Arthit Ronwirai

I hypothesize that recent speculation that the Fed will become more hawkish is based on primary data and that more detailed data still points to a rate cut in June.

Headline CPI data

March 12ththpublished by the Bureau of Labor Statistics.

Consumer Price Index (CPI) Report.

Inflation was slightly higher than market expectations and exceeded the Fed’s 2% target.

“The Consumer Price Index for urban consumers (CPI-U) rose a seasonally adjusted 0.4% in February, after rising 0.3% in January, the U.S. Bureau of Labor Statistics announced today. Over the past 12 months, the All-Item Index rose 3.2% on a seasonally unadjusted basis.”

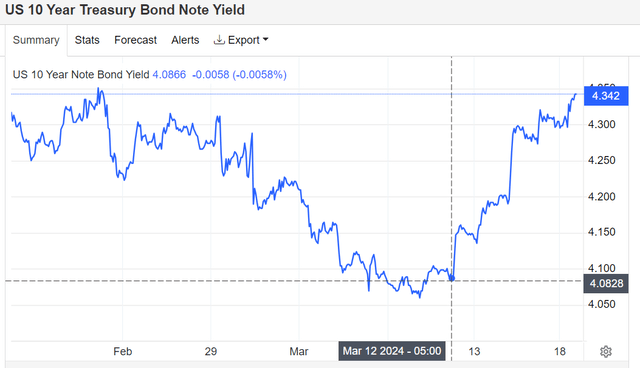

The numbers led the market to think that the Fed might be cutting rates slower than expected, and perhaps less often than expected. According to market expectations, the possibility of a March interest rate cut has almost disappeared, and the possibility of a June interest rate cut has fallen to just over 50%. As a result, the 10-year US Treasury yield (US10Y) jumped from just 4.08% before the news to over 4.3%.

trade economics

That’s quite a reaction, and from a headline standpoint, I can understand that. Inflation had been on the decline, but the latest announcement showed it was on the rise again, raising concerns that more measures are needed to curb inflation.

The Fed stirred up a bit of market anxiety by adding some hawkishness to its usually vague comments.

However, I still think a June rate cut is the most likely outcome for the following reasons.

- Key CPI numbers are inflated compared to actual inflation

- The Fed’s comments may simply be using a third lever.

The true inflation rate is much lower than the headlines

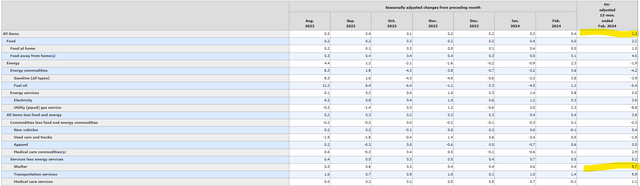

Below is a breakdown of inflation as published by the Bureau of Labor Statistics.

BLS

The headline 3.2% is actually a combination of other factors, each weighted according to what portion of consumer spending it accounts for.

Food and energy are often left out when discussing inflation because their prices don’t fluctuate as much with inflation as they do with certain commodity cycles. Therefore, they are considered a noise factor.

Shelters make up the largest portion of the remaining bucket, accounting for about a third of their weight in the overall CPI. The inflation rate for shelters was 5.7%, and their high weight significantly pushed up the overall inflation rate.

This 5.7% figure is the result of a very slow measurement method. Here’s how BLS describes the measurements:

“The rent component of the official CPI measures all rent changes, including new leases, renewals, and rents under lease.”

Renewals almost always tend to be rolled up from the initial rent because landlords know they will incur significant moving costs if the tenant moves out. Therefore, renewal fees can be hundreds of dollars more per month than the asking rent. Currently, the spread between asking rent and renewal is particularly wide.

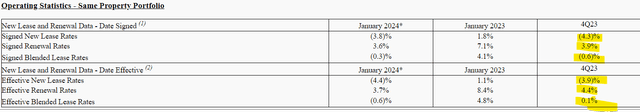

Data on this is readily available as Apartment REIT provides it in its earnings release. Camden Property Trust (CPT) represents a large sample of large apartment owners and their data includes:

CPT

New leases signed decreased by 4.3%.

However, BLS data looks at renewals in addition to active leases, so it primarily measures what happened six months to a year ago, rather than what’s happening now. . So the BLS data still shows this.

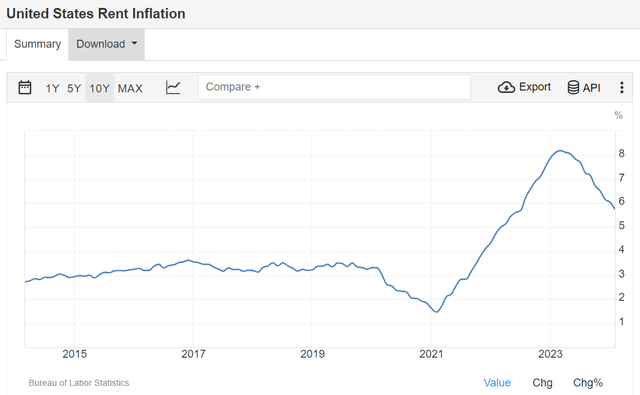

trade economics

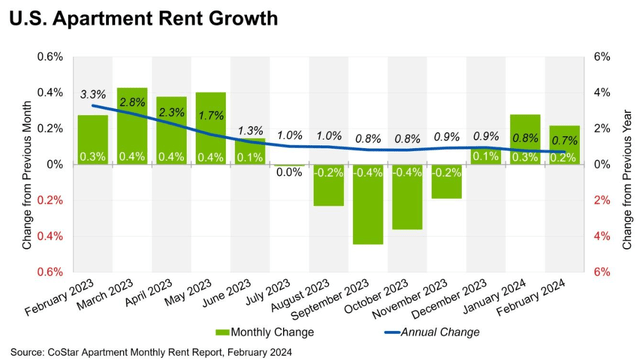

To illustrate that CPT’s data is not an anomaly, here’s national data from Apartments.com.

