Global data center colocation market

DUBLIN, March 15, 2024 (Globe Newswire) — The Global Data Center Colocation Market – Outlook and Forecast 2023-2028 report has been added. ResearchAndMarkets.com Recruitment.

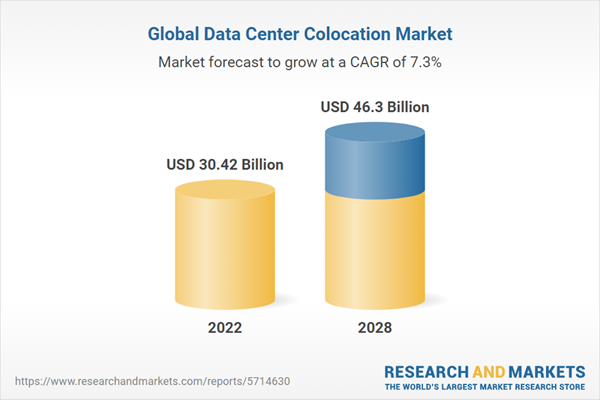

The data center colocation market was valued at USD 30.42 billion in 2022 and is projected to reach USD 46.3 billion in 2028, growing at a CAGR of 7.25% from 2022 to 2028.

The European data center colocation market is attracting significant investment, with Western Europe attracting the attention of global operators looking to expand their presence. Moreover, favorable policies make Scandinavia an attractive investment location. Countries contributing primarily to green data center development in Latin America include Brazil, Chile, Argentina, and Paraguay. Data center operators and governments in these countries are working to introduce renewable energy and other measures.

In Central and Eastern Europe, data center operators are securing land for new facilities or reusing existing buildings to meet growing infrastructure demands. In 2022, more than $450 million was invested in Central and Eastern European countries.

The UAE and Saudi Arabia are major contributors to power capacity in the Middle East and Africa region, with shares of around 24% and 16%, respectively. The data center colocation market in these countries is expected to grow rapidly in four to five years due to the transition from an oil economy to a digital economy. Additionally, South Africa is a major contributor to Africa’s electricity capacity, accounting for over 60% share. Nigeria and Kenya follow. Cloud-based services, smart city development, and fiber connectivity are also drivers of continued colocation data center investment across the region.

The Middle East and Africa market continues to grow in terms of connectivity with the introduction of new submarine cables such as Africa-1, 2Africa, India Europe Xpress (IEX), Raman, Saudi Vision, Blue, Equiano, Medusa submarine cable systems and SeaMeWe. is growing to. – 6, the service will be ready during the forecast period.

Data centers in the Middle East and Africa region are investing in cooling infrastructure due to the prevalence of high temperatures in some countries. In 2022, cooling systems accounted for more than 65% of the total mechanical infrastructure.

Key market trends

Growing focus on sustainability

-

Companies in the global data center colocation market are focusing on using renewable energy as their primary power source. Telecom operators plan to use clean energy solutions to reduce environmental damage. This change is part of a larger industry trend to incorporate renewable energy such as solar and wind power to operate data centers and other infrastructure.

5G deployment increases demand for edge data centers

-

The introduction of 5G networks has facilitated digital transformation, the growth of IoT and smart cities, and the fourth industrial revolution. All regions are working to implement digital transformation to attract foreign investment.

-

Rapid investment in 5G technology has increased demand for high-bandwidth internet and massive data volumes in tier 2 and tier 3 cities. These factors have accelerated the development of data centers that process information on par with those in major countries, supporting the growth of the data center colocation market.

-

The deployment of 5G services is impacting the ICT, government, manufacturing, services, agriculture, and retail industries. 5G network services will play a key role in supporting the digitalization of enterprises, thereby driving the adoption of IoT applications.

Implementation of advanced IT infrastructure in data centers

-

Data centers house servers, networks, and storage solutions. Traditional IT infrastructure is constantly impacting the data center industry as it requires more physical space, is more expensive, and as a result reduces demand.

-

Converged infrastructure is a hardware platform that is delivered as an integrated rack-scale system of servers and network switches with internal or external storage options.

-

ARM is a chip technology company that creates intellectual property that other companies license to form processor chips. ARM servers are enterprise-class computer servers that employ many ARM processors instead of traditional processors.

-

Server virtualization uses various software applications to divide a physical server into multiple independent servers. Server virtualization has been widely adopted in the data center colocation market because it allows a single physical server to host dozens of applications as virtual machines, rather than hosting each application on a designated server. technology costs are reduced by 50%.

