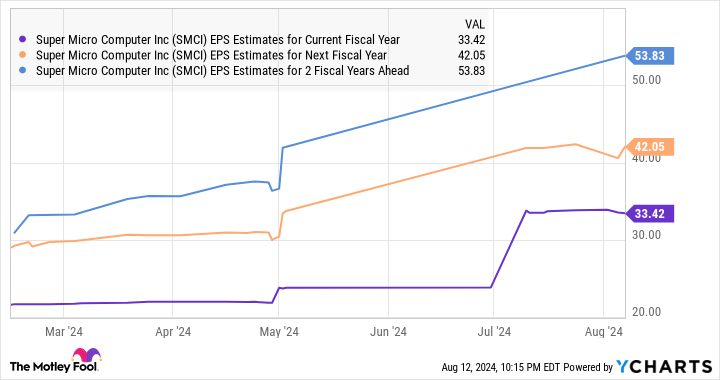

This suggests the company is gaining market share in AI servers, which is why sacrificing margins in the short term seems right given the long-term opportunity. Supermicro’s management believes margins will return to normal ranges by the end of fiscal 2025. Analysts remain bullish on the company’s bottom-line growth outlook following an 87% increase in earnings to $22.09 per share in fiscal 2024.

Most importantly, Supermicro’s stock is currently trading at 24 times its past year earnings and 13 times its forward earnings, a significant discount to the Nasdaq 100 Index. Investors should consider adding this fast-growing company to their portfolios while the stock remains undervalued.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before buying Taiwan Semiconductor Manufacturing shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now: Taiwan Semiconductor Manufacturing Co. Ltd. was not included. The 10 stocks selected have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $763,374.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of August 12, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends buying Intel’s January 2025 $45 calls and selling Intel’s August 2024 $35 calls. The Motley Fool has a disclosure policy.

Stock Market Offering: The Best Artificial Intelligence (AI) Growth Stocks to Buy Now was originally published by The Motley Fool.