AI stocks are all the rage these days. And one of the hottest stocks in the hot AI sector so far this year is Soundhound AI (NASDAQ:SOUN)is a Santa Clara, California-based company that develops AI solutions for voice applications that can be used in television, the Internet of Things, and customer service.

In early February alone, SoundHound’s stock price soared 420%. Moreover, SoundHound achieved these profits even though he missed out on revenue at the end of February. How did that happen?

Now, even though SoundHound missed out on revenue, it still had a lot of good news to report. Full-year sales in 2023 increased by 47%, gross profit margin increased by 6% compared to 2022, and helped cut losses per share by almost half to $0.40. did. SoundHound’s fourth quarter performance was particularly strong, with sales growth accelerating to 80% and gross profit margin increasing again by 6 percentage points, but ending up at 77%, with gross profit margin for the year 2 points higher.

Oh, and its fourth-quarter loss was more than half that year-over-year, to just $0.07 per share.

Numbers like this are bound to grab attention on Wall Street, and in the case of SoundHound, that’s exactly what it did. A few weeks after the earnings call, SoundHound sat down with DA Davidson’s Gil Luria, a 5-star analyst ranked in the top 4% of equity experts on the Street.

So what do you need to know about it?

As Luria explains, SoundHound has a “three pillar” strategy to grow its business. So there are three major revenue streams coming in. The first is a royalty payment for each technology unit (car, television, etc.) that utilizes SoundHound’s voice AI capabilities. SoundHound owns 25% of this market, and these royalties currently make up 90% of its revenue base.

SoundHound’s second pillar, or revenue stream, is businesses that pay a subscription fee to access SoundHound voice AI capabilities. The company cited restaurant chains White Castle and Jersey Mikes as two customers using SoundHound to enhance drive-thru ordering. Last year, he said, these voice AI subscriptions accounted for less than 10% of his SoundHound revenue base, but the company expects that percentage to more than double in the short term (just kidding). ).

And finally, SoundHound is working to build a third revenue pillar by tying together the first two. Essentially, the company wants to use voice AI to allow restaurant customers to place drive-thru orders directly to their customers before they even arrive at the restaurant. The company’s acquisition of SNYQ3 Restaurant Solutions, announced in December 2023, will accelerate the growth of this latest pillar through its existing relationships with 10,000 restaurants nationwide, “including Chipotles nationwide.” (emphasis added).

Ultimately, SoundHound expects each of these three pillars to grow into a more than $1 billion business, at which point each will represent approximately 33% of the company’s revenue stream. That’s quite a jump from SoundHound’s current $46 million in annual sales. Businesses derive 90% of their revenue from Pillar 1 alone.

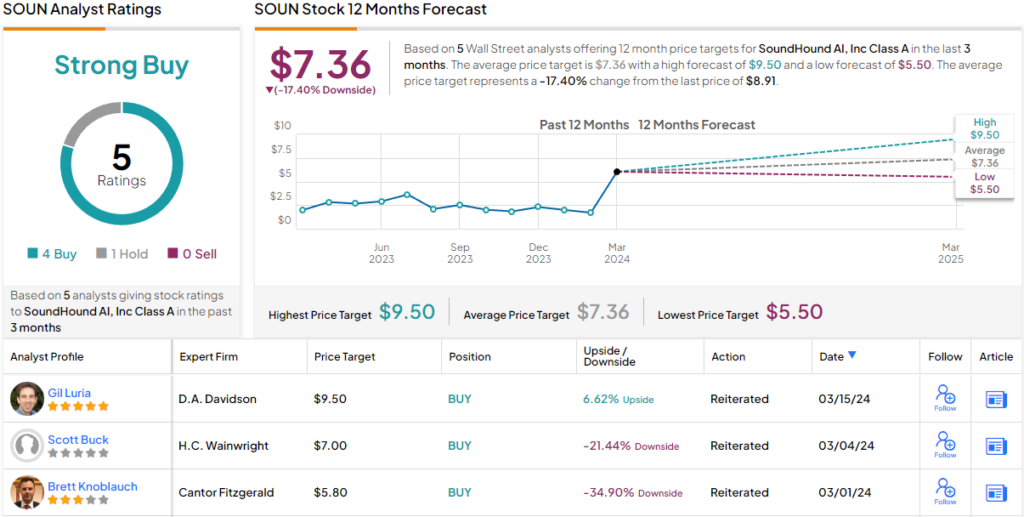

Looking ahead to that day, Luria recommends investors “buy” Soundhound stock, which he values at $9.50 per share. (Click here to see Luria’s track record)

This is Prosecutor Davidson’s view, but what does the rest of the Street think? The current outlook poses a conundrum. On the other hand, the stock has a Strong Buy consensus rating, based on 4 Buy ratings and only 1 Hold. But analysts expect the stock to cool after soaring this year, with a 17% drop expected in the coming months.

It will be interesting to see if analysts raise their price targets to match SOUN’s continued rise. (look SOUN stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.