The stocks known as the Magnificent Seven, named after the 1960 Western movie, helped the S&P 500 recover from bear market lows and enter bull territory. All of these industry leaders are involved in technology in some way, and also offer investors exposure to the high-growth field of artificial intelligence (AI). These players do some or all of the following: developing AI, using it to improve their own operations, and selling AI tools to customers.

However, you don’t have to buy all of the Magnificent Seven’s shares to benefit. By acquiring shares in just a few of these companies, you can invest in companies that have already proven their ability to grow profits over time and have what it takes to win in the potential AI revolution. can be accessed. Even better, you don’t need a lot of money to invest in these promising AI stocks. In fact, you can buy the top two stocks in Magnificent Seven AI for less than $500. This is a stock you want to hold for a long time.

1.Amazon

Amazon (NASDAQ:AMZN) is a giant in e-commerce and cloud computing, two high-growth sectors that have helped the company generate billions of dollars in revenue in recent years. The company’s dominance in these markets will continue as it invests in key areas to support growth.

For example, in e-commerce, Amazon recently reached an all-time record for delivery times and aims to make them even faster. And in the cloud, Amazon Web Services (AWS) has made significant investments in technology infrastructure to expand its services.

That all sounds good, but Amazon’s focus on AI puts it into perspective even brighter. The company uses this technology across its e-commerce business to streamline operations and better serve customers. This should reduce costs, bring back shoppers, and increase revenue over time.

And AWS offers customers a huge menu of AI products and services, from access to top chips and power platforms to fully managed services that let you customize existing language models at scale. These efforts should also improve profitability in the long term.

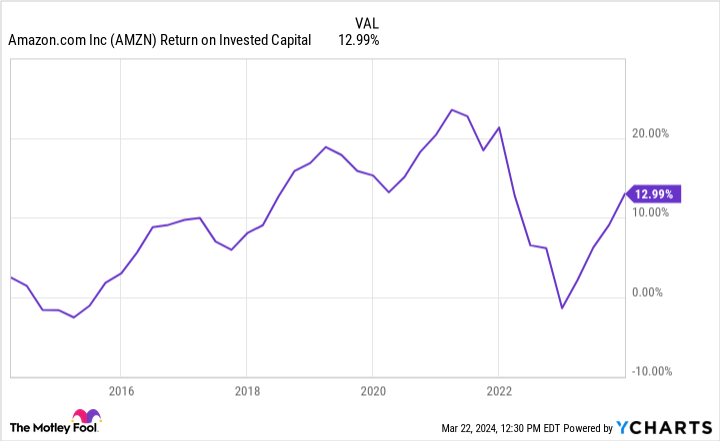

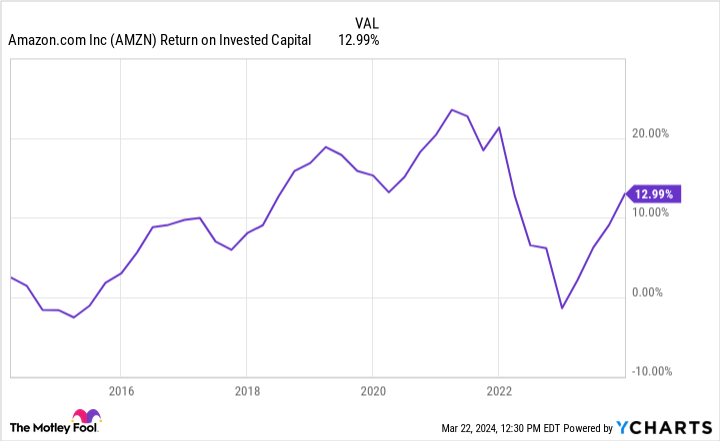

Amazon has a long-term track record of increasing return on invested capital (ROIC), indicating that the company has been making smart investment decisions. Therefore, there is reason to believe that this trend may continue.

AMZN Return on Invested Capital Data by YCharts

And the story includes about 42 times forward earnings, a deal that takes into account Amazon’s strengths in both e-commerce and cloud, as well as its long-term AI prospects.

2. Alphabet

alphabet (NASDAQ:GOOG) (NASDAQ:Google) is another leader in this field. The company is the parent company of search engine Google, which always holds more than 90% of the world search market. And it’s very likely that Google will maintain its position well into the future.

why? That’s because it’s part of most people’s daily routine and has entered our vocabulary. If you don’t know the answer to a question, “Google it.” So as long as Google continues to produce great search results, it should have an advantage.

But Alphabet is doing something to truly ensure search quality and maintain market share. The company is investing in his AI. Alphabet’s Search Generative Experience is available in certain countries and already speeds up searches and provides a wider range of links and answers to questions.

Alphabet makes most of its revenue from advertising on the Google search platform, so having an edge in search is critical. If advertisers continue to perceive that most people support Google, they will continue to spend money there, and if AI makes her Google searches even better, advertisers will Might even increase her Google ad spend.

But Alphabet doesn’t stop there. The company recently announced its most powerful AI model to date, Gemini, and is applying it across its products and services. The tech powerhouse may be a smaller company than Amazon when it comes to cloud services, but Google Cloud has been experiencing strong growth, with double-digit growth in the most recent quarter. And the provision of AI tools could help maintain that steady pace of growth.

All of this means that Alphabet looks very cheap at 22 times forward earnings and could be a winning AI stock for you in the long run.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Adria Cimino has a position at her Amazon. The Motley Fool has positions in and recommends Alphabet and Amazon. The Motley Fool has a disclosure policy.

2 Top ‘Magnificent Seven’ Artificial Intelligence (AI) Stocks to Buy for $500 and Hold for the Long Term was originally published by The Motley Fool.