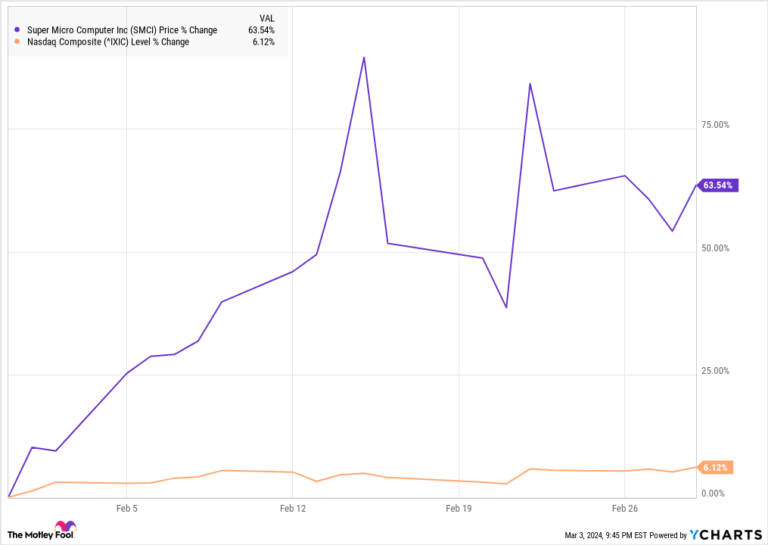

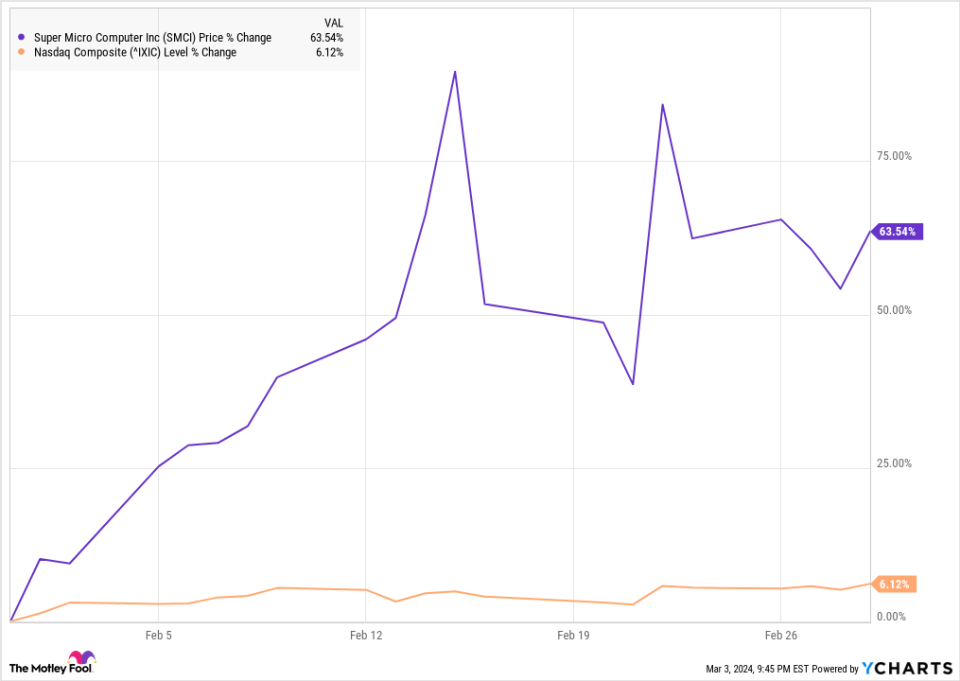

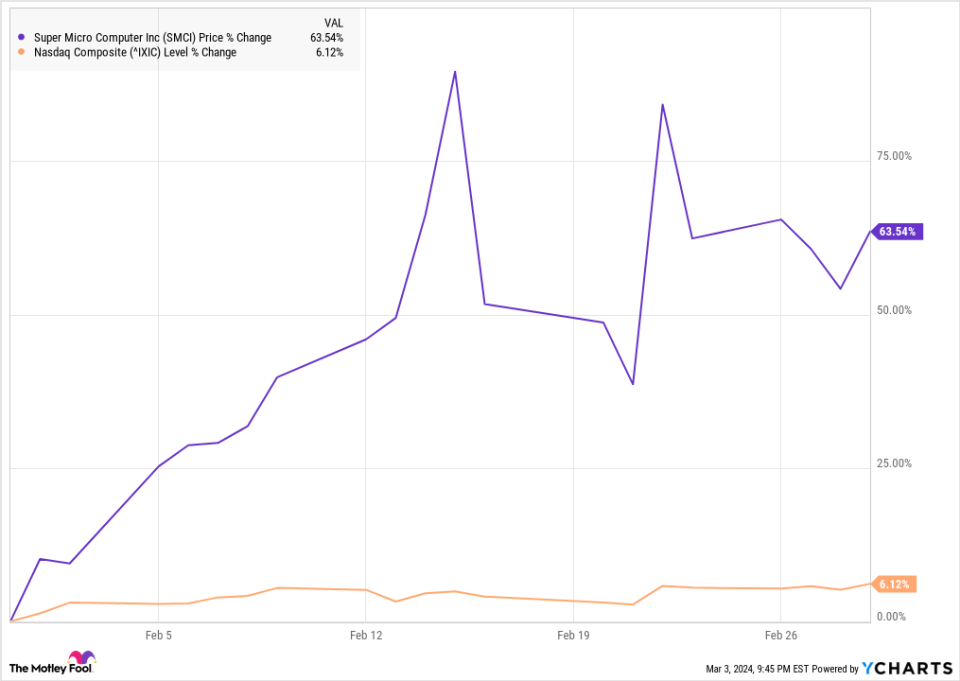

super microcomputer (NASDAQ:SMCI) It was a big winner last month. The maker of storage and server systems, which is highly regarded for its artificial intelligence applications, benefited from strong quarterly results, continuing to rise after releasing a significant earnings report in late January. Nvidia, a major supplier. The stock rose 63% in February, according to data from S&P Global Market Intelligence.

Like Nvidia, Supermicro has emerged as something of a bellwether in the AI stock sector, with its stock price highly volatile and fluctuating in response to broader sentiment towards AI stocks.

The AI boom is still heating up

It’s unusual for a stock to jump this much in a month without any big company-specific news, but Supermicro’s rise shows how much the company is benefiting from the excitement surrounding AI.

Similar to Nvidia, Supermicro is also seeing rapid revenue growth. Investors see the company as a big winner of the AI boom, with revenue up 103% in a quarterly report released at the end of January.

In addition to the momentum from this earnings report, the stock price goldman sachs I mentioned Nvidia, citing strong demand for AI servers. As a result, Supermicro’s stock price rose 14% on February 5th. Later that week, on February 9, the stock skyrocketed. arm holdings Citing rising demand for AI, it released an explosive earnings report.

Eventually, the stock price briefly exceeded $1,000 per share the following week on February 15th. american bank We initiated coverage with a buy rating, saying the market for AI servers is much larger than Wall Street thinks.

