Max Lab

Following reports that the Japanese economy showed a bright recovery in the second quarter, preliminary PMI survey results for August will be eagerly assessed for clues as to whether the economy can overcome headwinds to growth.

return growth

Japan’s economy performed well in the second quarter, according to official data, confirming recent strong survey data. Initial estimates from the Cabinet Office showed gross domestic product grew 0.8% in the three months to June. The expansion is welcome news after official data showed GDP fell 0.6% in the first quarter.

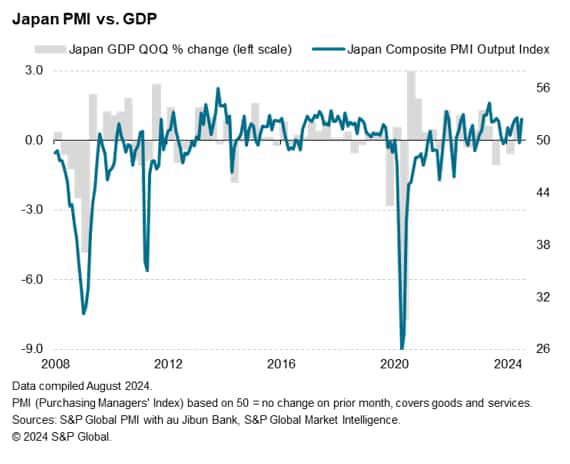

The second-quarter improvement was signaled ahead of time by the au Jibun Bank PMI survey compiled by S&P Global, which suggested output rose in the five months to May. The survey’s headline index, which covers production of goods and services, was unchanged in June but rose in the second quarter. The quarterly average was a solid 51.5, compared with the survey’s long-term average of 49.2. An index above 50 indicates expanding production.

Encouragingly, the index recovered from 49.7 in June to 52.5 in July, indicating that Japan’s economy is off to a strong start in the third quarter.

Headwinds intensify

Whether this recent improvement in growth will be sustained in the coming months remains unclear. Although the July PMI survey showed positive signs, with new order growth picking up and employment growth and future business prospects also improving, the Japanese economy certainly faces challenges in the near term.

First, Japan has experienced a surge in financial market volatility in recent weeks, creating increased uncertainty among investors, borrowers and savers.

Second, political uncertainty has arisen following Prime Minister Kushida’s surprise announcement that he will not seek re-election.

Third, the slowdown in global trade has hit Japan’s open-minded manufacturing economy, with merchandise exports falling for the 29th consecutive month and the economy relying on the services sector to maintain growth.

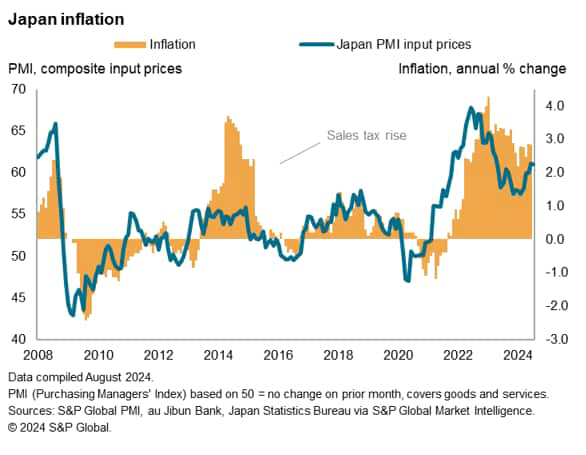

Fourth, even as the yen remains at a historically low level, goods exports are declining and import costs are rising, resulting in inflation of 2.8%, still high by Japan’s historical standards.

Those rising costs and currency worries prompted the Bank of Japan to tighten monetary policy, raising interest rates to a post-financial crisis high of about 0.25% in August. The hike came after policymakers ended Japan’s negative interest rate regime in March.

Higher interest rates are typically designed to support the currency and stifle domestic demand, acting as an additional brake on exports and domestic spending, respectively.

How Japan will weather these headwinds will become clear in the release of preliminary PMI data on August 22. The preliminary PMI will be particularly closely watched for insights into the performance of the manufacturing sector (including exports in particular) and clues about the resilience of foreign tourist spending, especially consumer spending, which has supported the Japanese economy amid the weak yen. Finally, price data will also provide a sharp assessment of future inflation trends.

Original Post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.