Nvidia (NVDA 1.29%) It attracted a lot of attention at the company’s annual GPU Technology Conference (GTC), which has been called the “Woodstock of artificial intelligence (AI).” CEO Jensen Huang introduced the much-anticipated Blackwell architecture in Monday’s keynote. He called the new flagship processor, the GB200 Grace Blackwell Superchip, “the world’s most powerful chip” for AI.

Beyond industry-leading technical specs, Tuesday’s revelations are seen as a blow to rivals Advanced Micro Devices (AMD -1.99%) And it could seriously hinder the company’s AI goals.

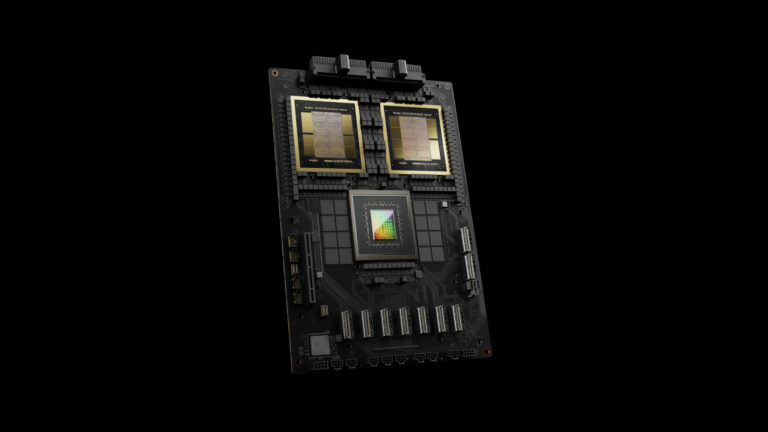

GB200 Grace Blackwell Super Chip. Image source: Nvidia.

“The world’s most powerful chip” for AI

Nvidia’s Blackwell architecture had high expectations, and the company did not disappoint. The Blackwell graphics processing unit (GPU) boasts his 208 billion transistors, up from his 80 billion in the previous generation. The GB200 combines Grace Hopper’s CPU (central processing unit) with his two B200 Tensor Core GPUs, and an ultra-fast chip-to-chip link to form a “single integrated GPU.”

Nvidia also announced the GB200 NVL72, a “multi-node liquid-cooled rack-scale system that combines 36 Grace Blackwell superchips, including 72 Blackwell GPUs and 36 Grace CPUs interconnected with 5th generation NVLink” . The company says its rack-scale systems deliver up to 30 times more performance while reducing energy consumption by 25 times.

The technical capabilities of Blackwell processors alone will make life harder for AMD, but Nvidia is going even further to outperform its competitors.

long-time rivals

There’s a long-standing rivalry between Nvidia and AMD, with the two companies historically competing for dominance in the GPU space. For example, at an event to unveil its Instinct MI300X AI chip in early December, AMD showed that its flagship processor outperformed its closest competitor, Nvidia’s year-old H100, using a variety of benchmarks. You went to great lengths to show that you performed well.

Shortly after, Nvidia deleted a blog post disputing this claim, pointing out that AMD intentionally did not use Nvidia’s optimized software, which skewed the results in AMD’s favor. Nvidia said the H100 is “2x faster” when properly benchmarked.

One area where competitors have not competed so far is price. Despite AMD’s protests to the contrary, Nvidia has long been recognized as the industry leader, even though AMD’s equivalent chips are much cheaper. According to a report published last month, AMD’s top-of-the-line MI300X chips cost between $10,000 and $15,000 each, while Nvidia’s H100 sells for as much as $40,000. The company’s pricing power has been proven.

Is Nvidia going for the throat?

In an interview with CNBC, Huang revealed that Blackwell GPUs, which are scheduled to ship later this year, will cost between $30,000 and $40,000, suggesting that the next-generation processors will be priced the same as current processors or at a slight premium. suggested that it would be. H100.

Nvidia’s aggressive pricing strategy came as a surprise to analysts covering the stock. Morgan Stanley analyst Joseph Moore said NVIDIA is pricing its new Blackwell chips “at a more competitive price point than we previously expected.” [which will] Perhaps enthusiasm for Nvidia’s alternatives, both commercial and custom silicon, could cool down. ”

“The more conservative pricing[of Nvidia’s Blackwell GPUs]was perceived as a positive for[Nvidia]stock, with large capex focused on the cloud,” said Jordan Klein, an analyst at Mizuho Securities. “It opens the door for more customers to buy, rather than just one.” Hyperscalers and wealthy sovereign states. ”

This pricing will give new and existing customers another reason to choose Nvidia over AMD, as the price differential is narrowing.

Will this be another nail in AMD’s coffin?

To be clear, AMD has established itself as a worthy, if somewhat distant, competitor. Nvidia’s latest processors, as well as its aggressive pricing policy, are sure to raise deposits. It is possible that Nvidia will expand its already dominant market share in the AI field, or it may keep its rivals at bay for a while.

These moves would certainly put AMD at a disadvantage, but it’s unlikely that AMD will be going anywhere anytime soon.