Co-star

In fact, rents are almost flat.

A year ago, it was up about 5.7%, which the inflation data shows, but that has nothing to do with today’s inflation.

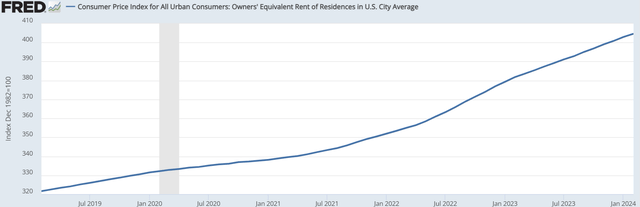

Another important piece of data the Fed looks at regarding shelter inflation is the equivalent rent of homeowners.

Rent for homeowners is also delayed.

Equivalent rents for homeowners continued to rise through January, according to FRED data.

fred

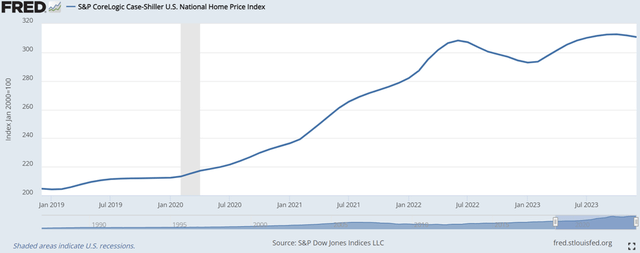

However, actual house prices only really spiked by mid-2022, and have since bounced back, resulting in net prices remaining roughly flat.

fred

Therefore, the headline inflation rate appeared to be much higher than it actually was, as the shelter component weighed heavily at 32% at 5.7%, even though actual shelter costs remained roughly the same. is our conclusion.

Adjusting for delays in shelter-in-place recommendations, actual inflation appears to be much closer to the Fed’s 2% target, paving the way for a rate cut in June.

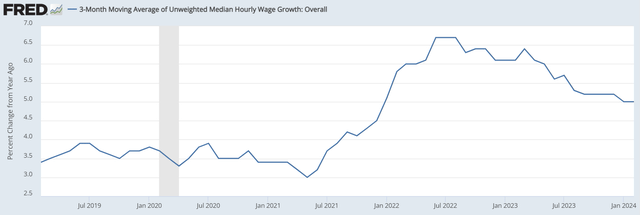

What about wages?

The persistence of wage inflation is also a concern, as it could fuel long-term inflation. Jay Powell (Fed Chairman) has stated multiple times that he is closely monitoring this factor.

BLS numbers show that wage inflation is declining, but still at a moderately high level of about 5%.

fred

Wage growth itself is only part of the equation and does not represent inflation. If a worker produces twice as much as he does and receives twice as much wages, the inflation rate will be 0% for him. In other words, the cost of production due to labor input remains unchanged.

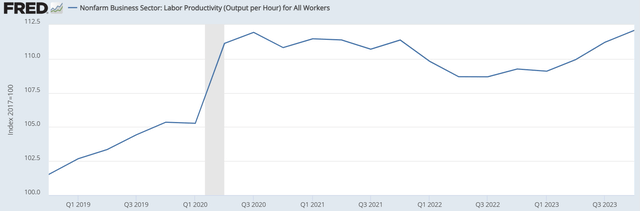

Therefore, we need to compare wage growth with productivity growth, as shown in the graph below.

fred

There are two major events that skew the graph above.

- Firing low-wage workers during the pandemic

- Low-wage workers will be rehired from the end of 2021 to the beginning of 2022.

Because low-wage and part-time workers are, on average, less productive per hour, the events described above will cause average productivity to spike during the pandemic, and once those workers are rehired, average productivity will drop. It has decreased.

On an equal-worker basis, which is how wages are measured, productivity has increased very significantly over the last few years. Offsetting productivity gains will keep wage inflation well within a healthy range.

I think that with the above adjustments, inflation appears to be fairly contained and should allow the Fed to cut rates. The remaining problem is the Fed’s hawkish statements.

Jaw bone removal?

So the Fed has two main tools to influence the economy.

- Changes in the federal funds rate

- Quantitative easing or tightening?

These are fairly dull instruments and have a very delayed impact. Therefore, the Fed often implements its three policies.rd Unofficial tools:

- Jaw bone removal.

Simply commenting on the economy or the Fed’s future plans can provoke reactions that actually affect the economy. Unlike other tools, jaw-breaking has immediate consequences, as seen by the spike in 10-year Treasury yields every time Mr. Powell says something hawkish.

This tool is faster and requires less commitment, so it makes sense for the Fed to use it to fine-tune policy.

I am confident that Mr. Powell and other members of the Fed are already well aware of the complexities and delays in CPI and wages discussed in this article. However, it is at their discretion whether to discuss their understanding of CPI delays.

The headline numbers remain a bit alarming, with the Fed signaling a final bit of tightening into the economy, giving further confidence that rate cuts won’t reignite inflation.

No one knows if that’s what they’re doing. I think so, but I can’t read Mr. Powell’s mind. The important point here is that hawkish rhetoric does not necessarily lead to hawkish policies. Developing a more neutral or dovish policy may be difficult.

Interest rates are notoriously difficult to predict, but the underlying nuances of the CPI data mean a rate cut in June or July is very likely.