However, the stock price plummeted the next day. wells fargo He rated the stock “equally weighted” and said his high expectations were largely priced in.

After a brief swoon, stock prices soared on February 22nd after NVIDIA released another shocking earnings report. After that, the rest of the month was cooler.

Will Supermicro continue to be profitable?

Supermicro had a strong start to March, jumping 4.5% on March 1st, following its rivals. Dell Technologies He said that demand for AI servers is rapidly increasing. Supermicro shares soared again after hours on Friday after the company gained entry into the U.S. market. S&P500, an important milestone that serves as a stamp of approval from broader market indexes. Its inclusion means that ETFs tracking the S&P 500 must buy this stock.

Supermicro’s stock price has already tripled this year, and the increase seems justified given the company’s strong performance and surging demand for its AI hardware. Given the hype around the AI sector, the stock is likely to remain volatile, but it still looks like a good bet to move higher.

Should you invest $1,000 in a super micro computer right now?

Before buying Super Micro Computer stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors could buy right now…and super micro computers weren’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Bank of America is an advertising partner of The Motley Fool’s Ascent. Wells Fargo is an advertising partner of The Motley Fool’s Ascent. Jeremy Bowman holds positions at Bank of America and Wells Fargo. The Motley Fool has positions in and recommends Bank of America, Goldman Sachs Group, and Nvidia. The Motley Fool recommends Super Micro Computers. The Motley Fool has a disclosure policy.

The original article on why supermicrocomputer stocks soared 64% in February was published by The Motley Fool.