As the new year dawns, I’m reflecting on the roller coaster of 2023 for the auto industry. Last year, we saw the auto sector grapple with challenges such as declining EV sales, widespread strikes at U.S. factories, supply chain disruptions, and rising material costs. But amidst these turbulent times, there were glimmers of hope and resilience. Combined sales of passenger cars and commercial vehicles exceeded 90 million units, an astonishing double-digit growth rate. India has grown rapidly to become the fourth largest automobile market for light vehicles.

As 2024 begins, we want to share with our team Marketsandmarket’s insights and predictions about an industry in the midst of transformation due to significant advances in connectivity, electrification, and sustainability. This is a transformative time for the industry, and I’m excited to be part of this journey. As we wait for 2024 to unfold, let’s explore the key trends that will shape the global automotive market this year.

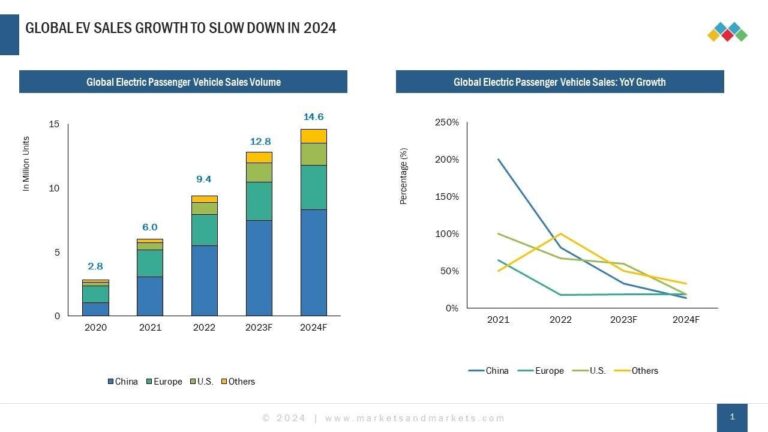

Electric cars: slowing down instead of stalling

Although slowing, EV sales are expected to continue increasing in 2024. In the US, EV sales in 2024 are expected to grow only 16% year over year, compared to about 64% in 2023. In China, the year-on-year growth rate in 2024 will be 11.1%. Factors such as reduced incentives, limited charging infrastructure, and saturation of early adopters are major hurdles. To attract the mass market, industry leaders like Musk are lowering prices, which I think is a move in the right direction. But the economic slowdown has forced major companies like GM, VW and Ford to adjust their strategies, with some cutting prices or delaying new models.

Global EV sales slow down

Markets and Markets, Statista, and more

China’s dominance in the EV market continues globally, not locally

With a sleek line of cutting-edge EVs, China has established itself as a market giant and a country with global influence, contributing to 60% of global EV sales. . A managed supply chain, constant innovation and growing global presence solidify the company’s leadership. China is expected to capture 12% of the European EV market by 2025 due to competitive pricing, cutting-edge battery technology, and the growing popularity of Chinese electric vehicle brands in the UK and other European and Asian markets. ing. In 2024, China will solidify its position as the powerhouse of her EV revolution both in the domestic market and in the world.

Online car sales soar

Global online car sales, where the complete car buying experience takes place online, are rapidly increasing and are expected to reach 7.1-7.3 million units by 2024. Many EV manufacturers have entered online sales, and online sales are available in all major markets. North America leads the way with more than a third of the global market share, with APAC rapidly catching up thanks to a younger, tech-savvy generation. This trend encompasses both used and new cars, and online platforms offer convenience and transparency. The automotive industry is moving toward a future where fully online sales will contribute significantly to total new vehicle sales.

Redefining luxury: A new class of cars is here

Luxury car trends are undergoing a paradigm shift, with traditional players redefining the “ultra-luxury segment” and non-luxury car manufacturers strategically positioning their top-of-the-line models as luxury cars. The past few years have seen a major shift, with SUVs becoming the ultimate ultra-luxury car of choice for millionaires, influencing brands such as Aston Martin and Lamborghini. EVs are increasingly part of the luxury segment and are expected to account for 15-17% of sales by 2024. China is driving the transformation of this luxury goods market as its affluent population increases.

Plugging into the future: The EV charging revolution

By 2024, the number of charging stations is expected to increase significantly, reaching approximately 2 million locations worldwide. The government and his OEMs are investing heavily in infrastructure, with DC fast charging and ultra-fast charging leading the way. China is an important player, and its fast charging technology is expected to triple by 2024. E-Forecourt and depot charging solutions will also see significant growth. The number of new electric commercial vehicle chargers is expected to reach 347,000 in 2024 and increase to 1.14 million by 2030, with the majority of the increase being contributed by his DC chargers. Fast chargers and ultra-fast chargers in electric commercial vehicle depots are expected to grow at a CAGR of up to 35% between 2023 and 2030.

Used car market attracts attention

The global used car market is experiencing significant growth, especially in the Asia Pacific region. In 2023, sales are expected to increase by 3-4% to 94-96 million units, and in 2024, it is expected to grow by 5-6%. The B2C segment is expected to become more dominant, with its share exceeding 50%. Market shares in Asia Pacific and North America indicate a shift towards a more organized market. Recent IPOs by companies like Vroom, Auto1, Cazoo, CarTrade, and Carvana have had mixed results, but the market is poised for change. The rise of online used car sellers and aggregators such as Droom in India is disrupting the industry and hinting at a future shaped by innovation, customer trust and convenience.

5G takes control: Connected cars and a lifestyle revolution

This is not just about faster internet speeds. I would like to call it the wheel revolution. 5G technology is set to revolutionize the automotive industry, with major companies such as Audi, Mercedes-Benz, GM, Ford, Skoda, and Geely deploying 5G in their smart factories to improve automation, safety, and efficiency. We embrace technology. This will only improve the in-car experience with faster data transmission, lower latency communications, and improved navigation and infotainment systems. In the automotive sector, 5G deployment is expected to grow at an annual growth rate of 30-35% in the coming years. 5G will also facilitate what we call the “car as a connected living solution.” This will make the car of the future an element of connected homes, connected workplaces, connected energy, and connected cities, providing an integrated and seamless experience. OEMs can generate additional revenue during the vehicle’s lifecycle.

Generative AI: Shaping the future of cars

Generative AI is transforming the automotive sector, impacting vehicle design, navigation, predictive maintenance, voice assistants, manufacturing, supply chain, and quality control. This makes in-vehicle interactions safer, more efficient and more personal. Major car companies are increasingly adopting this technology, including Toyota and BMW in vehicle design, Tesla in advanced driver assistance systems (ADAS), Continental in digital cockpits, and Mercedes-Benz in personal voice assistants. This marks a shift towards more intelligent and responsive vehicle technology.

Preparing for the future: Other trends to watch in 2024

The impact of smart manufacturing, gigacasting, digital twins, and the impending Euro 7 standard is shaping the industry in 2024 by delivering efficiencies and redefining operational strategies.

conclusion

Although the industry is on track to reach a milestone of 100 million passenger and commercial vehicle sales by 2026, although growth rates will slow toward 2024, anticipates a year full of milestones and transformative experiences. What awaits us this year!

follow me twitter Or LinkedIn. check out My website and other works can be found here.

For more information, please see this report.