Rapid increase in rack power density

-

Rack power density is one of the key factors in data center design, capacity planning, cooling, and power provisioning.

-

Over the past few years, we have observed an unprecedented increase in rack power density for IT equipment. The introduction of compute-intensive workloads such as AI, IoT, augmented reality and virtual reality (AR/VR), and the popular cryptocurrency mining trend are increasing data storage and processing requirements and requiring high-density racks. It has become necessary.

-

The surge in demand for high-performance computing (HPC) driven by the adoption of converged and hyperconverged solutions and virtualization technologies is expected to contribute to rack power density rising to an average of 10-12 kW during the forecast period .

-

Increased rack power densities are driving the use of innovative and flexible facility designs, as well as increasing the adoption of rack-level UPS solutions and diverse power distribution to the racks.

Factors enabling market growth

-

Increase in M&A and joint ventures in the market

-

Expanding subsea and inland connectivity

-

Accelerating data center investment with big data and IoT

-

Government support for data center development

market constraints

-

Increased carbon emissions from data centers

-

Location constraints in data center development

-

Concerns about power availability challenges

-

Lack of skilled data center professionals

-

Security challenges in data centers

-

High maintenance costs and inefficiencies

-

Supply chain disruption

Key attributes:

|

report attributes |

detail |

|

number of pages |

980 |

|

Forecast period |

2022-2028 |

|

Estimated market value in 2022 (USD) |

$30.42 billion |

|

Projected market value to 2028 (USD) |

$46.3 billion |

|

compound annual growth rate |

7.2% |

|

Target area |

global |

Segmentation insights

Segmentation with colocation services

-

retail colocation

-

wholesale colocation

Segmentation by infrastructure

Segmentation by electrical infrastructure

Segmentation by mechanical infrastructure

Segmentation by cooling system

-

CRAC and CRAH units

-

chiller unit

-

Cooling towers, condensers, dry coolers

-

Economizer and evaporative cooler

-

Other cooling units

Segmentation by cooling technology

-

air cooling

-

liquid based cooling

General construction industry segment

-

Core and shell development

-

Installation and commissioning service

-

engineering and architectural design

-

Fire detection and extinguishing

-

physical security

-

DCIM/BMS solution

Vendor scenery

Wholesale and retail colocation vendors are expected to grow in the future due to increasing market demand. Various sectors such as BFSI, IT/Telecom, and Cloud are increasing the demand for colocation services. The global data center colocation market has grown significantly in the last few years due to investments from global, regional, and data center operators.

The development of hyperscale data center campuses in all regions will generate significant revenue for vendors offering the fastest growing technologies, including immersion cooling, direct chip cooling, lithium-ion UPS, HVO generators, and microgrid technologies. brings opportunities. , renewable power solutions, and net-zero water data centers.

Prominent data center investor

Other notable vendors

-

365 data center

-

Adani Conex

-

African data center

-

air trunk

-

Connected data centers

-

american tower

-

atman

-

in the north

-

at tokyo

-

Aruba

-

big data exchange

-

CDC Data Center

-

center 3

-

Chayora

-

cloud headquarters

-

colorix

-

Colt Data Center Services

-

compass data center

-

COPT Data Center Solutions

-

CtrlS Data Center

-

Cyxtera Technologies

-

data 4

-

data bank

-

dc blocks

-

DCI Indonesia

-

edge center

-

ePLDT

-

Flexible

-

global switch

-

green mountain

-

gulf data hub

-

H5 data center

-

host dime

-

iron mountain

-

internet thailand

-

KDDI

-

Keppel Data Center

-

Kazuna Data Center

-

LG U Plus

-

Metta DC

-

NEXTDC

-

open access data center

-

orange business service

-

princeton digital group

-

QTS Realty Trust

-

Rostelecom Data Center

-

Sabey data center

-

skybox data center

-

stream data center

-

scala data center

-

Scifi Technologies

-

SUNeVison Holdings (iAdvantage)

-

switch

-

T5 data center

-

Tenglong Holding Group

-

tier points

-

Türksel

-

Arbacon Data Center Solutions

-

Bethtel IDC

-

wing

-

Yondol

-

yotta infrastructure

new entrant

For more information on this report, please visit https://www.researchandmarkets.com/r/6te5ek.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900