Following the massive data breaches that targeted AT&T and Ticketmaster this year, a new cyberattack has compromised the personal information of countless more Americans.

National Public Data, a background check company owned by Jericho Pictures, has been the victim of two cyber attacks this year, with the first occurring in April, the company said in a statement on its website. It should be noted that the NPD website is blocked on some browsers as an added layer of security.

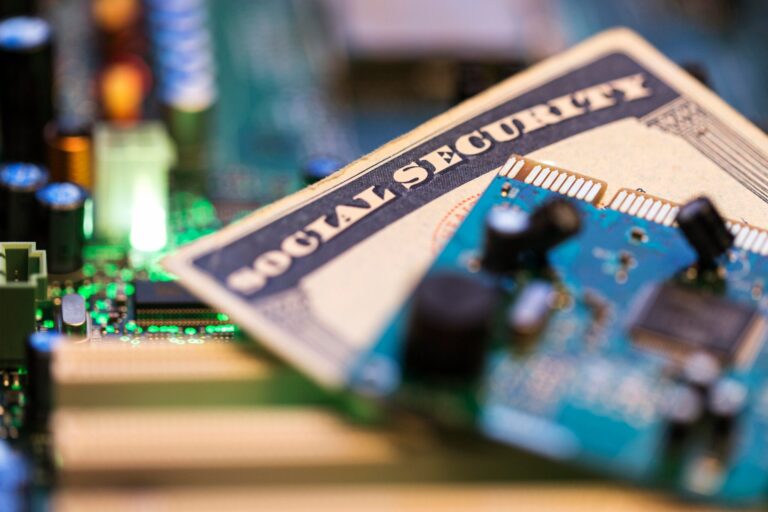

The data stolen by the hackers includes names, Social Security numbers, phone numbers, email addresses, and mailing addresses, but NPD has not disclosed how many people were affected by the breach.

“We have cooperated with law enforcement and government investigators to conduct an investigation into any records that may have been affected, and will notify you of any significant developments that concern our customers in the future,” NPD said. “We have also implemented additional security measures to prevent a recurrence of such a breach and to protect our systems.”

The number of affected Americans could reach 2.9 billion, according to a new lawsuit filed in the U.S. District Court for the District of South Florida. The lawsuit, which seeks class-action status, claims that the stolen data was then offered for sale on the dark web by the USDoD cybercrime group for $3.5 million.

NPD’s public statement about the breach comes after nearly two weeks of relative silence amid numerous media reports. The plaintiff in the aforementioned lawsuit, a California resident, said he learned of NPD’s breach on July 24 after receiving a notice from an identity theft protection service.

National Public Data and Jericho Pictures Inc. did not respond to multiple requests for comment from CNET.

How to protect your personal information after a data breach

Data breaches are becoming more frequent: According to the Identity Theft Resource Center, more than 1,500 data breaches will occur in the first half of 2024, affecting nearly one billion people. If you’re concerned about this latest data breach or simply want to protect your personal data, there are steps you can take.

Remember, just because your data is compromised in a data breach doesn’t mean your personal information is stolen, but it does give bad actors a more detailed profile of you if you end up being a target.

Luckily, there are many things you can do to protect your identity.

change password

If you receive notification that your data has been compromised in a breach, you should first change the passwords for any affected accounts to prevent unauthorized access. If you use the same passwords for other accounts, we recommend updating those passwords as well.

A good rule of thumb is to use a unique password for each of your online accounts, and if you find this difficult to manage, use a password manager to keep your passwords safe.

Beware of phishing and smishing attempts

Beware of targeted phishing and smishing attacks by cybercriminals trying to steal your personal information. With so much information about us available online and on social media, cybercriminals have gotten very good at devising effective scam plans to trick their victims.

It is important not to click on random links on your phone or in emails, as this could download malicious software onto your device.

Additionally, you should never give out your financial account information or social security number to anyone, as this could lead to unauthorized access to your bank account or identity theft.

Sign up for identity theft protection

If you’re really worried about your identity being stolen, it might be worth signing up for identity theft protection. Individual coverage runs from $7 to $15 a month, and family plans are available.

Services like Aura, CNET’s top identity theft protection service, scan the dark web for your personal data and monitor your credit and bank account activity. If your identity is stolen, top identity theft protection companies can help you recover it and provide insurance to cover stolen funds and necessary expenses.

aura

CNET’s Top Overall Identity Theft Protection Service

Freeze credit

Freezing your credit with Equifax, Experian, and TransUnion is the best way to prevent bad actors from opening new credit accounts in your name. I just froze my credit and the process was surprisingly easy. You’ll need to unfreeze your credit any time you apply for a new credit card or car loan, but in our opinion, the benefits outweigh any drawbacks.

Note that this isn’t a perfect solution, as cybercriminals will still have access to your existing credit and bank accounts, but freezing your credit is free.

Keep an eye on your credit report

If you don’t freeze your credit report, you can still download your credit report for free each week from the three major credit bureaus. Be sure to monitor your credit profile for any new accounts you haven’t opened. You can download your free credit report here:

You can also sign up for a credit monitoring service that will notify you when new accounts are opened in your name: CNET Money editor Evan Zimmer recommends Experian’s credit monitoring service, which costs between $0 and $25 per month.

It’s also important to get into the habit of checking your bank statements for any unauthorized charges.